February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Inventory Levels Up, Values Down as Sandhills Global Market Reports Show Continuing Trends

Inventory levels showed another month of increases across Sandhills Global marketplaces for used trucks, trailers, construction equipment, and farm machinery. And in what has become a recurring trend, asking and auction values dropped year over year in most of the equipment categories Sandhills monitors. As an example, the asking value for a typical 4-year-old sleeper truck was around $120,000 in April 2022. By contrast, asking value this April for the typical 4-year-old sleeper was around $80,000, one-third less YOY. Value trends are likely to continue moving lower for heavy-duty trucks into the near future.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets as well as model year equipment actively in use.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Each report includes detailed analysis and charts that help readers visualize the data. The newest reports examine year-over-year variance in detail, noting changes from April 2022 to April 2023 with an eye to inventory, asking value, and auction value trends.

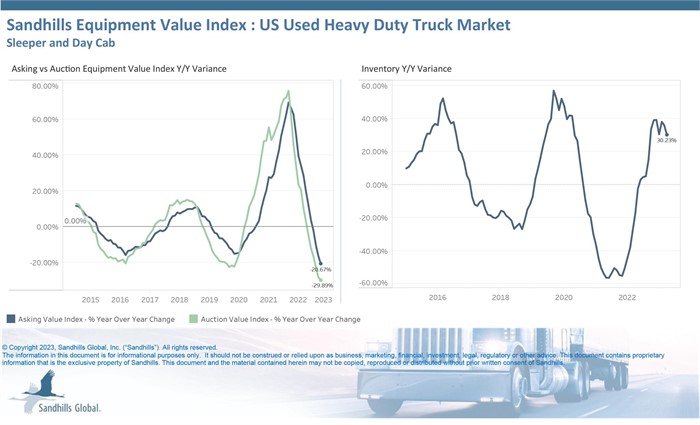

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI shows heavy-duty truck inventory increased 4.82% month over month and 30.23% YOY in April.

- Heavy-duty truck values have been in nearly continual decline since March 2022, and in April, asking values dropped 2.7% M/M and 20.67% YOY.

- Auction values also declined, falling 5.36% M/M and 29.89% YOY.

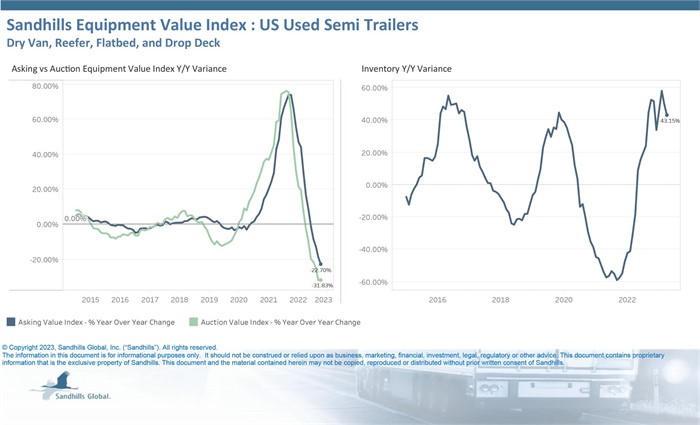

U.S. Used Semitrailers

- April’s semitrailer inventory increases were driven by dry van and reefer semitrailers. The Sandhills EVI expects semitrailer inventory to continue to increase and values to soften going forward.

- Semitrailer inventory levels increased 4.66% M/M, extending consecutive months of gains, and were up 43.15% YOY.

- Asking values in April were down 1.09% M/M and 22.7% YOY.

- Semitrailer auction values decreased 2.17% M/M and 31.83% YOY.

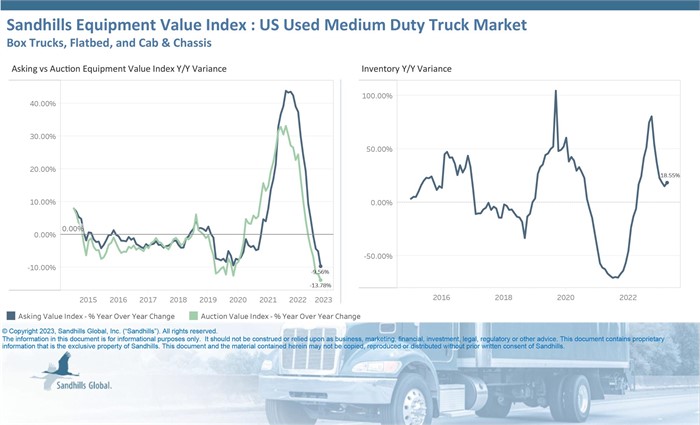

U.S. Used Medium-Duty Trucks

- Used medium-duty truck inventory has been rising since the start of 2023. In April, inventory levels increased 5.46% M/M and 18.55% YOY.

