February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Rising Inventories and Decreasing Values Persist for Used Heavy-Duty Trucks and Trailers

According to the newest market reports from Sandhills Global, supply increases throughout 2023 for used heavy-duty trucks, semitrailers, tractors, construction equipment, and lifts in Sandhills marketplaces have not been accompanied by corresponding increases in demand. This has led to a decline in asset values in most equipment, truck, and trailer categories.

“The trend we’re tracking across all three industries—trucks, farm equipment, and construction equipment—is especially pronounced within the heavy-duty truck and semitrailer markets,” says Truck Paper Sales Manager Scott Lubischer. “These markets have declined continually since the last value peaks occurred in Q2 2022.”

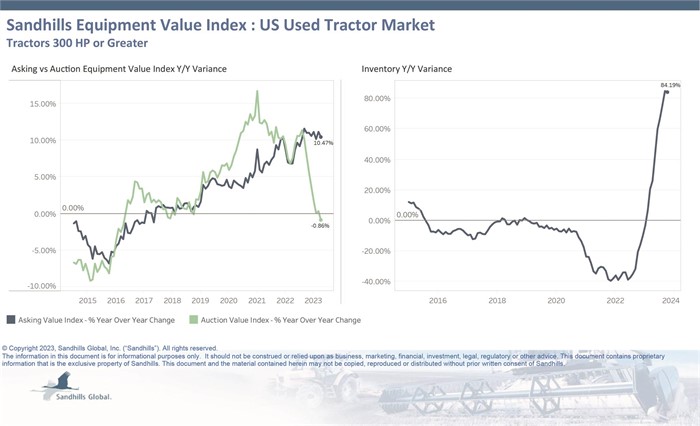

High-horsepower tractors (those with 300 horsepower or greater) are the only exception to the trend. This market has shown a greater degree of stability and growth in asking values over the past year compared to other markets. By contrast, the other markets have been weak, with current asking and auction values falling below year-ago levels.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

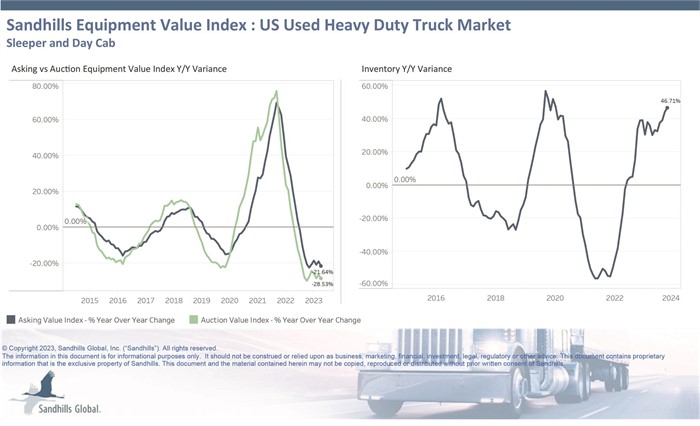

U.S. Used Heavy-Duty Trucks

- The supply of used heavy-duty trucks in the U.S. has been rising for several months with inventory levels reaching a 46.71% year-over-year increase in October. Inventory levels were up 3.35% month over month and are trending up.

- However, the market has not responded with strong demand for the abundance of used trucks, as illustrated by 18 months of consecutive declines in asking and auction values. Asking and auction values were both lower in October than they were last year, reflecting a weak overall market for used heavy-duty trucks. Asking values were down 3.31% M/M and 21.64% YOY and are trending down.

- Auction values were down 4.33% M/M and 28.53% YOY and are trending down.

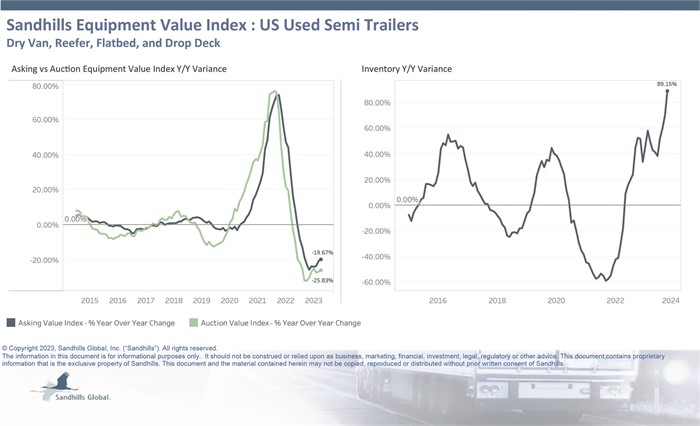

U.S. Used Semitrailers

- Inventory levels of used semitrailers have exhibited significant growth in 2023. This is particularly true of dry van semitrailers as their supply more than doubled compared to last year. Used semitrailer inventory increased 8.29% M/M following several months of increases and rose 89.15% YOY.

