February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Agriculture, Construction & Heavy-Duty Truck Markets Up YOY in November; Sandhills Global Market Data Shows Key Age Groups and Equipment Driving Gains

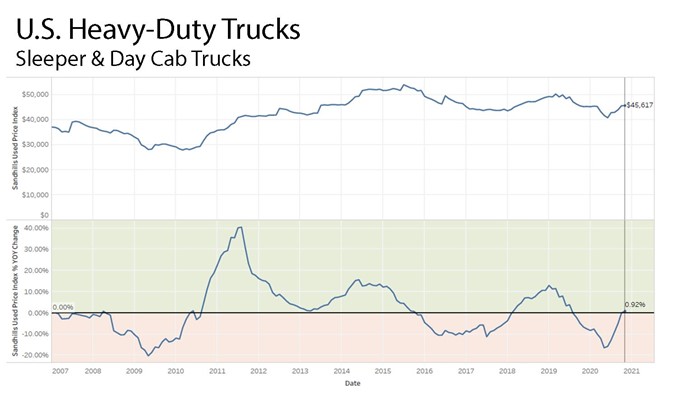

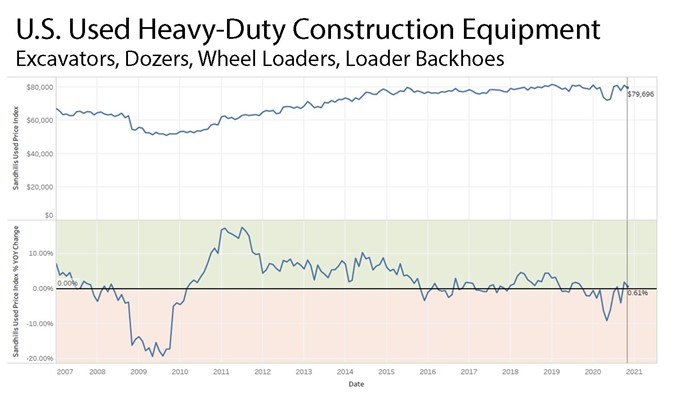

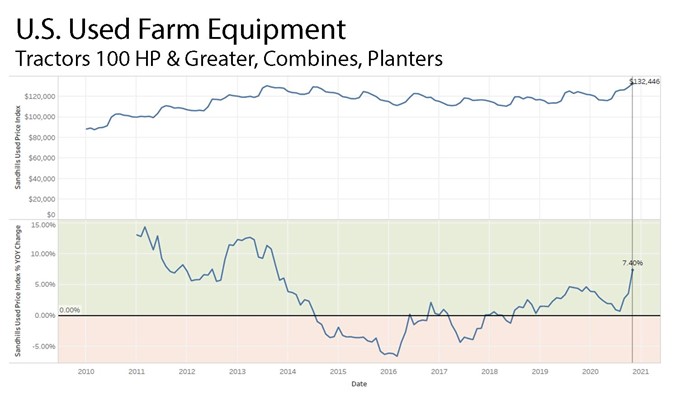

A new Sandhills Global market data report reveals the used price indexes it tracks among the construction, farm, and truck markets all saw year-over-year increases in the month of November. In the Sandhills Used Truck Market Index, which is up 0.92% YOY, November 2020 was the first positive month since July of 2019. Sandhills’ market data reports dig into the deeper market forces and equipment trends driving each industry to provide valuable analysis buyers and sellers can use going forward.

Chart Takeaways

“Overall market trends are merely part of the story equipment sellers need to know when valuing equipment,” says Mitch Helman, sales manager at Sandhills Global. “The age group information found in Sandhills’ market reports, for example, gives dealers a more thorough assessment of the market, including the age and equipment groups impacting the overall trends.” Just some of the key drivers of change include:

U.S. Used Heavy-Duty Trucks

- Looking specifically at heavy-duty sleeper trucks, the Used Price Index shows a 2.7% value increase. The increase in Sleepers is being driven by a 2.1% YOY average price increase in the 1- to 5-year age group.

-

Overall, used sleeper inventory continues to fall to historic lows.

U.S. Used Heavy-Duty Construction Equipment

- The Used Construction Market Index is up 0.61% YOY. The increase is highlighted by dozer values, which were up a superb 3.7% overall.

-

The 11-plus-year age group in dozers was a primary value driver in November. Average used prices in this “not-yet-classic” group were up 9.6%, a more than $4,000 increase in average asking price.

U.S. Used Farm Equipment

- In the agriculture market, used equipment values were up 7.4% YOY, highlighted by YOY increases in planting equipment, harvesters, and tractors.

-

Planting equipment average values were up 12.3% with the 6- to 10-year age group, displaying a tremendous average value jump YOY at 17.9%—representing an almost $9,000 average value increase.

Sandhills market data reports are based on the massive pool of worldwide data from Sandhills marketplaces including TruckPaper.com, MachineryTrader.com, TractorHouse.com, and AuctionTime.com. Buyers and sellers can use the information to track the pulse of the market and get the biggest return for specific assets with changing values.

Obtain The Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About Sandhills Used Price Index

Sandhills Used Price Index is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhillls’ marketplaces. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, the Used Price Index provides useful insights into the ever-changing supply-and-demand conditions for each industry.