February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Tractor Inventory Climbs Across All Categories in February, Adding to Long-Term Inventory Recovery Trend

Used tractor inventory levels in Sandhills Global marketplaces rose again in February, continuing a long-term inventory rebound that began in Q2 2022 as various pandemic-related farm equipment production and supply chain constraints began to ease. Inventory levels increased across all used tractor categories, from under-100-horsepower compact and utility tractors to 300-and-greater-HP tractors, when comparing February 2022 to February 2023.

“We typically see tractor inventory levels increase in January and February, but the year-over-year gains in recent months indicate that current inventory trends are outpacing seasonal effects,” says Sales Manager Mitch Helman. “Inventory of compact and utility tractors have increased faster than higher-horsepower farm tractors, so farm equipment sellers should monitor changing trends as buyers come in this spring.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Effective with the January 2023 EVI, Sandhills introduced version enhancements and weighted adjustments. All historic EVI metrics were amended and recalculated back to 2005, and all calendar year 2023 EVI releases will include these enhancements.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used farm machinery, heavy-duty truck, semitrailer, and construction equipment markets. Each report includes detailed analysis and charts that help readers visualize the data. The newest reports examine year-over-year variance in detail, noting changes from February 2022 to February 2023 with an eye to inventory, asking value, and auction value trends.

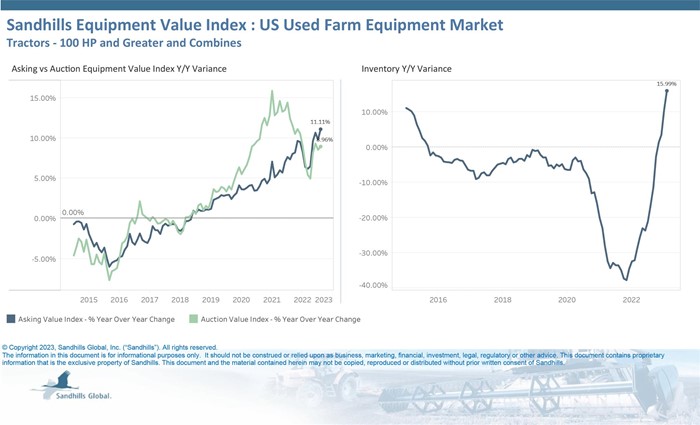

U.S. Used Farm Equipment

- Used farm equipment inventory, which includes 100 HP or greater tractors and combines, has climbed steadily since the middle of 2022. In February, farm equipment inventory levels were up 2.78% month over month and 15.99% YOY.

- Asking values have remained strong for used farm equipment during the extended inventory rebound. Asking values increased 0.82% M/M and were up 11.11% YOY.

- Auction values for used farm equipment dropped 0.42% M/M but increased 8.96% YOY in February.

- Increases in YOY asking and auction values were driven by late-model combines and high-HP (300-and-greater-HP) tractors.

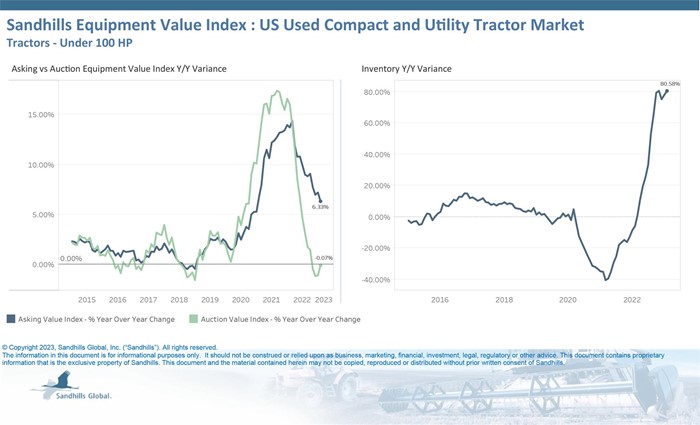

U.S. Used Compact and Utility Tractors

- Inventory levels for used compact and utility tractors increased 1.58% from January to February and were 80.58% higher YOY in February.

