February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Equipment Markets Face Continued Inventory and Value Challenges

December was a challenging month for U.S. used equipment markets. New market reports from Sandhills Global reveal a consistent decline in asking and auction values coupled with a notable increase in inventory levels for construction equipment, farm machinery, trucks, and semitrailers in Sandhills marketplaces. Overall, the reports show markets adjusting to oversupply and softer demand.

“The trends observed in the latest market reports highlight ongoing struggles in the used heavy-duty truck, semitrailer, and other equipment sectors,” says Truck Paper Sales Manager Scott Lubischer. “It’s important for sellers to watch these trends carefully and adapt their strategies to match these evolving market conditions.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

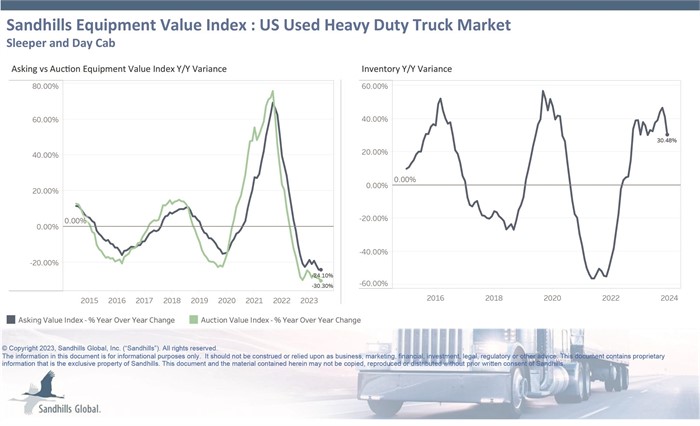

U.S. Used Heavy-Duty Trucks

- Used heavy-duty trucks in Sandhills marketplaces continued to face challenges in December as inventory levels, asking values, and auction values all declined month over month. Inventory levels fell 4.8% M/M but remained higher than last year, up 30.48% year over year, indicating a persistent oversupply of trucks. Inventory levels are currently trending sideways.

- The heavy-duty truck market has been trending downward since mid-2022, mainly due to production and supply chain issues. Asking values have decreased for several consecutive months and continued that trend in December with decreases of 1.82% M/M and 24.1% YOY.

- Auction values fell 3.37% M/M and 30.3% YOY, also following months of decreases.

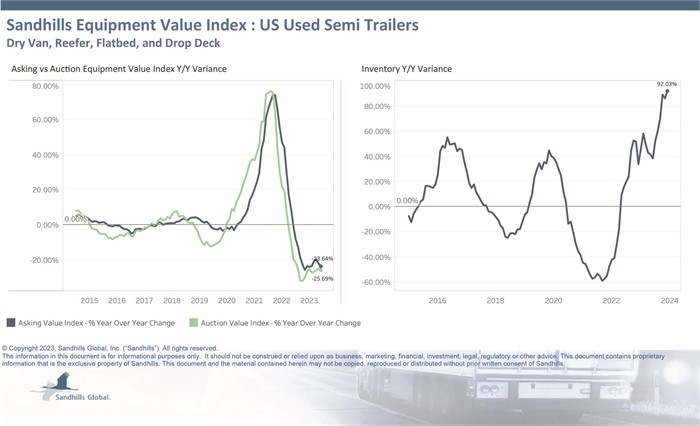

U.S. Used Semitrailers

- Used semitrailer inventory levels rose slightly in December, up 2.08% M/M, reaching a level that is almost double that of last year (up 92.03% YOY). This points to low demand as buyers are either postponing or canceling their purchases. On the other hand, values have been dropping consistently.

- Asking values were down 2.51% M/M and 23.64% YOY after months of decreases.

- Auction values were down 2.45% M/M and 25.69% YOY, also following months of decreases.

