February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Demand for Long-Haul Trucks and Trailers Remains Weak

The used heavy-duty truck and semitrailer markets have undergone a correction in 2023 in response to the extreme supply-demand imbalance that emerged in 2022. According to new market reports from Sandhills Global, inventory levels of used heavy-duty trucks and semitrailers in Sandhills marketplaces continue to rise and are much higher than they were last year. Demand, however, has been lower due to turbulence in the freight sector, with reduced freight activity expected to continue into 2024.

“The market outlook for heavy-duty trucks and trailers is still weak, and that isn’t likely to change over the next few months,” says Truck Paper Sales Manager Scott Lubischer. “One viable solution for dealers wanting to maximize returns right now is to take advantage of year-end auctions. December auctions on AuctionTime.com are generally the largest auctions of the year and demand is typically high.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

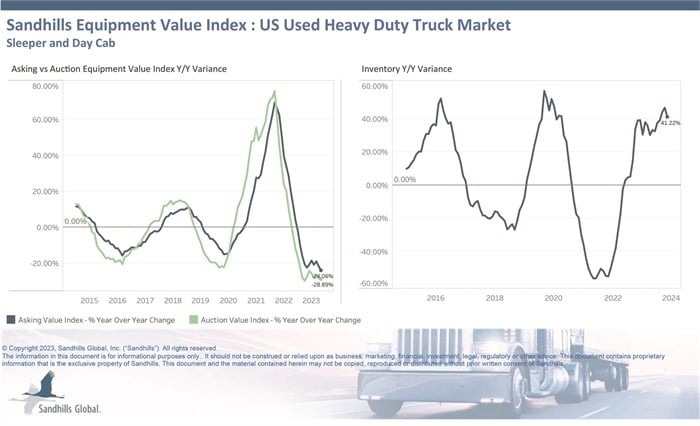

U.S. Used Heavy-Duty Trucks

- Despite a 1.53% month over month decrease in used heavy-duty truck inventory levels in November, inventory levels remained significantly higher year over year at 41.22%. Combined with ongoing decreases in demand in 2023, these inventory increases have produced a stark surplus of trucks, prompting value decreases for over a year and a half.

- Asking values dropped 4.51% M/M in November after several months of decreases and were 24.06% lower YOY.

- Auction values decreased 1.77% M/M and 28.89% YOY, also after months of decreases.

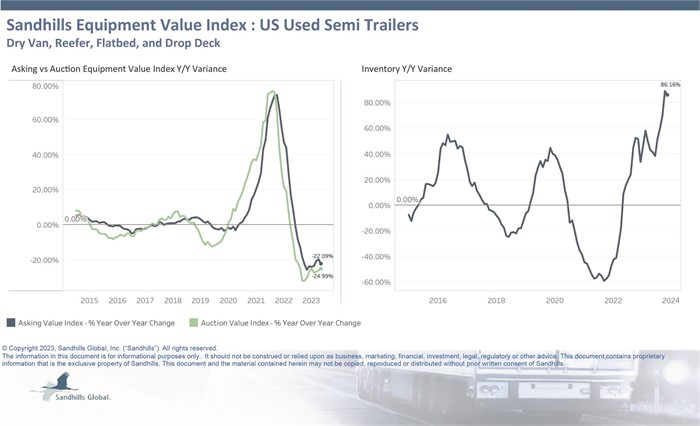

U.S. Used Semitrailers

- Inventory levels of used semitrailers have increased steadily for many months and in November reached a record high, up 86.16% YOY. An oversupply of the most popular category, dry van semitrailers, is largely responsible for this. Inventory was up 1.57% M/M. Demand, however, remains low.

- Asking and auction values in this market have fallen sharply for months. Asking values were down 5.18% M/M and 22.09% YOY in November.

- Auction values were down 3.48% M/M and 24.99% YOY.

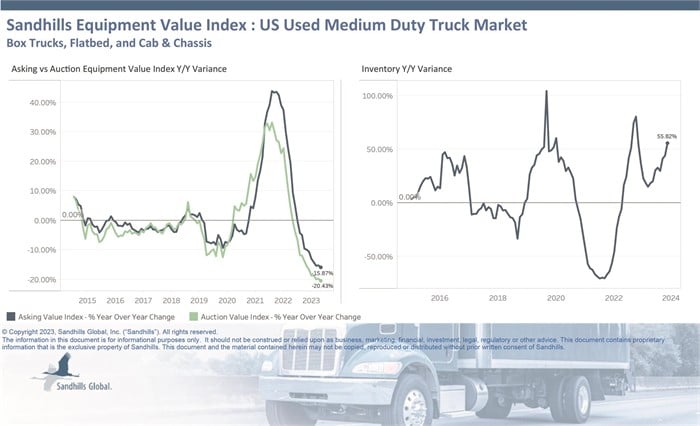

U.S. Used Medium-Duty Trucks

- Used medium-duty truck inventory levels have been increasing for most of 2023 and were up 55.82% YOY in November despite a 7.03% M/M decrease. Demand has been low, however, as economic and post-pandemic conditions continue to plague the transportation sector.

