February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

U.S. Used Planter Market Now Covered in Sandhills Global’s Monthly Equipment, Truck, and Trailer Market Reports

Last month, Sandhills Global noted an influx of factory-new equipment, trucks, and trailers entering the market, while late-model assets were increasingly accumulating on dealers’ lots. In its newest market reports, which now include a report dedicated to the U.S. used planter market, Sandhills observed a continuation of this trend. These reports cover the U.S. used construction equipment, farm machinery, truck, and semitrailer markets in Sandhills marketplaces.

“Just as we’ve seen with high-horsepower tractors and combines, we’re now seeing late-model equipment availability increase substantially across other categories over the past year,” says TractorHouse Sales Manager Ryan Dolezal. “This trend is also impacting used planters. As the planter market moves toward higher-speed technologies, larger row units, and retrofitting, it’s important to watch how these changes affect used retail and auction pricing.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Effective with the January 2024 EVI, Sandhills introduced version enhancements and weighted adjustments. All historic EVI metrics were amended and recalculated back to 2005, and all calendar year 2024 EVI releases will include these enhancements; as a result, prior numbers will not be comparable to the new, more insightful values.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

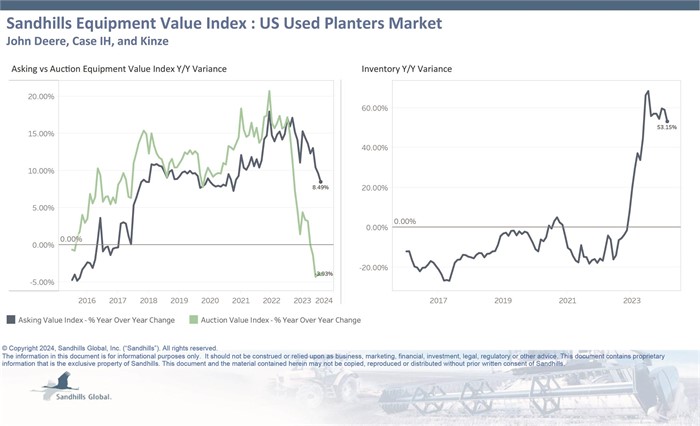

U.S. Used Planters

- Sandhills now offers a market report for the U.S. used planter market, which monitors trends among John Deere, Case IH, and Kinze planters. Inventory levels of used planters have shifted appreciably within the past year. Despite a month-over-month decrease of 4.39% in February, due in part to seasonal inventory drawdowns, inventory levels jumped 53.15% year over year and are currently trending sideways.

- Asking and auction values both posted marginal M/M decreases. Asking values were down 1.93% M/M and up 8.49% YOY and are trending sideways.

- Auction values decreased across the board in February with drops of 1.89% M/M and 3.93% YOY and are trending down. These trends suggest a market in transition as auction value movements typically precede asking value changes.

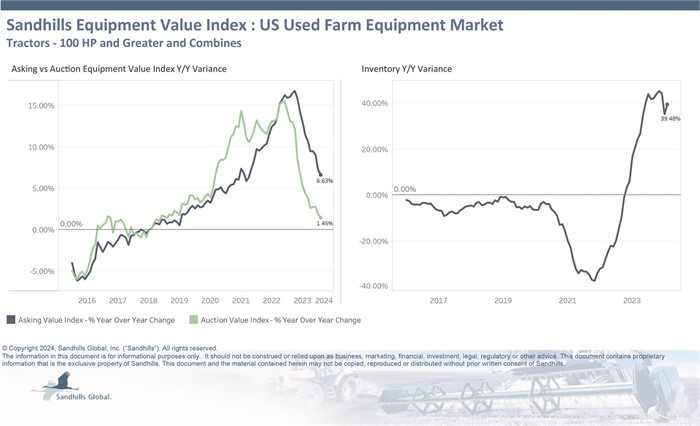

U.S. Used Farm Equipment

- Over the past two years, pandemic-era production and supply issues have given way to a steady increase in new manufacturing. This has greatly impacted the used farm equipment landscape. Inventory levels were much higher than last year, up 39.48% YOY in February, in addition to a noteworthy 5.13% M/M increase.

- Asking values decreased 0.74% M/M but remained up YOY at 6.63% and are trending sideways.

- Auction values declined slightly M/M, by 1.71%, but managed to gain 1.45% YOY. These value figures reflect a market that is shifting toward newer late-model units.

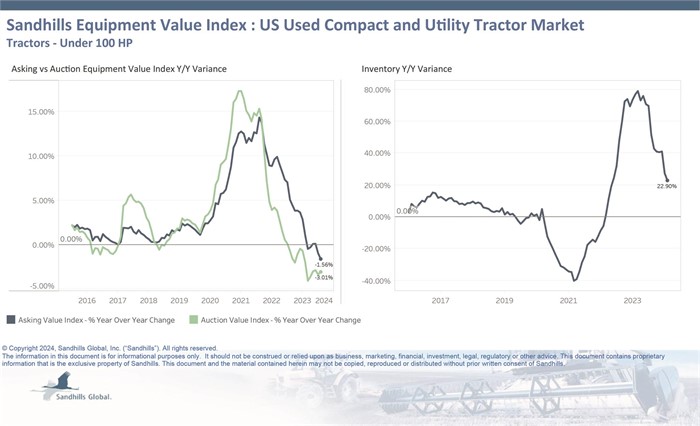

U.S. Used Compact and Utility Tractors

- In the U.S. market for used compact and utility tractors, the availability of late-model units has surged over the past year. Despite a slight 1.66% M/M dip in February, inventory levels were 22.9% higher YOY.

