February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

New Sandhills Global Market Data Shows Gains in Equipment Values Driven by Decreasing Inventory Levels

A new Sandhills Global market data report highlights dropping inventory levels making a major impact on year-over-year used equipment values in key construction, farm, and truck markets. By assessing year-over-year inventory and equipment values, Sandhills Used Price Index is able to deliver insights that go beyond conventional measures that don’t typically consider predictable market patterns and seasonal swings. As a result, the market data reports give sellers a better idea of the sectors driving trends in these used equipment markets.

Chart Takeaways

Sandhills market data reports are based on the massive pool of worldwide data from Sandhills marketplaces including TruckPaper.com, MachineryTrader.com, TractorHouse.com, and AuctionTime.com. Buyers and sellers can use the information to track the pulse of the market and get the biggest return for specific assets with changing values. YOY trends to note from this November include:

U.S. Used Heavy-Duty Trucks

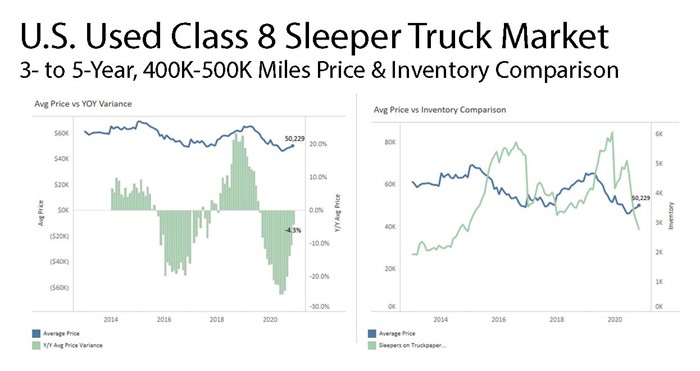

- Heavy-duty sleeper truck values were up 2.7% YOY, and when looking specifically into the 3- to 5-year age group with 400,000 to 500,000 miles, the Used Price Index shows an upward trend in average price since Q2 2020.

-

This trend continues a sharp decline in inventory.

U.S. Used Heavy-Duty Construction Equipment

- Equipment values in the Used Construction Market Index are up 0.61% YOY.

-

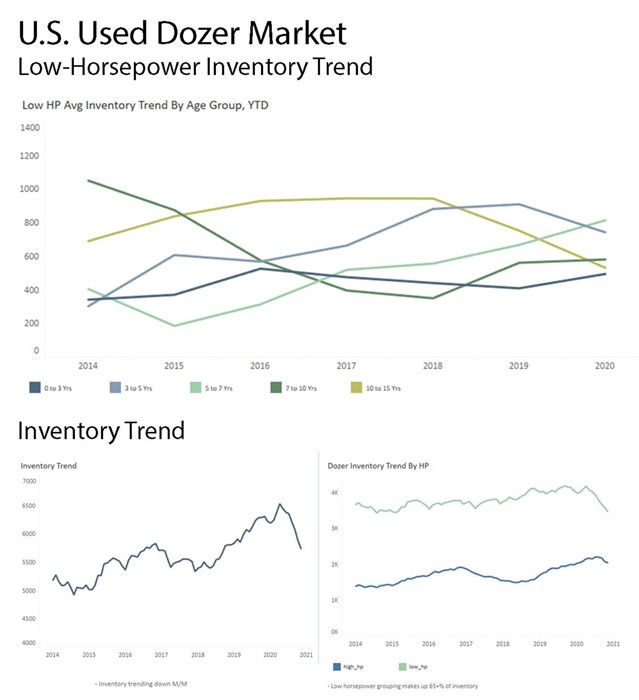

The increase is highlighted by dozer values, which are up 3.7% overall. Within the dozer market, the under-200-horsepower group, which makes up the highest volume of inventory, is trending down 16% YOY. The decrease is mainly driven by the 10- to 15-year age group, which is down 41% YOY.

U.S. Used Farm Equipment

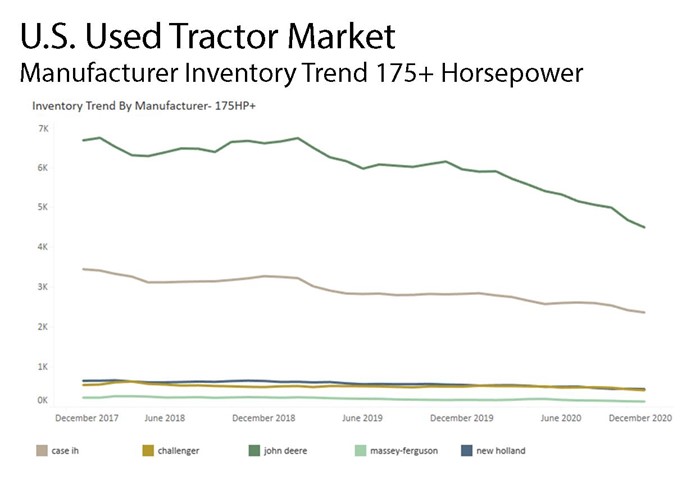

- The Used Agriculture Market Index shows values up 7.4% YOY with tractor values up 7.7% overall. The increase in tractor values is driven by the 175-plus-hp group.

-

Delving deeper, the dropping used inventory volumes for the 175-plus-hp group are driven by John Deere tractors. In November 2019, John Deere 175-plus-hp tractors numbered 6,152, and after a steady decrease in inventory throughout 2020, John Deere tractors in this grouping totaled just 4,500—a drop of 27% YOY.

Obtain The Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About Sandhills Used Price Index

Sandhills Used Price Index is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, the Used Price Index provides useful insights into the ever-changing supply-and-demand conditions for each industry.