February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Equipment Value Decreases Accelerating Across Industries

According to the newest Sandhills Global market reports, ongoing inventory increases have led to decreased auction values across the construction equipment, farm machinery, heavy-duty truck, and semitrailer categories in Sandhills marketplaces. These increases have led to decreased auction values and a wider spread between asking and auction values.

“As we continue seeing inventory levels rise across our markets, a corresponding drop in auction values is to be expected,” says Sales Manager Mitch Helman. “Asking values are dropping less quickly in some markets. The spread between asking and auction values is especially pronounced for medium-duty construction equipment, medium-duty trucks, and high-horsepower tractors.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

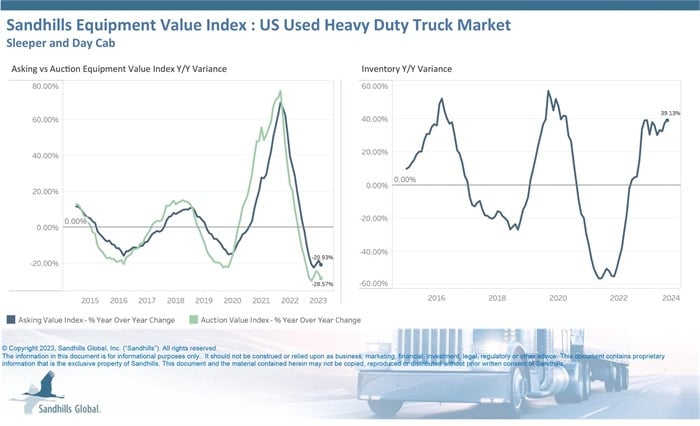

U.S. Used Heavy-Duty Trucks

- Inventory level increases paused in August for used heavy-duty trucks. However, an upward trend remains and is expected to continue.

- Asking and auction values maintained a downward trend that began in Q2 2022, with sleeper trucks falling at a faster pace than day cabs in August. Asking values fell 3.72% month to month and 20.93% year over year following consecutive months of decreases.

- Auction values declined 2.43% M/M and 28.57% YOY, also following consecutive months of decreases.

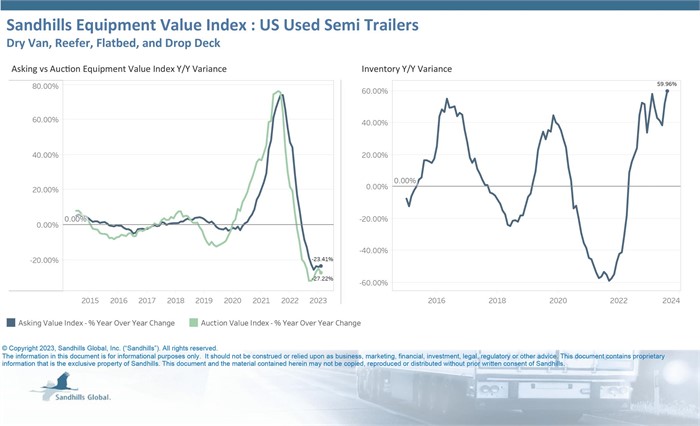

U.S. Used Semitrailers

- Used semitrailer inventory levels were up 3.55% M/M and 59.96% YOY after several months of increases, with the dry van and reefer semitrailer categories leading the way.

- A downward trend continued for both asking and auction values, with dry van semitrailers exhibiting the most significant M/M value decreases in August. Asking values were up 0.05% M/M and down 23.41% YOY in August.

- Auction values fell 2.87% M/M and 27.22% YOY following months of decreases.

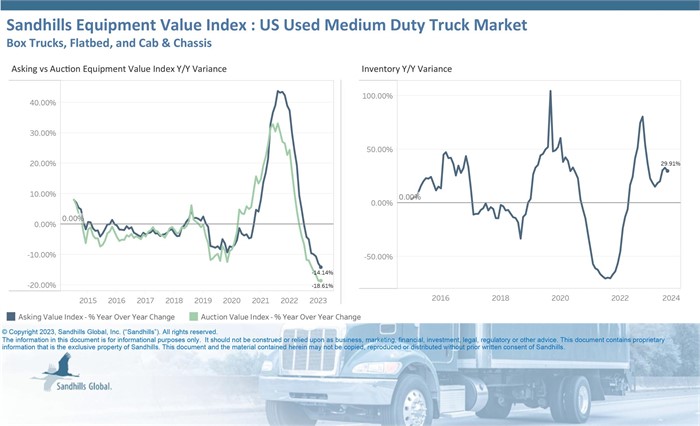

U.S. Used Medium-Duty Trucks

- Inventory levels of used medium-duty trucks have been trending up for several months, led by the box truck category. Inventory was up 1.54% M/M and 29.91% YOY in August.

