February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Late-Model Heavy-Duty Truck and Equipment Values Show Smallest Month-Over-Month Gain Year-to-Date Across Industries

Stabilizing inventory levels of late-model used heavy-duty trucks, construction equipment, and farm machinery have moderated the groups’ general upward trend in asking values, according to a new Sandhills Global Market Report. Average asking prices for farm machinery and Class 8 trucks age 0 to 5 years are showing their smallest month-over-month increase this year to date, while late-model used construction machinery stretched its slide in average asking values to a second consecutive month. Historically, as inventory finds its equilibrium, auction and asking value changes begin to slow.

The key metric used in this reporting is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in the used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest report indicates that interrelated marketing fundamentals such as supply and demand still hold sway across multiple industries.

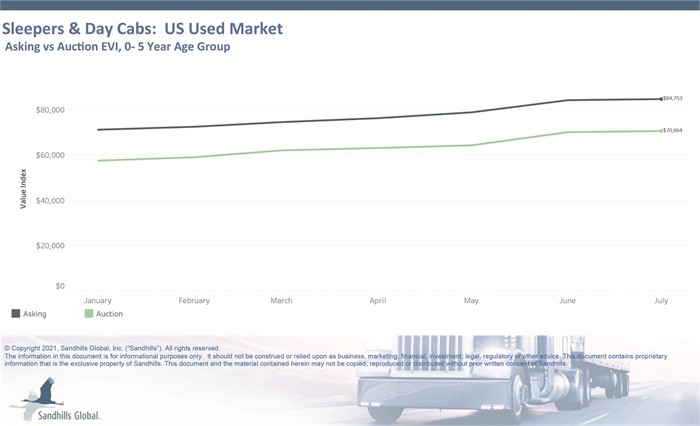

U.S. Used Heavy-Duty Trucks

- Within the heavy-duty truck market, late-model sleeper trucks and day cabs have averaged a 3% month-over-month increase in asking values throughout 2021.

- The July EVI for heavy trucks aged 0 to 5 years evidenced a 0.5% M/M increase compared to June, which was the smallest gain of the year to date. The asking EVI for July for heavy-duty trucks showed $84,753 compared to $84,261 in June.

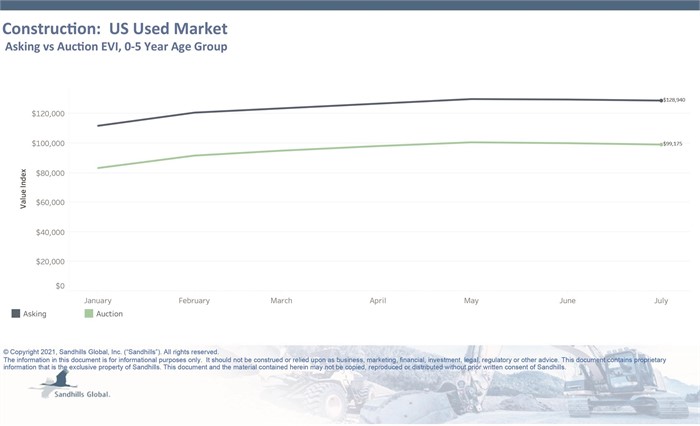

U.S. Used Heavy-Duty Construction Equipment

- The used construction equipment asking market has averaged a 2% M/M increase throughout 2021 within late-model machines in the 0- to 5-year age group.

- The July EVI recorded a -0.5% M/M decrease compared to June, which was the second continuous month showing a decline. The $128,940 asking EVI for July dropped approximately $700 from $129,639 in June.

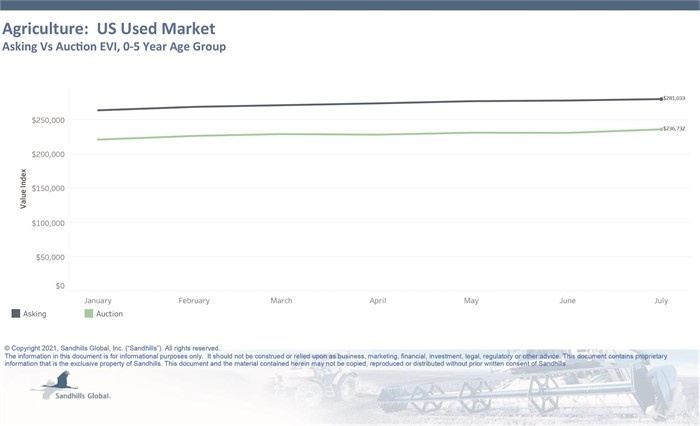

U.S. Used Farm Equipment

- Asking values in the used agricultural machinery market has averaged a 1% M/M increase throughout 2021 within late-model machines.

- The July EVI for farm equipment in the 0- to 5-year age group recorded a 0.77% M/M increase compared to June. The asking EVI for July rose to $281,033 from $278,897 in June.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.