- As used inventory for compact and utility tractors has continued to grow, asking value increases have slowed and auction values remained on par with last year.

- Asking values decreased 0.23% M/M but increased 6.33% YOY and are currently trending up.

- Auction values increased 1.5% M/M and were nearly even (0.07%) YOY and are currently trending sideways.

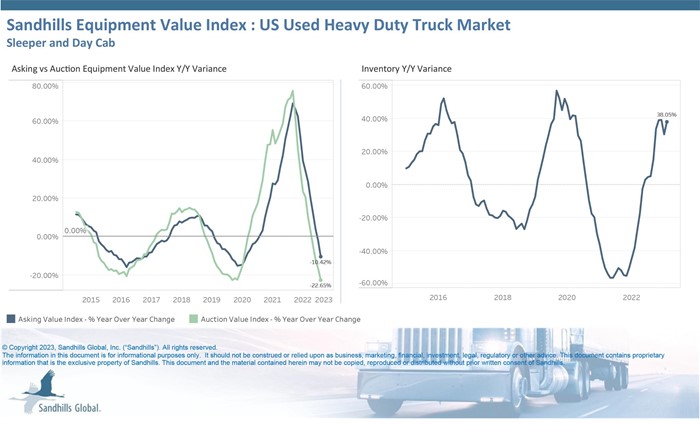

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI shows used heavy-duty truck inventory is trending up. In February, inventory levels increased 4.76% M/M and 38.05% YOY.

- Heavy-duty truck values softened overall in February. Asking values declined for the 10th consecutive month, dropping 3.23% M/M, and were down 10.42% YOY.

- The downward auction value trends that began in April 2022 continued in February 2023. Used heavy-duty truck auction values decreased 3.22% M/M and 22.65% YOY.

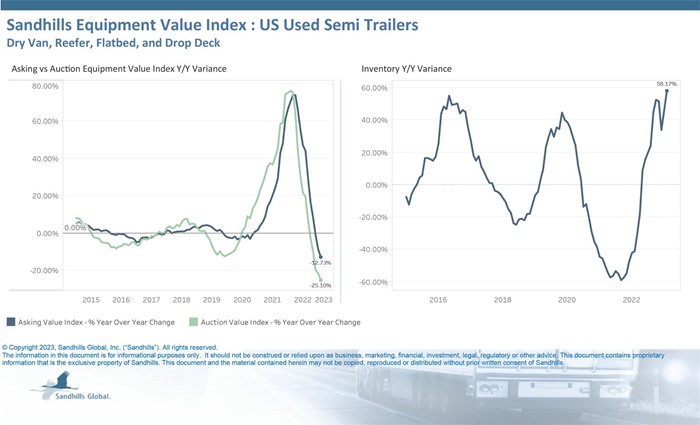

U.S. Used Semitrailers

- Inventory for used semitrailers spiked 7.08% from January to February, following a 9.53% gain from December to January. Used semitrailer inventory increased 58.17% YOY.

- Inventory increases, and resulting lower asking and auction values, were driven by dry van and reefer semitrailers.

- Semitrailer asking values decreased again in February, dropping 0.43% M/M and 12.73% YOY.

- Used semitrailer auction values are currently trending sideways and decreased 0.42% M/M in February. Compared to last February, auction values were down 25.1%.