- This market segment showed the largest gap between asking and auction values. Asking values declined 0.44% M/M and 14.14% YOY in August.

- While used medium-duty truck asking values have continued to fall, auction value decreases have paused for a few months. In August, auction values were up 1.16% M/M and down 18.61% YOY. Auction values are currently trending down.

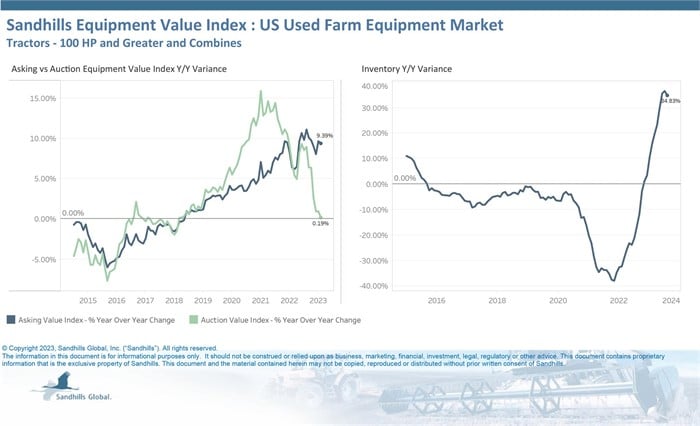

U.S. Used Farm Equipment

- Used farm equipment inventory levels were up 0.66% M/M and 34.83% YOY in August and are trending up. Sandhills has observed seasonal inventory decreases in the used combine category.

- Asking values remain elevated and are greater than they were a year ago, up 0.69% M/M and 9.39% YOY after consecutive months of increases.

- Auction value decreases have been noted among used combines and high-horsepower tractors (300 HP and greater) in past months, but even with recent decreases, auction values are on par with last year. Auction values were up 0.19% M/M and 0.19% YOY and are trending sideways.

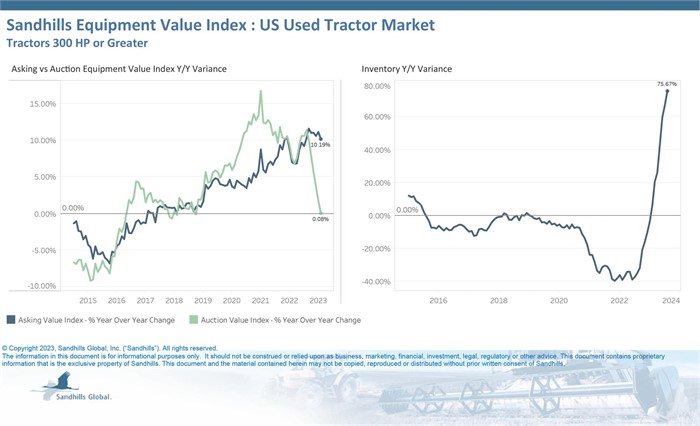

U.S. Used High-Horsepower Tractors (300 HP and Greater)

- Continuing several months of increases, inventory levels of used high-horsepower tractors were up 8.13% M/M and 75.67% YOY in August, a noteworthy acceleration led in part by 2022 model year tractors.

- Asking values are trending upward, up 0.93% M/M and 10.19% YOY in August after months of increases, while auction values are trending downward.

- Auction values were up just 0.41% M/M and 0.08% YOY and are trending down. The spread between asking and auction values expanded in August.

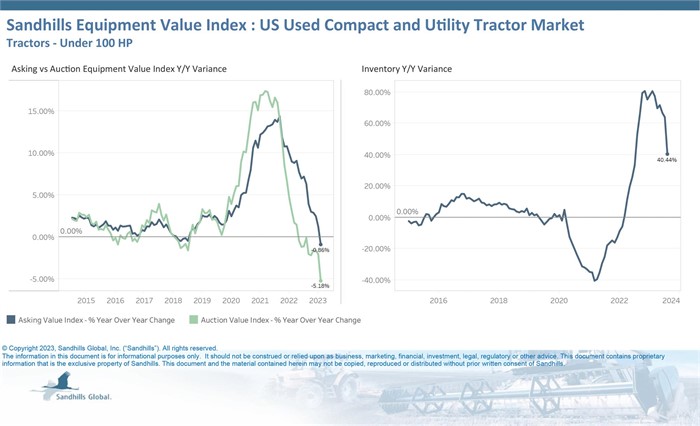

U.S. Used Compact and Utility Tractors

- Inventory levels of used compact and utility tractors have been piling up in 2023. August was no different, as inventories increased 3.06% M/M and 40.44% YOY. The categories of model years 2021 and newer are driving the changes in this category.

- Asking values increased 0.23% M/M, decreased 0.86% YOY, and are trending down. Asking values have been lagging behind auction values.

