February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

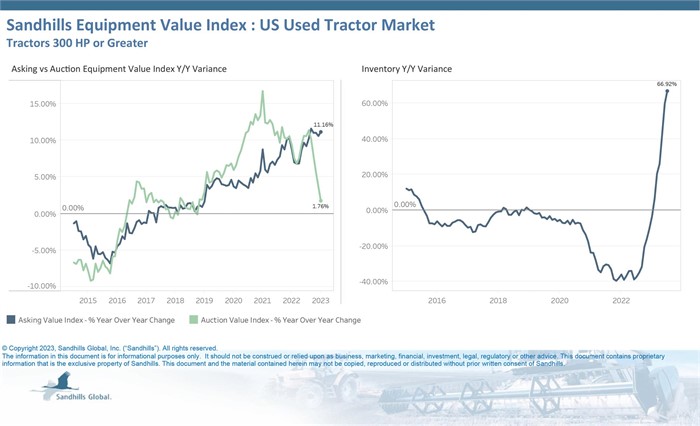

Auction Values of Used High-Horsepower Tractors Trending Downward

As inventory levels of used tractors in Sandhills Global marketplaces continue to recover from post-pandemic lows, auction values are exhibiting a decline, according to Sandhills' newest market reports. Inventories of used high-horsepower tractors (300 horsepower and greater) are increasing especially quickly, with auction values trending downward as a result. Used high-horsepower tractor asking values have reacted more slowly to inventory increases, however, resulting in a widening gap between auction and asking values.

Inventory increases across the other industries Sandhills tracks—used farm equipment, construction equipment, heavy-duty trucks, and semitrailers—are also leading to lower auction values as well as a widening gap between asking and auction values. Auction value declines paused in July, however, in the used combine category as seasonal inventory decreases were observed.

“As inventories are building back up for high-horsepower tractors, asking values haven't been impacted as much as auction values,” says Sales Manager Mitch Helman. “The gap between auction and asking values keeps growing, so it’s important for dealers to note the detailed analysis in the market reports and watch how these trends develop.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

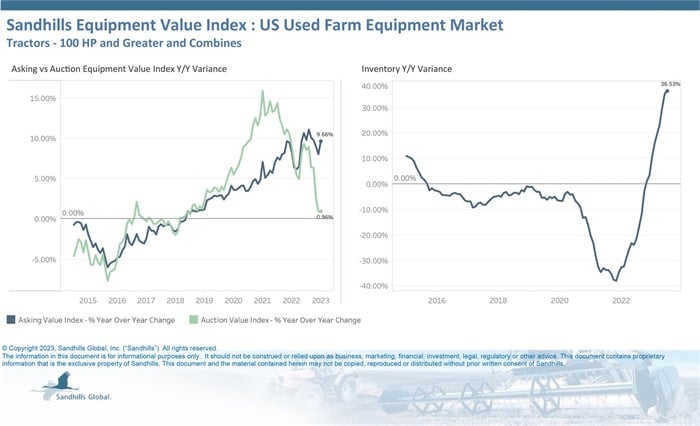

U.S. Used Farm Equipment

- Used farm equipment inventory levels decreased 0.01% month over month in July but rose 36.53% YOY and are currently trending up.

- Asking values increased 1.52% M/M and 9.66% YOY and are trending up.

- Although auction values were 0.96% higher YOY in July, auction values only notched up 0.04% M/M and are trending down.

U.S. Used Tractors 300 Horsepower and Greater

- Used high-horsepower tractor inventory is quickly on the rise and auction values have declined as a result. Inventory levels rose 7.69% M/M in July following consecutive months of increases and were up 66.92% YOY.

- Asking values have been slow to react to inventory level increases, a trend Sandhills reported last month that continues to hold true. Asking values increased 0.97% M/M and 11.16% YOY after several months of increases.

- Auction values were 0.87% lower M/M after months of decreases but were 1.76% higher YOY.

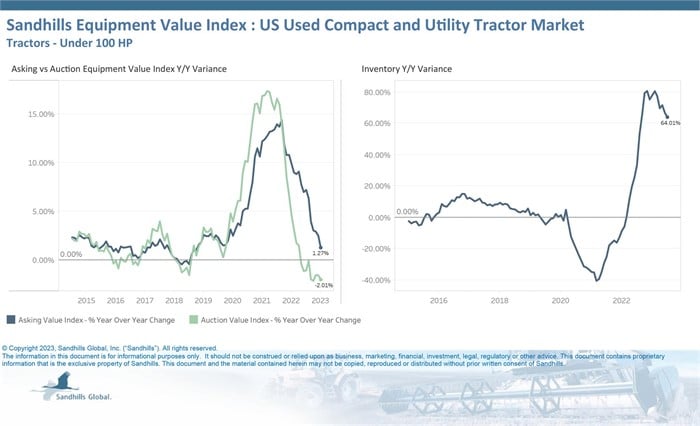

U.S. Used Compact and Utility Tractors

- Inventory levels of used compact and utility tractors under 100 HP have surpassed pre-pandemic levels. Continuing after several months of increases, inventory levels were up 4.64% M/M and 64.01% YOY in July.