- Asking values declined 2.73% M/M and 15.87% YOY in November after several months of decreases.

- Auction values have also been declining for months, indicating that sellers are lowering prices to attract buyers. Auction values were down 3.29% M/M and 20.43% YOY and are trending down.

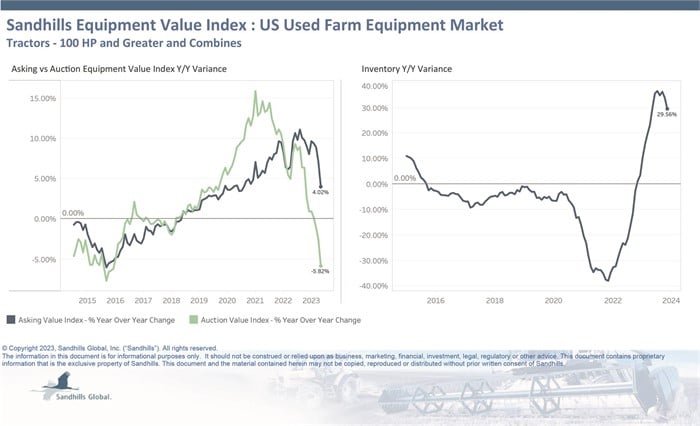

U.S. Used Farm Equipment

- Sandhills has observed fluctuations in the used farm equipment market throughout 2023, with inventory levels rising and values changing in different directions. Inventory levels were up 1.3% M/M and 29.56% YOY in November and are trending up.

- High levels of product availability have been met with variable demand, producing mixed value trends. Asking values ticked upward 0.17% M/M and rose 4.02% YOY in November, suggesting a higher expectation among sellers.

- Auction values inched up 0.69% M/M but were 5.82% lower YOY, indicating lower resale values, and are trending sideways. High-horsepower tractors (those 300 HP or greater) have been driving value changes in the broader used farm equipment market.

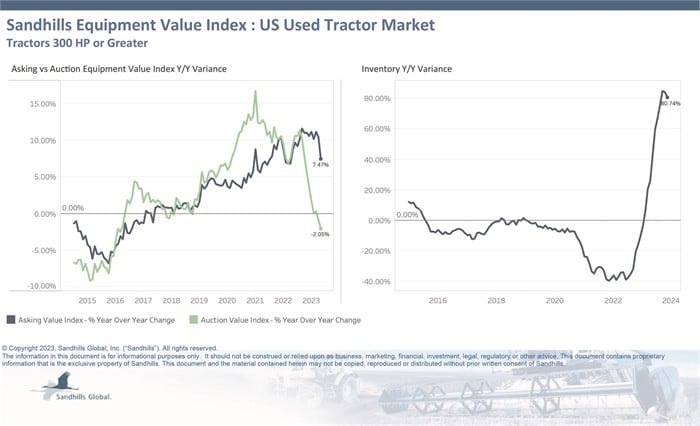

U.S. Used High-Horsepower Tractors (300HP and Greater)

- The used high-horsepower tractor category has been adjusting to higher supply levels in 2023. Inventory was up 1% M/M and 80.74% YOY in November after months of increases.

- Value trends in this category are mixed. Asking values decreased 0.45% M/M and increased 7.47% YOY in November and are trending up.

- Auction values, meanwhile, increased 2.18% M/M, decreased 2.05% YOY, and are trending sideways. The mix of higher YOY asking values and lower YOY auction values indicates a slowdown in asking values is on the horizon.

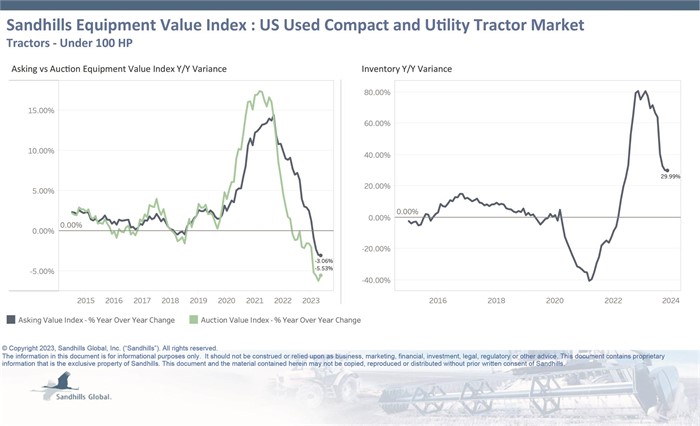

U.S. Used Compact and Utility Tractors

- The market for used compact and utility tractors has surpassed pre-pandemic supply levels, which has impacted demand in 2023. Inventory levels were up 2.28% M/M and 29.99% YOY in November after months of increases.