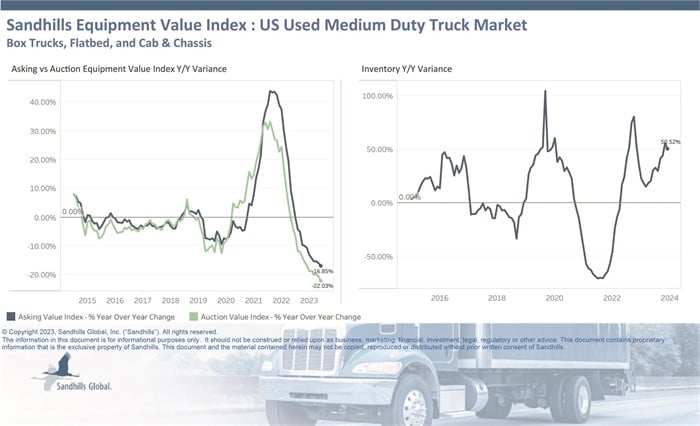

U.S. Used Medium-Duty Trucks

- Like the used heavy-duty truck market, used medium-duty trucks experienced declines in inventory levels and values in December, pointing to an oversupply. Medium-duty truck inventory levels were down 4.84% M/M and up 50.52% YOY and are currently trending sideways. \

- Asking values decreased 2.6% M/M, marking the third consecutive month of declines, and were down 16.85% YOY.

- Auction values fell 3.83% M/M, continuing a downward trend for the second month in a row, and were down 22.03% YOY.

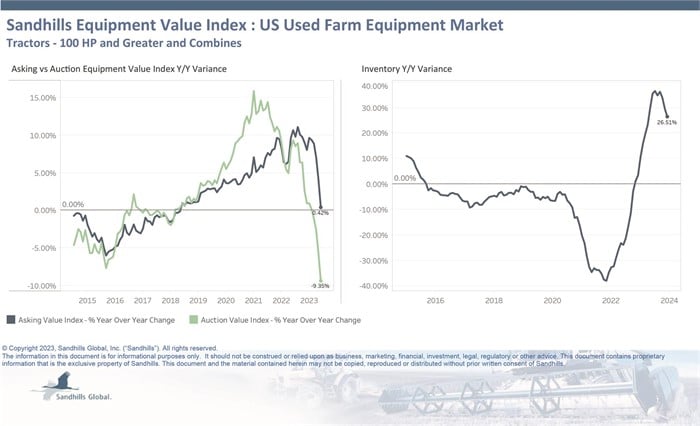

U.S. Used Farm Equipment

- Continuing an upward trend for the second month in a row, used farm equipment inventory levels rose 1.1% M/M and 26.51% YOY. The largest inventory rise was observed in the combine category (up 3.73% M/M), but inventory levels of high-horsepower (300 HP or greater) tractors are also noteworthy as they have been steadily growing for eight months in a row.

- Asking values decreased 1.06% M/M, increased 0.42% YOY, and are trending sideways.

- Auction values dipped by 1.22% M/M, initiating a downward trend, and fell 9.35% YOY. December value trends indicate that supply is higher than demand as the market faces a glut of inventory and falling prices.

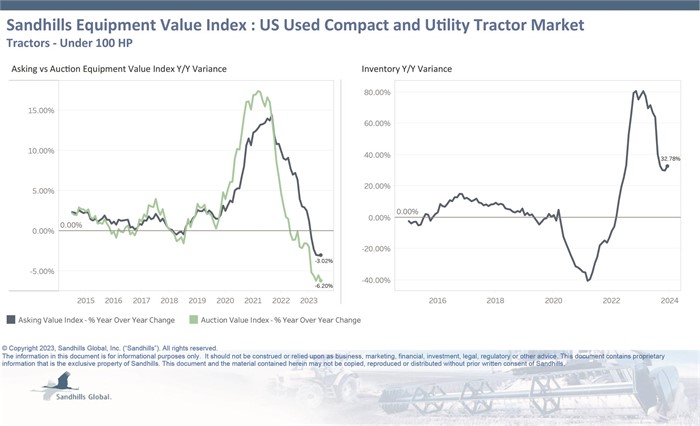

U.S. Used Compact and Utility Tractors

- Sandhills observed an increase in inventory levels and a decrease in values within the used compact and utility tractor market. Inventory levels were up 1.88% M/M, continuing an upward trend for the eighth consecutive month, and were up 32.78% YOY.

- Asking values remained stable for the second month in a row. Asking values decreased 0.12% M/M and 3.02% YOY after several months of decreases.

- Auction values extended a months-long downward trend, posting decreases of 0.99% M/M and 6.2% YOY in December. Given the trends of excess inventory and dropping values, market conditions are unfavorable for sellers of used compact and utility tractors.