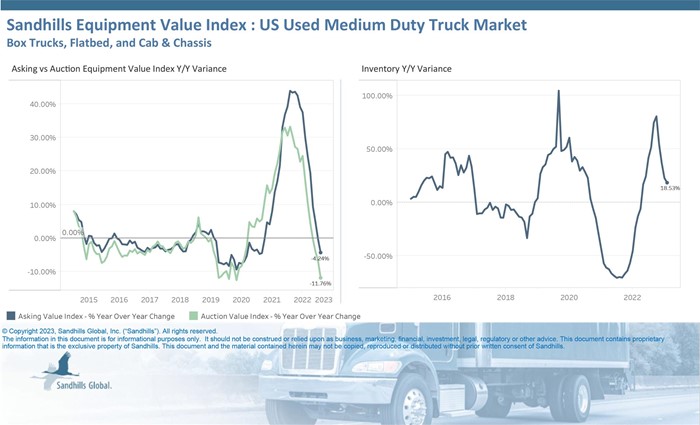

U.S. Used Medium-Duty Trucks

- Inventory for used medium-duty trucks has remained steady in recent months; however, levels increased 7.09% from January to February. Inventory levels were up 18.53% YOY.

- The Sandhills EVI shows asking values for medium-duty trucks continued to decline. In February, asking values decreased 1.39% M/M and 4.24% YOY.

- Auction values have decreased in consecutive months, and in February, values dropped 3.78% M/M and 11.76% YOY.

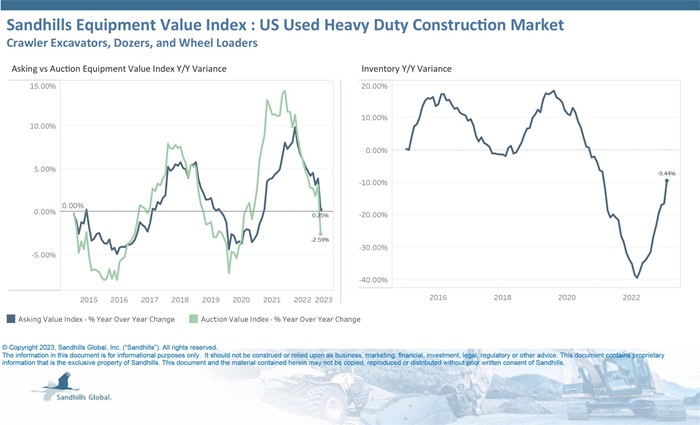

U.S. Used Heavy-Duty Construction Equipment

- Used heavy-duty construction equipment inventory levels have maintained a relatively steady pattern since Q2 2022. Inventory levels increased 3.48% M/M and were down 9.44% YOY in February.

- The Sandhills EVI shows the asking and auction value increases seen throughout much of 2022 have slowed in 2023.

- Asking values for used heavy-duty construction equipment were up 1.09% M/M and increased only 0.25% from last year.

- The sideways trend also occurred in auction values, which increased 0.66% M/M and decreased 2.59% YOY.

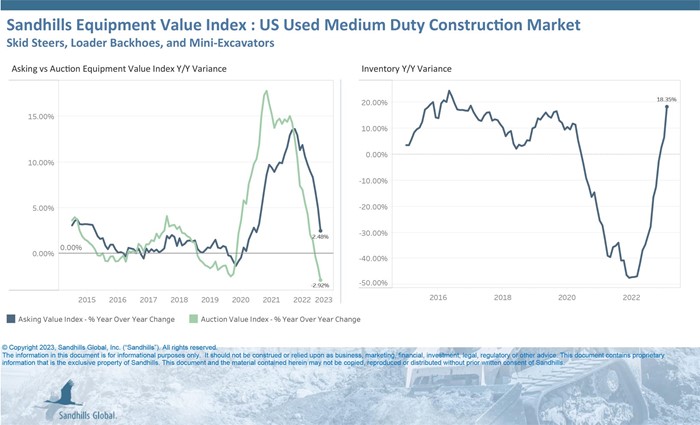

U.S. Used Medium-Duty Construction Equipment

- Inventory for used medium-duty construction equipment began to trend up in February, led by mini excavators and track skid steers. Inventory levels were up 9.88% M/M and 18.35% YOY.

- Although asking and auction values trended lower for many medium-duty construction machines, track skid steer values remained strong in February.

- Asking values in medium-duty construction equipment increased 1.5% M/M and 2.48% YOY; auction values were up 2.56% M/M but down 2.92% YOY.

Obtain the Full Reports

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.