- Prices in this category have been dropping for several months, indicating a weaker resale value. Asking values were down 0.4% M/M and 3.06% YOY in November.

- Auction values were down 0.57% M/M and 5.53% YOY.

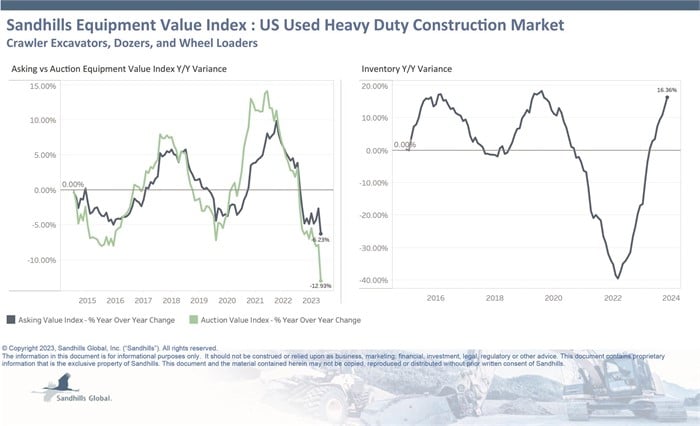

U.S. Used Heavy-Duty Construction Equipment

- This is another market that has been experiencing a lower demand and a higher supply in 2023. Used heavy-duty construction equipment inventory levels were up 2.11% M/M and 16.36% YOY in November after months of increases.

- Values in this market have been declining for several months. The excavator category has led the way in both inventory increases and value decrease within the broader market. Asking values were down 2.98% M/M and 6.23% YOY and are trending down.

- Auction values decreased 4.64% M/M and 12.93% YOY.

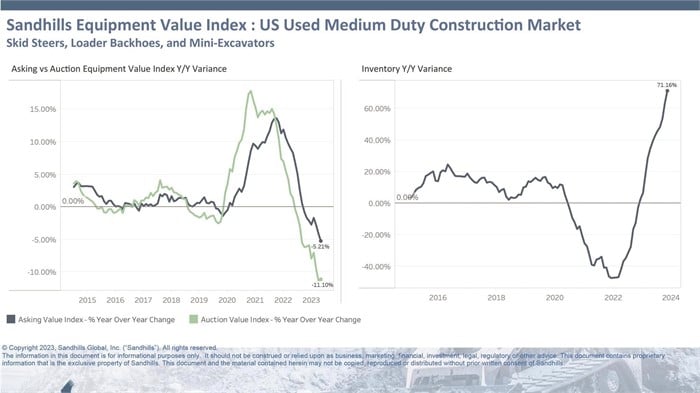

U.S. Used Medium-Duty Construction Equipment

- Sandhills has observed a supply recovery and softening demand in 2023 for used medium-duty construction equipment. Inventory levels have been rising for months, indicating an accumulation of used equipment. Inventory was also up in November, by 5.47% M/M and 71.16% YOY.

- Buyers have not expressed as much interest in used equipment as they did in 2022, leading to price drops this year. Sandhills anticipates these supply-demand factors will remain unchanged in the coming months. Asking values decreased 1.42% M/M and 5.21% YOY.

- Auction values declined 0.12% M/M and 11.1% YOY.

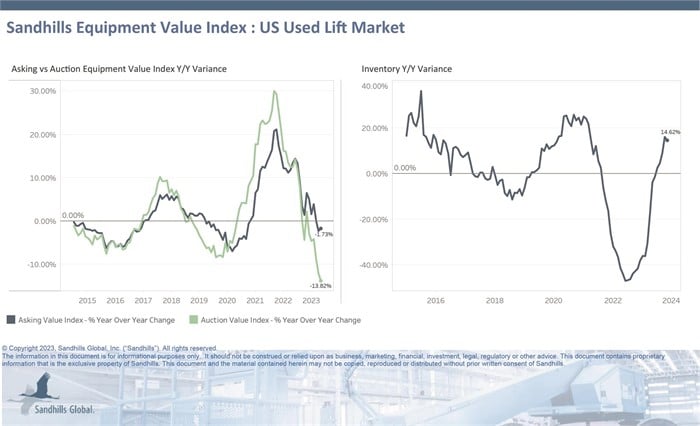

U.S. Used Lifts

- There was lower demand in the U.S. for used lifts in 2023, leading to several months of supply increases. Inventory levels dropped 3.19% M/M but rose 14.62% YOY in November and are trending up.

- Used lift prices have been declining for several months. Asking values were up 1.42% M/M but down 1.73% YOY and are trending down.

- Auction values fell 1.36% M/M and 13.82% YOY after months of decreases.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.