- Increased supply has led to declines in asking and auction values, both of which are trending down. Asking values inched down 0.98% M/M in October after months of decreases and were 19.67% lower than last year.

- Auction values showed a similar pattern, down 1.05% M/M after months of decreases and posting a 25.83% YOY decline.

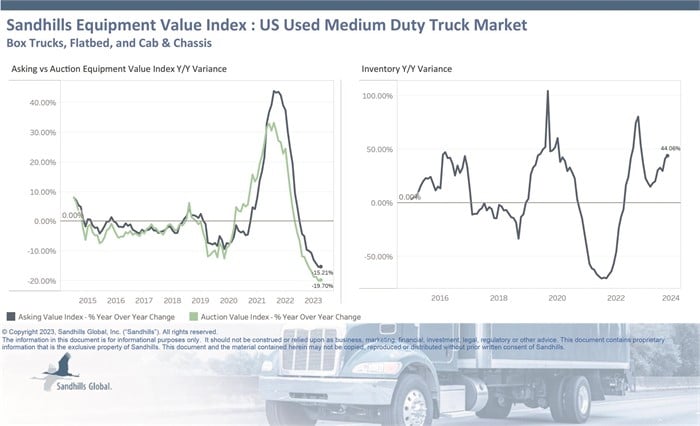

U.S. Used Medium-Duty Trucks

- Used medium-duty truck inventory levels have surged in 2023. Following months of consecutive increases, inventory levels ticked up 0.34% M/M and rose 44.06% YOY in October.

- Asking and auction values, however, have not risen, and the latest figures indicate a weak demand in this market. Asking values were down 0.12% M/M in October after months of decreases and were 15.21% lower than last year.

- Auction values were up 0.29% M/M and down 19.7% YOY and are trending down.

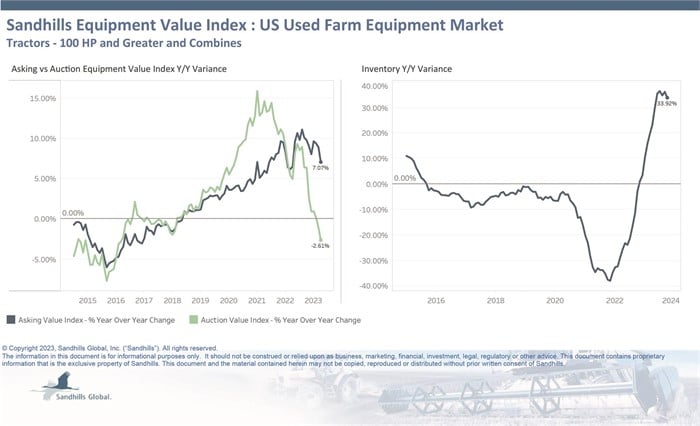

U.S. Used Farm Equipment

- Sandhills observed an anticipated seasonal dip in used farm equipment inventory levels in October, but supply was still 33.92% higher than year-ago levels. Inventory levels fell slightly M/M with a 0.87% decline and are trending up.

- Asking values were down 0.6% M/M and up 7.07% YOY and are trending up.

- Auction values increased 0.23% M/M but declined 2.61% YOY and are trending down. The used high-horsepower tractor market is responsible for mixed trends in asking and auction values in the overall farm equipment market.

U.S. Used High-Horsepower Tractors (300 HP and Greater)

- Inventory levels of used high-horsepower tractors rose 3.29% M/M and 84.19% YOY in October.

- This market has recently shown some stability for both asking and auction values, indicating market corrections are in play. Asking values were up 0.27% M/M and 10.47% YOY and are trending up.

- Auction values were up 0.66% M/M following months of increases but were down 0.86% YOY.

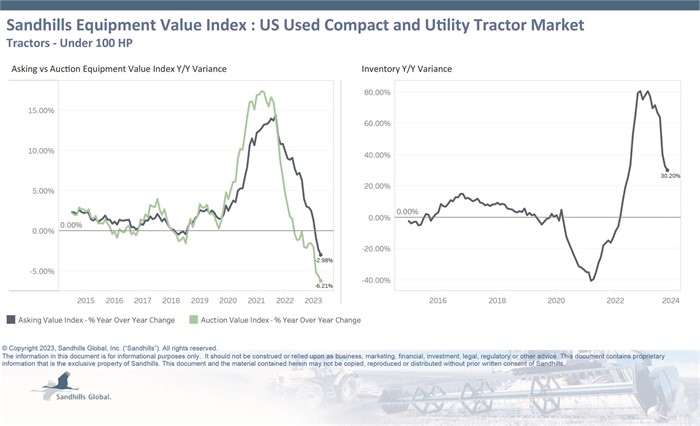

U.S. Used Compact and Utility Tractors

- Used compact and utility tractor inventory levels have grown throughout 2023. Following months of increases, inventory levels were up 6.76% M/M and 30.2% YOY in October.