- So far in 2023, medium-duty truck asking and auction values have decreased by 2% to 3% each month.

- In April, asking values decreased 2.32% M/M and 9.56% YOY.

- Auction values experienced similar drops, declining 2.03% M/M and 13.78% YOY.

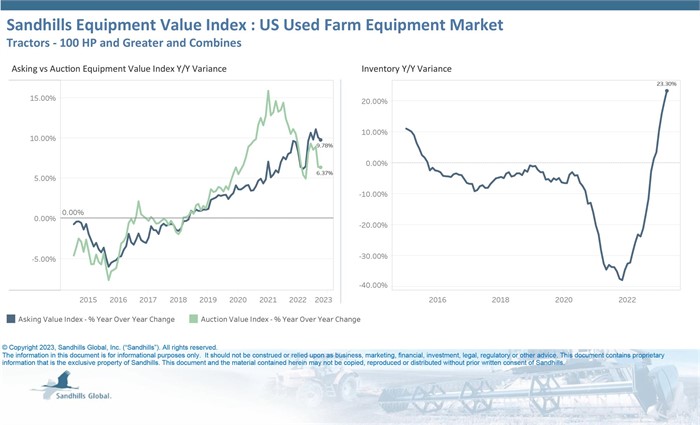

U.S. Used Farm Equipment

- As used farm equipment inventory levels continue to climb, the gap between asking and auction values is increasing; these trends are leading indicators of a coming decline in asking and auction values.

- Inventory levels increased 1.05% M/M and 23.3% YOY in April.

- Over the past few months, farm equipment asking values held steady, and this trend continued in April. Asking values decreased 0.18% M/M and were up 9.78% YOY.

- Auction values for the used farm equipment market, which includes combines and 300-horsepower-or-greater tractors, have cooled in recent months, but values are currently trending sideways.

- In April, auction values decreased 0.79% M/M and were 6.37% higher than last year.

U.S. Used Compact and Utility Tractors

- Used compact and utility tractor inventories experienced seasonal declines in April, with levels dropping 2.83% M/M. However, the long-term recovery trend remained intact with levels up 69.67% YOY.

- The Sandhills EVI has shown asking and auction values for compact and utility tractors softening in recent months, and auction values were already lower this April than they were in April 2022. YOY asking value drops are likely to follow.

- Asking values decreased 0.67% M/M and are currently trending sideways. Compared to last April, asking values were up 3.03%.

- Auction values are also currently trending sideways. Sandhills EVI indicates that auction values decreased just 0.33% from March to April and were down 2.14% YOY.

U.S. Used Heavy-Duty Construction Equipment

- Unlike inventory levels in the truck, trailer, and ag equipment markets, used heavy-duty construction equipment inventory has held steady since last year and is currently trending sideways. In April, inventory increased 1.04% M/M and 0.6% YOY.

- Asking and auction values have been in decline since the start of 2023; used crawler excavators are the primary driver of these decreases.

- In April, asking values decreased 1.26% M/M and 4.76% YOY.

- Auction values declined 0.17% M/M and 6.32% YOY.

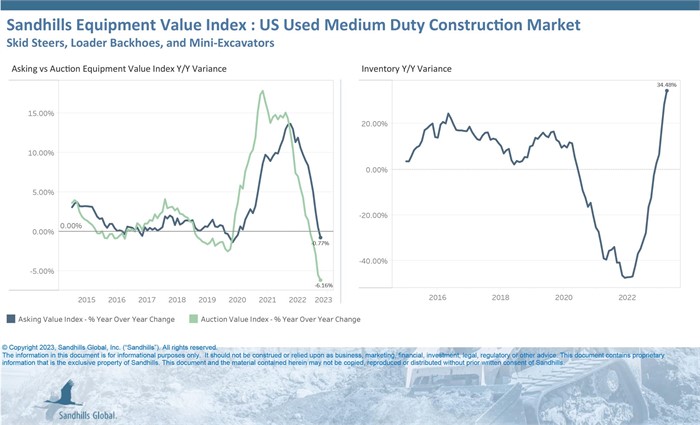

U.S. Used Medium-Duty Construction Equipment

- Inventory levels in this category have been trending up since the start of 2023, led by mini excavators and track skid steers.

- The Sandhills EVI shows used medium-duty construction equipment inventory increased 3.39% M/M and 34.48% YOY.

- Loader backhoes played a role in asking value declines for used medium-duty construction equipment in April. Overall, asking values were nearly flat M/M and decreased 0.77% YOY.

- Auction values declined 0.48% M/M in April, continuing a string of M/M decreases, and were 6.16% lower than last year.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.