- Asking and auction values continue to slowly bleed and trend downward. Asking values rose 1.27% YOY but dropped 0.83% M/M and are currently trending down.

- Auction values have also experienced consecutive months of decreases and continued that trend in July, dropping 1.00% M/M and 2.01% YOY.

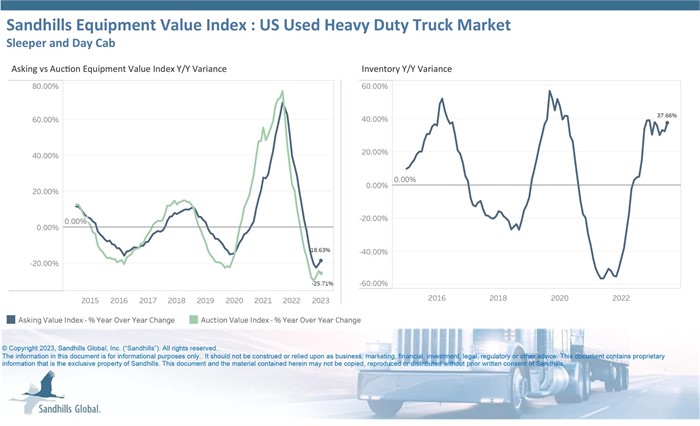

U.S. Used Heavy-Duty Trucks

- Used heavy-duty truck inventory increases and value decreases have persisted for many months. The inventory trend continued in July with 5.06% M/M and 37.66% YOY increases. Day cab trucks have exhibited more substantial changes, with inventory levels quickly on the rise over the past few months and auction values falling faster than sleeper trucks in July.

- Used heavy-duty truck asking values declined 0.92% M/M and 18.63% YOY in July after consecutive months of decreases.

- Auction values fell 3.84% M/M and 25.71% YOY, also following consecutive months of decreases.

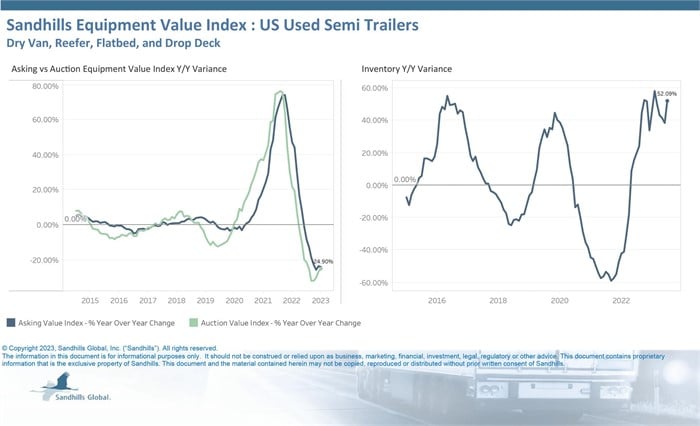

U.S. Used Semitrailers

- Used semitrailer inventory continues to recover from historic lows observed at the end of 2021. Following months of increases, inventory levels in this market rose 7.95% M/M and 52.09% YOY in July. Dry van semitrailer inventory increased significantly compared to other semitrailer categories.

- Asking and auction values continue to follow trends similar to those of heavy-duty trucks. Asking values fell 3.06% M/M and 23.94% YOY after months of declines.

- Auction values also continued months of consecutive declines, posting 1.42% M/M and 24.9% decreases in July.

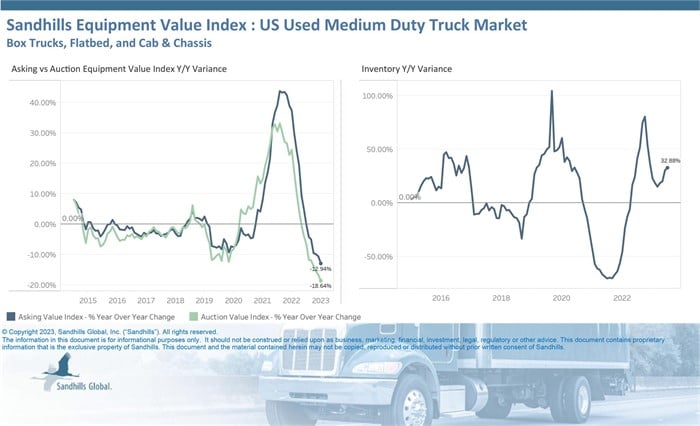

U.S. Used Medium-Duty Trucks

- After a brief decrease at the beginning of the 2023 calendar year, inventory levels have been adding up. Used inventory levels were up 4.98% M/M and 32.88% YOY in July.