- As inventory continues to pile up, asking and auction values have experienced months of declines. Asking values were down 0.1% M/M and 2.98% YOY.

- Auction values were down 0.8% M/M and 6.21% YOY in October.

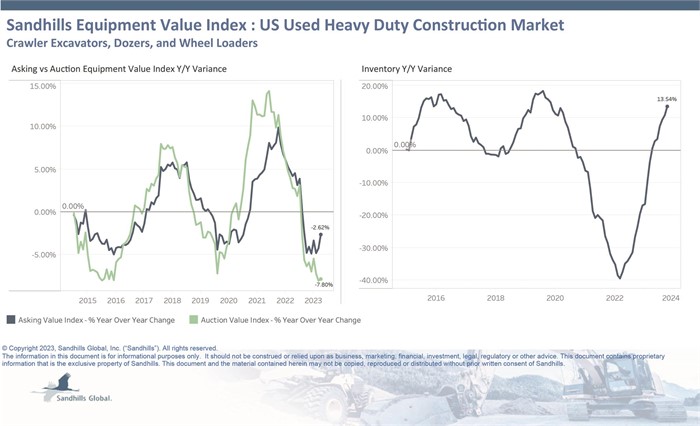

U.S. Used Heavy-Duty Construction Equipment

- The U.S. supply of used heavy-duty construction equipment has been growing for several months, but this has not been matched by strong demand. Inventory levels increased 1.46% M/M and 13.54% YOY in October.

- Asking values have been trending down but increased slightly, by 0.15% M/M, in October. Asking values were 2.62% lower YOY, reflecting a growing market for used heavy-duty construction equipment.

- Auction values were down 1.59% M/M and 7.8% YOY, adding to months of decreases, which indicates a weaker auction market for used heavy-duty construction equipment.

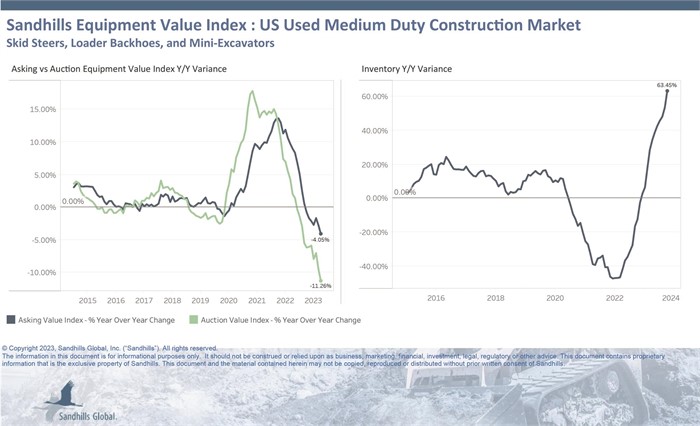

U.S. Used Medium-Duty Construction Equipment

- Supply in this market has been rising for months, reaching a 63.45% YOY increase in October, but demand has not kept up and both asking and auction values have dropped. Inventory rose 5.94% M/M.

- Both asking and auction values have declined for consecutive months. Asking values fell 1.18% M/M and 4.05% YOY in October.

- Auction values fell 2.68% M/M and 11.26% YOY. U.S.

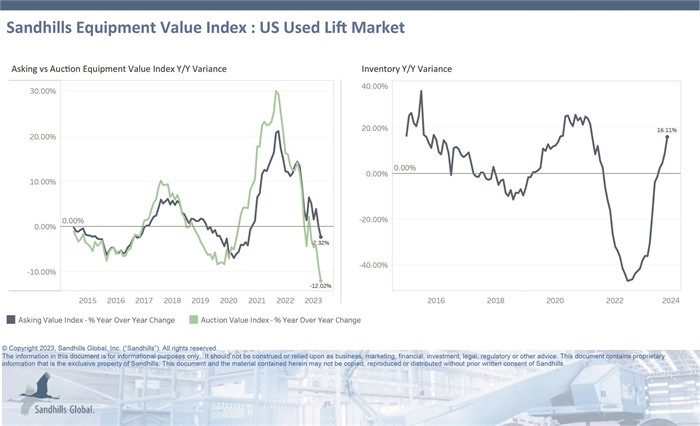

Used Lifts

- The supply of lifts in the U.S. has been rising for months. This did not change in October, with inventory levels posting increases of 1.73% M/M and 16.11% YOY.

- Asking and auction values, meanwhile, have been falling for consecutive months. Asking values dropped 1.84% M/M and 2.32% YOY in October.

- Auction values decreased 3.28% M/M and 12.02% YOY.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.