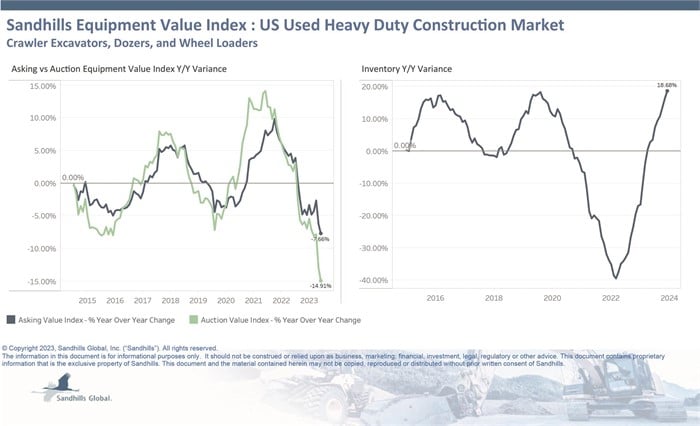

U.S. Used Heavy-Duty Construction Equipment

- Inventory levels were still above last year’s level (up 18.68% YOY) and are trending up, but levels dipped 0.83% lower M/M, reversing the previous trend of increases.

- Asking values fell for the second consecutive month, down 1.43% M/M in December, and fell 7.66% YOY. Within this market, crawler excavators exhibited the steepest M/M decline, down 1.93%.

- Auction values fell 1.8% M/M and 14.91% YOY after months of decreases, led by dozers with a 3.03% M/M drop. These changes suggest greater supply than demand for used heavy-duty construction equipment in the U.S.

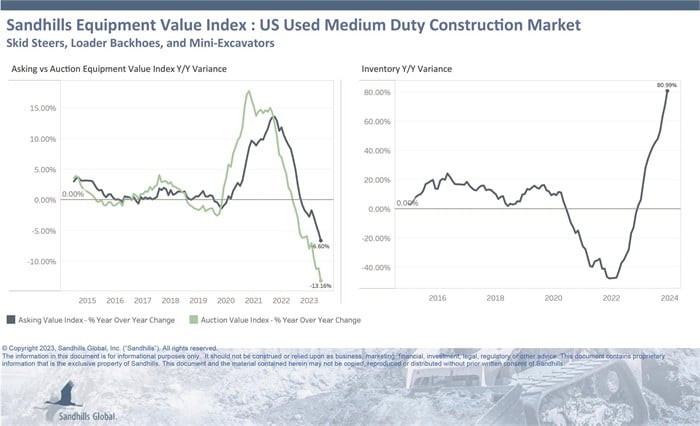

U.S. Used Medium-Duty Construction Equipment

- Inventory levels rose in this market for the 12th consecutive month, up 0.81% M/M in December, led by skid steers with a 2.84% M/M increase. Inventory levels were up 80.99% YOY.

- Asking values declined 1.37% M/M after months of decreases and fell 6.6% YOY.

- Auction values declined for the 10th month in a row, down 2.55% M/M and 13.16% YOY in December.

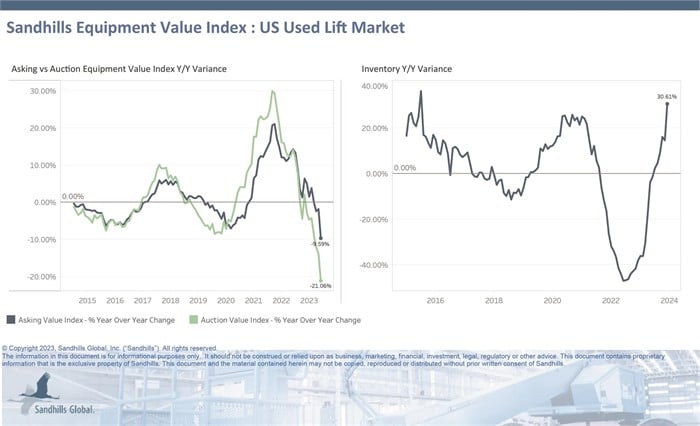

U.S. Used Lifts

- Sandhills noted a mixed performance within the used lift equipment market in December, as inventory levels increased (up 5.47% M/M and 30.61% YOY) but values fell.

- Asking values decreased 5.72% M/M and 9.59% YOY and are trending down.

- Auction values dropped 5.59% M/M after months of decreases and were down 21.06% YOY. These changes suggest a mismatch between supply and demand as the used lift market has too much inventory and falling prices.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.