February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Late-Model Sleeper Truck Inventory Rebounds as Auction, Asking Prices Continue Rising Across Industries

Amidst record-breaking end-of-year auctions and strong year-end retail sales, auction and asking values for used equipment and trucks in Sandhills Global marketplaces continued their upward trend. Furthermore, according to a new Sandhills Global Market Report, a more prominent (22%) increase in inventory levels for sleeper trucks in the 0- to 5-year age group came as a pleasant surprise for the trucking industry, although the number of used semi tractors on the market remain only half that of December 2020.

The key metric used in this reporting is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in the used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. Auction and asking values for sleeper trucks, crawler excavators, and high-horsepower tractors are just some of key trends you can explore in the latest market report.

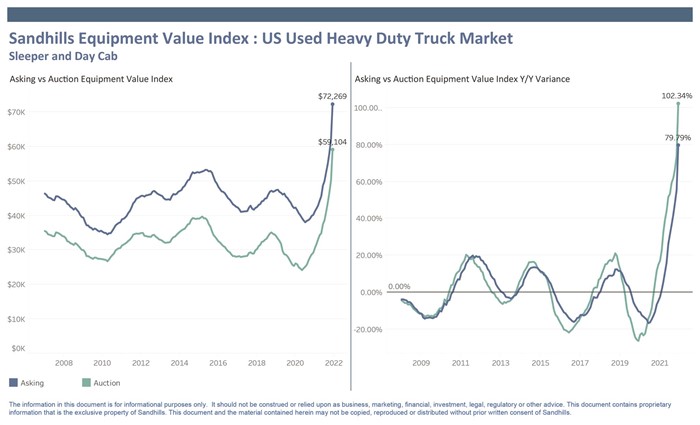

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI for heavy-duty trucks posted a 102.3% year-over-year increase in auction values in December and a 79.8% YOY rise in asking values (a $40,000 YOY gain).

- Sleeper trucks are driving this upward trend with 109.6% YOY higher auction values (from $34,000 in December 2020 to $71,000 in December 2021) and a 92.6% YOY increase in asking values (from $44,000 to $85,000).

- Sleeper truck inventory is down by 51.6% YOY, although it showed a 22% month-to-month gain between November and December 2021, driven by the 0- to 5-year age group. The increase of nearly 2,000 units resulted in inventory levels not seen since August 2020.

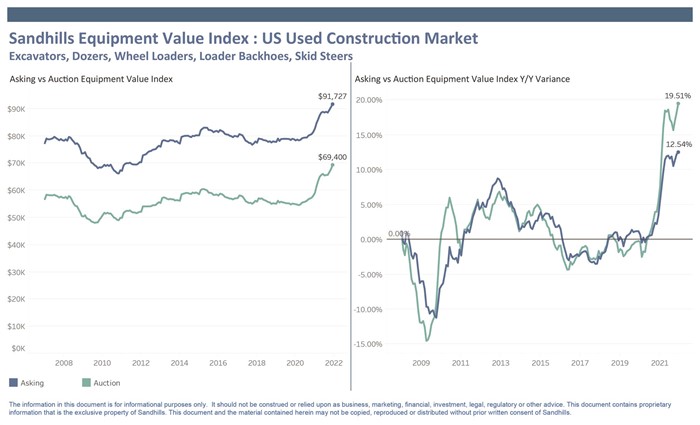

U.S. Used Construction Equipment

- Auction values for used excavators, dozers, loader backhoes, wheel loaders, and skid steers are up 19.5% YOY while asking values are up 12.5% (or $10,000) YOY, continuing a general upward trend.

- Improved values in the crawler excavator category are the primary reason for this construction market upswing, with 16.1% greater auction values YOY and 9.6% higher asking values YOY.

- Meanwhile, excavator inventory has decreased by 38.9% YOY and continues to show a month-over-month decline.

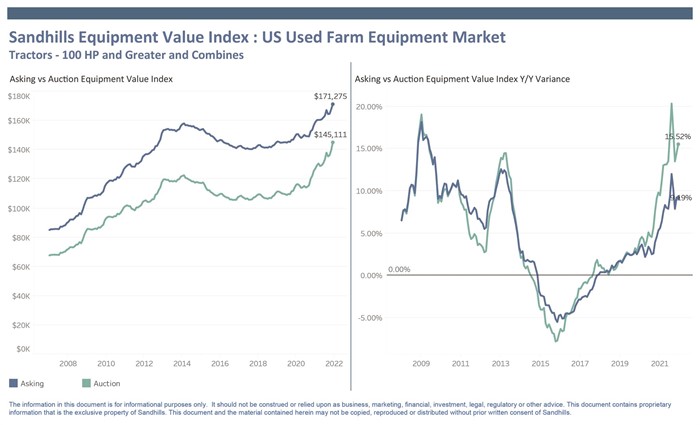

U.S. Used Agriculture Equipment

- The Sandhills EVI for the farm equipment market, which includes 100-horsepower and greater tractors and combines, notched 15.5% YOY higher auction values and 9.2% (or $15,000) YOY higher asking values in December.

- Used high-horsepower (300-HP and greater) tractors are the main impetus behind the overall ag equipment value increase, with 14.3% YOY greater auction values (up $20,000 in December 2021 compared to December 2020) and 10.4% higher asking values (up $24,000 YOY).

- Big tractor inventory levels have continued a month-over-month slide since July 2020, and as of December 2021 the category had fallen by 41.4% YOY.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.