- Auction values have been trending down for months and declined 1.06% M/M and 5.18% YOY in August.

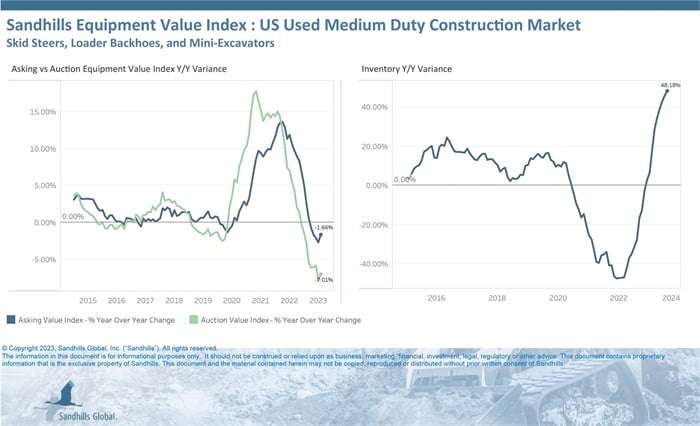

U.S. Used Medium-Duty Construction Equipment

- An upward trajectory continued for used medium-duty construction equipment inventory levels in August, which were up 6.14% M/M and 48.18% YOY. The largest M/M increases occurred in the track skid steer category; inventory levels were also up 83% YOY.

- Asking values ticked upward 0.24% M/M and downward 1.66% YOY in August and are trending down. The gap between asking and auction values has now reached historic highs.

- Auction values were down just 0.06% M/M after months of decreases and were 7.01% lower YOY. The most significant decreases were observed in the wheeled skid steer and mini excavator groups, with auction values down 10% YOY.

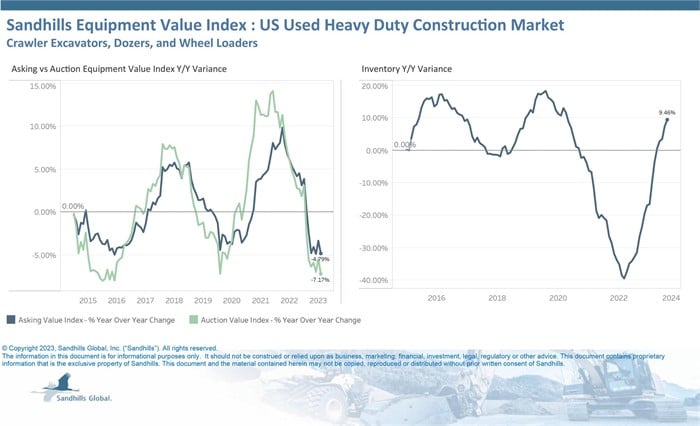

U.S. Used Heavy-Duty Construction Equipment

- The excavator category is leading the inventory recovery within the used heavy-duty construction equipment market. In the market overall, inventory levels were up 2.58% M/M following months of increases and rose 9.46% YOY.

- Asking and auction values are trending down with the largest value decreases seen in the excavator category. Dozer values are trending down, although not as quickly as the excavator and wheel loader categories. Overall, used heavy-duty construction equipment asking values dropped 1.74% M/M and 4.79% YOY in August.

- Auction values were down 2.18% M/M and 7.17% YOY and are trending down.

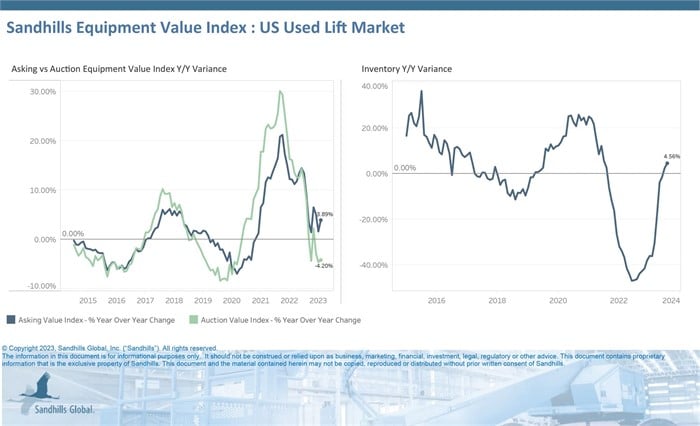

U.S. Used Lifts

- Inventory levels of used lift equipment are trending upwards with the telehandler and scissor lift categories taking the lead. Overall, inventory levels were up 2.33% M/M and 4.56% YOY.

- Asking values remained elevated in August, increasing 2.42% M/M and 3.89% YOY, and are trending sideways.

- Auction values are trending down with the largest decreases observed in the boom lift category. Auction values increased 1.01% M/M and decreased 4.2% YOY.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.