February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Truck Values Continue Historic Ascent and Construction Equipment Values Remain Flat as Farm Machinery Dips Slightly

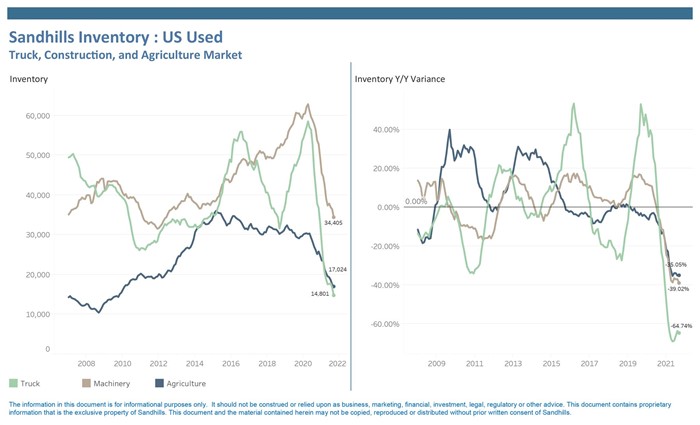

As used heavy equipment inventory levels continue to decline, a new Sandhills Global Market Report indicates nuanced trends in machinery values within each industry. Examining Sandhills Global marketplaces, the report finds that commercial truck prices continue to soar to unprecedented levels, construction machinery values are holding steady, and agricultural equipment values declined slightly for the first time since Q3 2020. Late-model trucks, dozers, and high-horsepower tractors are still showing the biggest gains in their respective categories.

The key metric used in this reporting is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in the used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest report demonstrates that late-model equipment is providing upward pressure on values within each category.

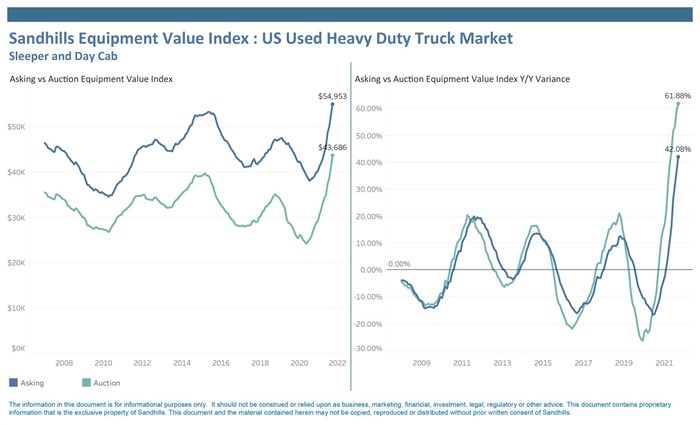

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI for used sleeper and day cab trucks posted a 61.9% year-over-year auction value increase to $44,000 in September compared to $27,000 in September 2020. Asking values also continued to trend upward with a 42.1% YOY increase to $55,000 this September compared to $39,000 the previous September. Truck inventory levels continue to trend downward.

- Both asking and auction values for sleeper trucks rose approximately $3,000 month-over-month, to $63,000 and $52,000, respectively, in September compared to August 2021.

- Sleeper trucks in the 0- to 5-year age group are driving month-over month growth in asking values, which posted a 7% increase in September, or $7,000 over August.

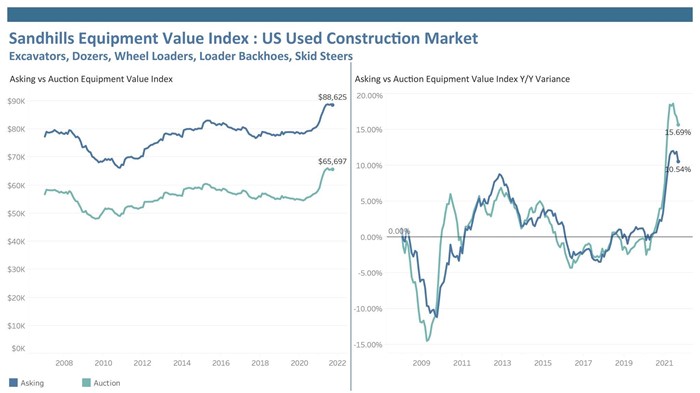

U.S. Used Heavy-Duty Construction Equipment

- The Sandhills auction EVI for the construction market indicated a 15.7% YOY value increase to $66,000 in September 2021, with the asking EVI up 10.5% YOY to $89,000.

- Asking and auction values in this market have remained fairly flat since May 2021; this follows a period of steady growth that began in August of 2020. Excavator, wheel loader, loader backhoe, and skid steer values have shown flat to slightly declining values.

- By contrast, dozer asking values have continued a steady increase throughout 2021, posting at $150,000 in September compared to $140,000 at the start of the year. The 0- to 5-year age group is driving this rise, charting a $40,000 year-to-date asking value increase as inventory steadily declines in this age group.

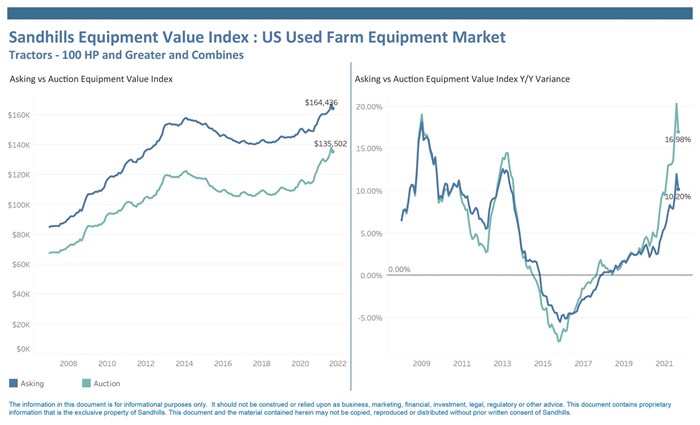

U.S. Used Agriculture Equipment

- The Sandhills EVI for the farm machinery market logged a 10.2% YOY rise in asking values and a 17.0% YOY increase in auction values.

- YOY asking values for combines and 100-horsepower and greater tractors climbed to $164,000 this September compared to $149,000 last September, while YOY auction values grew to $135,000 from $116,000 over the same time period.

- Within the ag market, the 300-hp and greater tractor category has risen most sharply in YTD asking values. Late-model, high-horsepower tractors in the 0- to 5-year age group continued a measured increase in 2021, at $351,000 in September as compared to $308,000 at the beginning of the year.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.