- There were slight reductions in asking values, down 0.16% M/M and 1.56% YOY, following consecutive months of decreases.

- Auction values increased slightly M/M by 1.07% but were down 3.01% YOY, indicating a stable trend. Auction values are trending sideways.

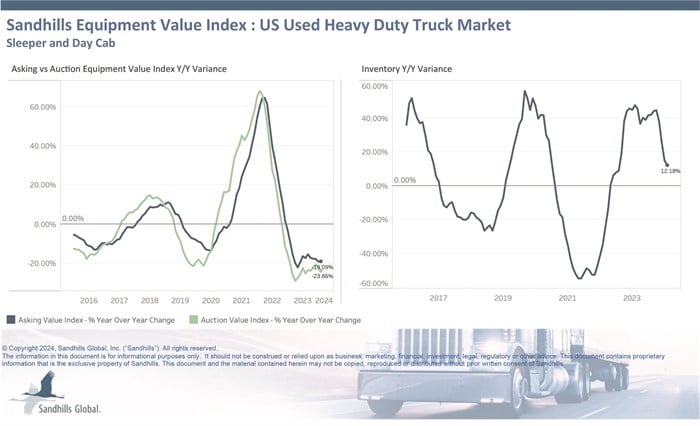

U.S. Used Heavy-Duty Trucks

- Inventory levels of used heavy-duty trucks were up 12.18% YOY in February but remained steady M/M with a slight 0.85% dip. Inventory levels are trending down.

- Used heavy-duty truck values have been sliding for months and showed continued decreases in February. Asking values were down 1.81% M/M and 19.09% YOY.

- Auction values fell 4.32% M/M, continuing a downward trend that has lasted for over 20 months, and were 23.86% lower YOY.

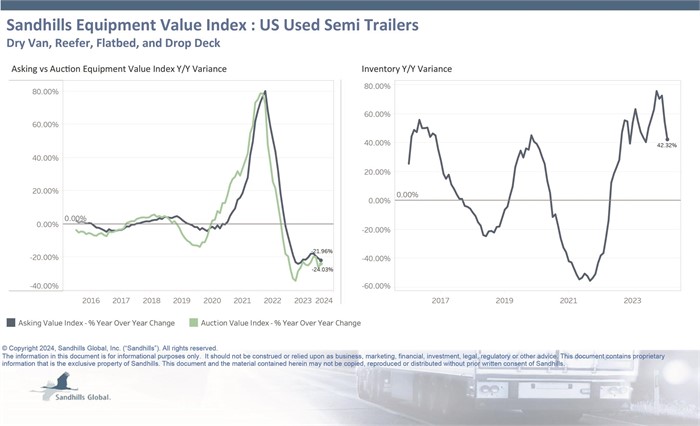

U.S. Used Semitrailers

- The U.S. used semitrailer market has experienced a notable shift over the past two years, with the dry van semitrailer category exhibiting the largest inventory and value fluctuations. Used semitrailer inventory levels dropped 2.49% M/M in February, indicating a degree of stabilization, yet they remained 42.32% higher YOY. Inventory levels are trending sideways.

- Asking values fell 3.09% M/M following a consistent decline in recent months. February asking values were 21.96% lower than the previous year.

- Auction values continued a downward trend with decreases of 2.15% M/M and 24.03% YOY.

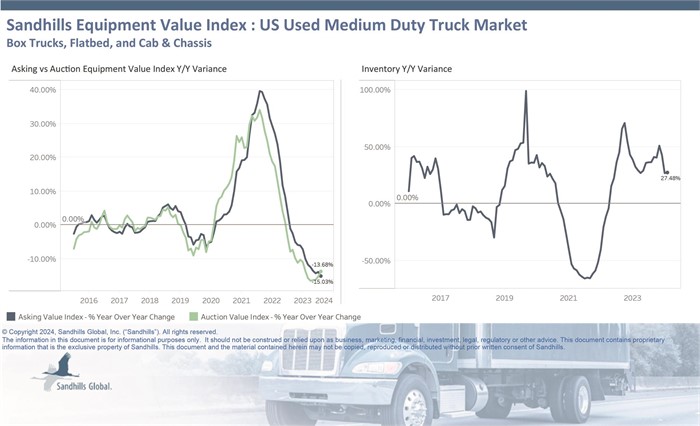

U.S. Used Medium-Duty Trucks

- Inventory levels in this market increased by 4.34% M/M in February and a noteworthy 27.48% YOY. Inventory levels are trending up.

- Values, meanwhile, fell across the board after several months of decreases. Asking values were down 3.05% M/M and 15.03% YOY.