- Asking and auction values in this market remain lower than last year by double digits. Asking values were down 1.35% M/M and 12.94% YOY after months of decreases.

- Auction values were down 0.36% M/M and 18.64% YOY, also after months of decreases. The spread between asking and auction values remains at historically high levels.

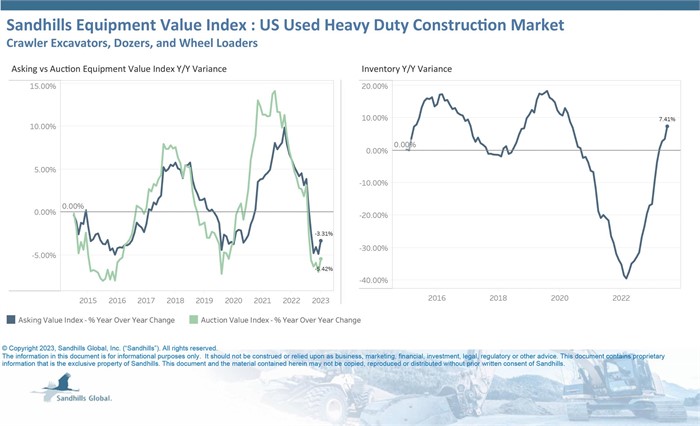

U.S. Used Heavy-Duty Construction Equipment

- Used heavy-duty equipment inventory levels have posted consecutive months of increases; levels were up 4.14% M/M and 7.41% YOY in July. Inventory levels have remained steady with the exception of excavators under 18 metric tons. Inventories in these segments are up by double digits and have been trending upwards since April of last year.

- Asking and auction values have slowly decreased since Q2 2022. Asking values notched upward 0.85% M/M, fell 3.31% YOY, and are currently trending down.

- Auction values inched up 0.45% M/M, dropped 5.42% YOY, and are trending down.

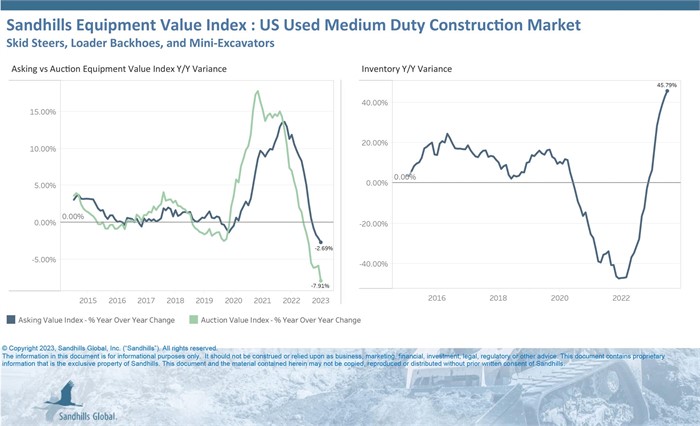

U.S. Used Medium-Duty Construction Equipment

- Used medium-duty equipment inventory levels are growing quickly, continuing months of increases, posting 5.91% M/M and 45.79% YOY increases in July. The track skid steer and mini excavator categories are leading recovery within this marketplace.

- Asking values drooped 0.18% M/M and 2.69% YOY after several months of declines.

- Auction values, which have also been declining for months, dropped 2.78% M/M and 7.91% YOY in July. As auction and asking values of used medium-duty construction equipment continue to decline, the spread between these values is nearing historical highs.

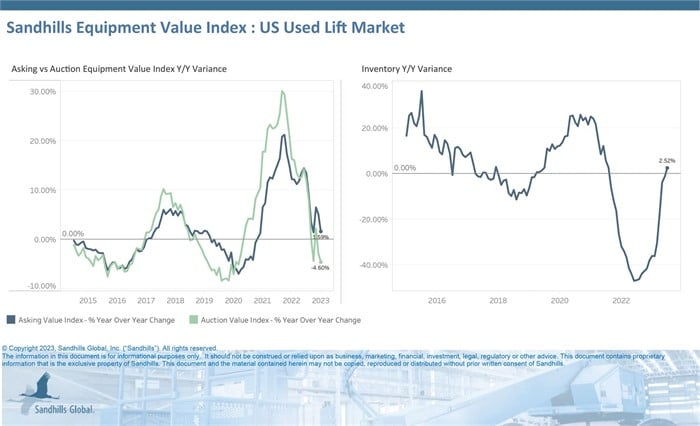

U.S. Used Lifts

- Inventory levels of used lift equipment have been increasing since February. Inventories decreased 0.26% M/M in July but increased 2.52% YOY.

- Sandhills has observed a mix of value trends in this market. For example, a spread between telehandler asking and auction values continues to widen while forklift asking values have begun to decrease following auction value declines. Asking values fell 3.19% M/M and increased 1.59% YOY after consecutive months of decreases.

- Auction values decreased 1.87% M/M and 4.6% YOY, also continuing consecutive months of decreases.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.