February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Heavy-Duty Sleeper Truck Values in Long-Term Slide with Further Decreases Likely

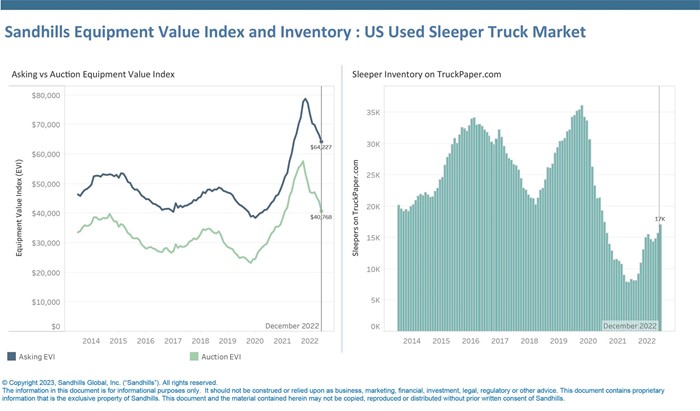

Inventory levels for used heavy-duty sleeper trucks in Sandhills Global marketplaces have been rising since January 2022. Value trends, however, have been in decline. Specifically, asking and auction values have decreased for seven and eight consecutive months, respectively, and recent sleeper truck inventory trends suggest value declines are likely to continue into early 2023. The latest Sandhills market reports shed light on these and other trends.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

This percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread, and during periods of accelerated or narrowing EVI spread, such as what Sandhills is seeing now, assessing buying and selling strategies is crucial in order to mitigate risk.

Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The current used sleeper truck market report examines a regional breakdown of inventory and values, as well as auction value trends across model age years.

U.S. Used Heavy-Duty Sleeper Trucks

- The Sandhills EVI indicates used heavy-duty sleeper truck inventory increased in December, gaining 8.7% month over month. Used inventory levels have doubled since December 2021, increasing 104.2% year over year.

- Sleeper truck auction values decreased 7.4% from November to December 2022, while asking values decreased 3.4% in the same time frame.

- Asking values are trending down at a slower pace than auction values. Auction values were down 20.4% YOY and asking values decreased 0.7% YOY in December.

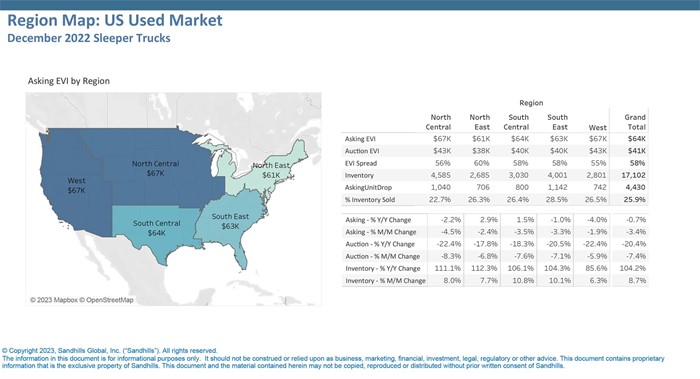

U.S. Used Heavy-Duty Sleeper Trucks by Region

- EVI spread has widened in recent months. Asking values for used heavy-duty sleeper trucks were 58% higher than auction values in December. Asking values are typically 55% to 60% higher than auction values as expressed in EVI spread.

- The North Central region displayed the biggest M/M decreases in asking values (down 4.5%) and auction values (8.3%) from November to December 2022.

- In the South Central region, sleeper truck inventory increased 10.8% M/M in December, the highest among U.S. regions.

- The West region displayed the lowest M/M inventory increase (up 6.3% in December), along with the smallest M/M regional value declines. West region sleeper truck auction and asking values dropped 5.9% and 1.9% M/M, respectively.

- Used heavy-duty sleeper truck values in the North East region are typically lower than in other U.S. regions. In December, asking EVI for sleeper trucks in the North East was $61,000 while auction EVI was $38,000.

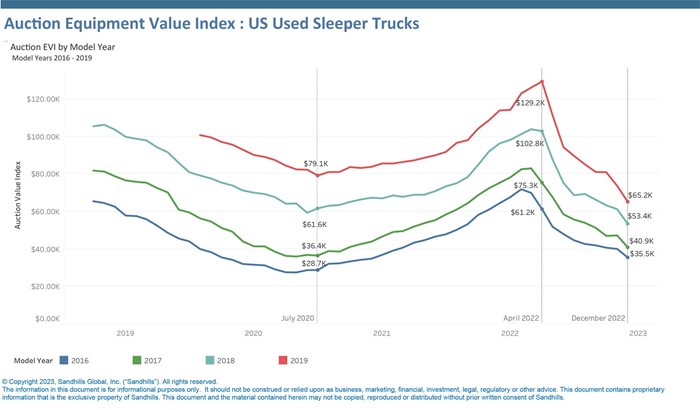

U.S. Used Heavy-Duty Sleeper Trucks by Model Year

- Consistent inventory decreases throughout 2020 and 2021 were a major driver of rising auction values in used sleeper trucks manufactured from 2016 to 2019; values for these model years peaked in March and April of 2022.

- The Sandhills EVI shows that sleeper trucks manufactured from 2016 to 2019 have decreased 40% to 50% since the 2022 peaks.

- At their peak, auction values for heavy-duty sleeper trucks manufactured in 2016 and 2017 doubled. Despite the recent drop, auction values for 2016 and 2017 sleeper trucks are still above those observed in July 2020.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.