- Auction values were down 0.67% M/M and 13.68% YOY. These value declines were consistent with those seen in the latter half of 2022 and were especially pronounced in the box truck category, which has been at the forefront of this downturn.

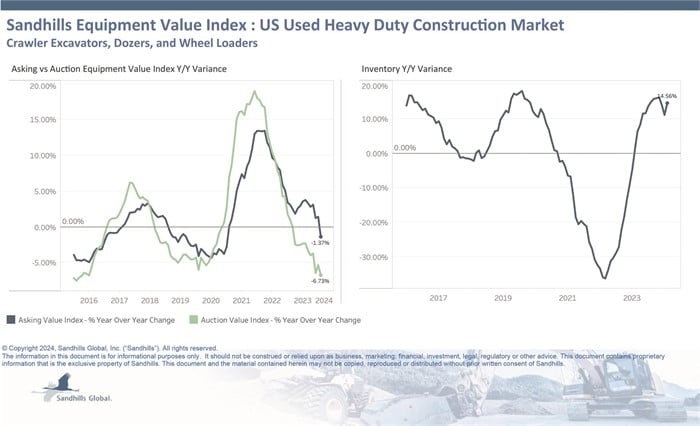

U.S. Used Heavy-Duty Construction Equipment

- Inventory levels of used heavy-duty construction equipment were up 6.2% M/M and 14.56% YOY in February and are trending up.

- Although individual machines are depreciating YOY, the overall value indexes have increased due to growing availability of late-model inventory. Excavators, particularly those with lower operating weights, have shown the most significant changes. In the overall heavy-duty construction equipment market, asking values increased 3.21% M/M but dropped 1.37% YOY and are trending down.

- Auction values, following a similar trend, increased 5.29% M/M but dropped 6.73% YOY and are trending down.

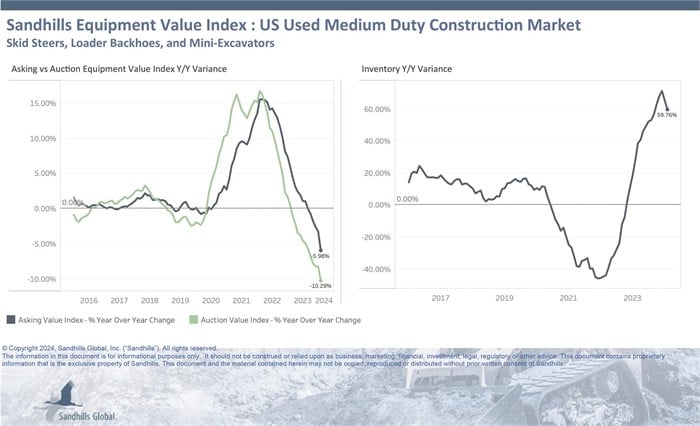

U.S. Used Medium-Duty Construction Equipment

- This market is currently experiencing a period of considerable growth and adjustment. Like the heavy-duty construction equipment market, Sandhills has noted that individual medium-duty machines are depreciating YOY while the overall value indexes increased as a result of newer late-model inventory availability. Inventory levels rose substantially YOY in February at 59.76% in addition to a 4.76% M/M increase following consecutive months of increases.

- Asking values, meanwhile, increased 1.3% M/M but remain 5.98% lower YOY, continuing a trend of declining prices. Asking values are currently trending down.

- Auction values also increased marginally at 1.96% M/M and were 10.29% lower YOY, suggesting a softening in market value. The inventory and value trends noted here have especially impacted the track skid steer and mini excavator categories, which have seen the largest changes in all three metrics.

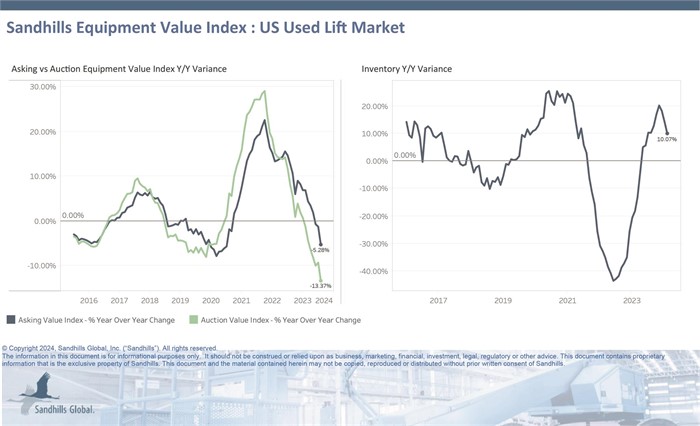

U.S. Used Lifts

- The used lift market is showing signs of stability with a slight 0.9% M/M decrease in inventory levels. Inventory was up 10.07% YOY, however. The telehandler category is largely responsible for driving inventory increases, which is placing pressure on market values. These trends indicate a market that is steady but may begin to experience pressures driven by increased inventory levels, particularly within specific categories such as telehandlers.

- Asking values rose 0.97% M/M in February, fell 5.28% YOY, and are trending sideways.

- Auction values ticked up 0.36% M/M but were 13.37% lower YOY. Auction values are trending sideways.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.