February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Aircraft Inventory Levels Continue Upward Trend

Last month, Sandhills Global reported that used aircraft inventory levels were resuming an upward trend. This continued in March, especially in the late-model used aircraft segment. “Although the bulk of available used aircraft in the market is five years old or older, we’ve seen an uptick in used late-model aircraft inventory levels over the past few months,” says Controller Department Manager Brant Washburn. “Late-model aircraft inventory levels increased more than 20% since February while other age groups increased marginally.”

Sandhills’ aviation products include Controller, Controller EMEA, Executive Controller, Charter Hub, Aviation Trader, Aircraft Cost Calculator, and AircraftEvaluator. AircraftEvaluator is Sandhills’ proprietary asset valuation tool for all types of aircraft, built using the same technology behind FleetEvaluator. Widely used and trusted across equipment, truck, and trailer industries, FleetEvaluator identifies asset values with unparalleled accuracy.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model-year equipment actively in use.

Additional Market Report Takeaways

This report includes detailed analysis of asking values and inventory trends in used aircraft markets along with charts that help readers visualize the data. It describes and quantifies important trends in the buying and selling of used jet, piston single, turboprop, and Robinson piston helicopter aircraft.

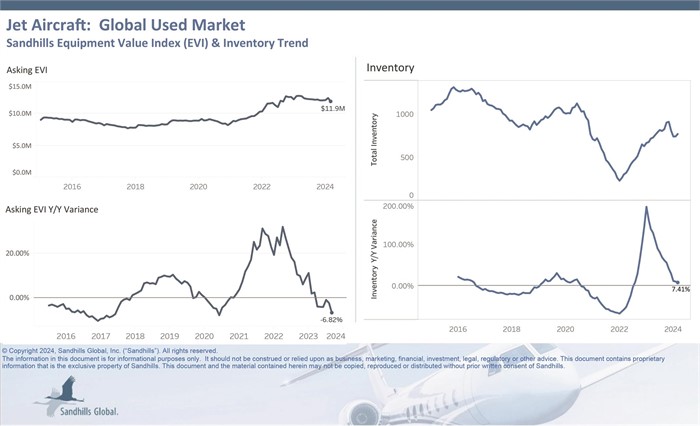

Global Used Jets

- Inventory levels of used jets grew 3.78% month over month in March. Inventory was up 7.41% year over year, indicating a steady supply, although the market is experiencing downward pressure on prices.

- Asking values decreased 4.23% M/M and 6.82% YOY in March. However, some segments within the overall jet category bucked this trend; the used light jet aircraft market, for instance, stands out with asking values remaining higher than last month’s figures.

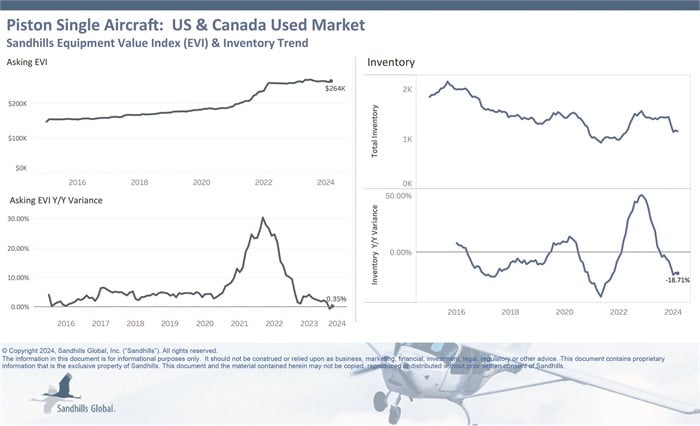

U.S. and Canada Used Piston Single Aircraft

- This market has seen a notable shift over the past year. Inventory levels of used piston single aircraft decreased 1.53% M/M and 18.71% YOY in March and continue to trend downwards.

- Asking prices increased slightly by 1.23% M/M and 0.35% YOY.

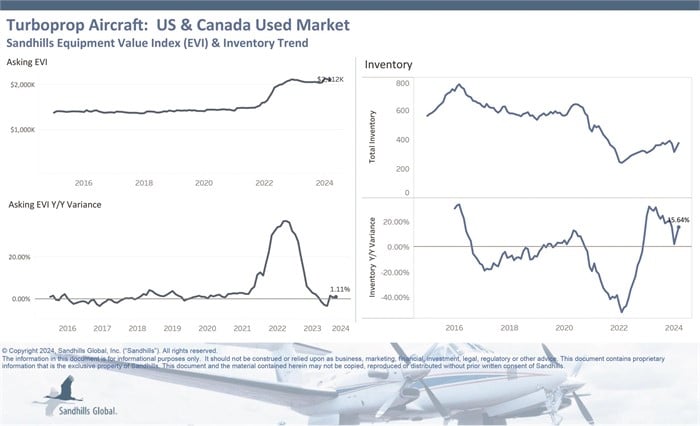

U.S. and Canada Used Turboprop Aircraft

- Inventory levels of used turboprop aircraft increased 8.33% M/M and 15.64% YOY and are now trending sideways.

- Asking values remained stable, ticking lower by 0.44% M/M and rising 1.11% YOY. Asking values are trending sideways.

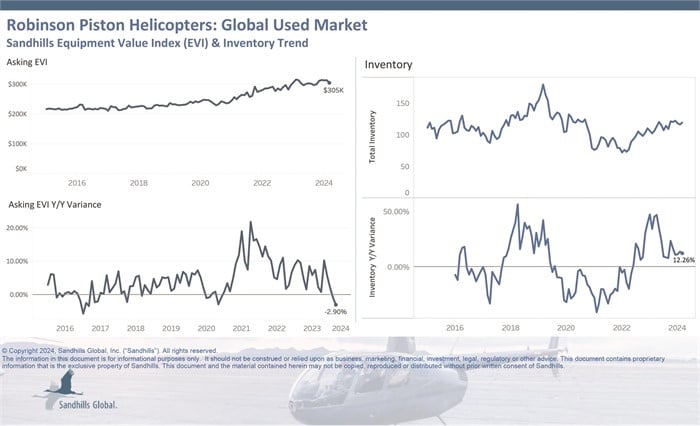

Global Used Robinson Piston Helicopters

- Inventory levels in this market rose 2.59% M/M and 12.26% YOY.

- Asking values remained relatively stable, dipping lower by 2.74% M/M and 2.9% YOY. Asking values are currently trending sideways.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About The Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, commercial trucking, and aviation industries represented by Sandhills Global marketplaces, including Controller.com, AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator and AircraftEvaluator, Sandhills’ proprietary asset valuation tools, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.