February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Heavy-Duty Truck and Semi-Trailer Values Continue Fall from Historic Highs

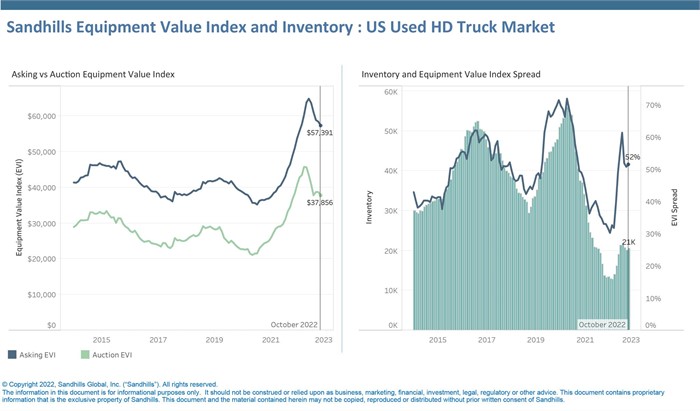

2022 has been a volatile year for heavy-duty truck and semi-trailer values, and the latest reports from Sandhills Global dive into the long-term and short-term trends for these two major equipment categories in Sandhills marketplaces. At the beginning of 2022, inventory levels bumped along historic lows for heavy-duty trucks and semi-trailers, which positively impacted auction and asking values. Trends in these two categories often mirror each other; as an example, auction values peaked for both heavy-duty trucks and semi-trailers this March, while asking values peaked in May.

Values dropped from their lofty peaks in Q2 2022 as used inventory levels began to recover among both heavy-duty trucks and semi-trailers. At the same time, the spread between auction and asking values has narrowed.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

This percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread, and during periods of accelerated or narrowing EVI spread, such as what Sandhills is seeing now, assessing buying and selling strategies is crucial in order to mitigate risk.

Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The new heavy-duty truck and semi-trailer market reports examine a regional breakdown of inventory and values, as well as auction value trends across model age years.

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI indicates used heavy-duty truck inventory, which includes sleepers and day cab models, increased in October, gaining 2.6% month-over-month. The increase reverses a short-term shift where inventory previously decreased in back-to-back months. Inventory levels were up 50.1% year-over-year from October 2021.

- Heavy-duty truck asking values decreased for the fifth consecutive month, dropping 1.8% from September to October, while auction values decreased 2.3% M/M.

- Compared to October 2021, auction values were up 3.1% and asking values increased 17.4% YOY.

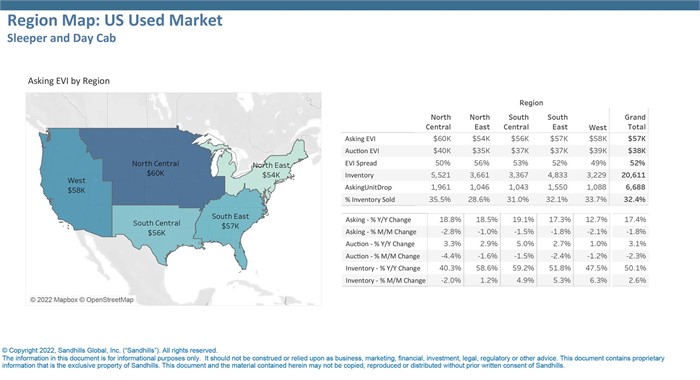

U.S. Used Heavy-Duty Trucks by Region

- Asking values for heavy-duty trucks were 52% higher than auction values in October, and this gap has narrowed in recent months.

- The North Central region displayed the biggest M/M decreases in auction values (down 4.4%) and asking values (down 2.8%) from September to October.

- EVI spread varies by region. The West region had the narrowest EVI spread (49%) among all regions and also displayed the highest M/M inventory increase, gaining 6.3% in October.

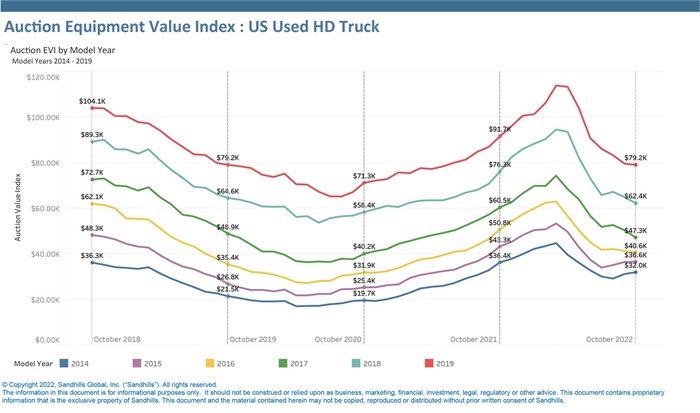

U.S. Used Heavy-Duty Trucks by Model Year

- Under typical market conditions, auction values depreciate over time as assets age. Low used inventory levels for heavy-duty trucks and challenging market conditions resulted in appreciating auction values for some age ranges throughout 2021 and early 2022.

- Auction EVI for heavy-duty trucks manufactured in 2017 peaked in March 2022 at $74,400. In October, auction EVI for 2017 model year trucks was $47,300, down from $60,500 the year prior.

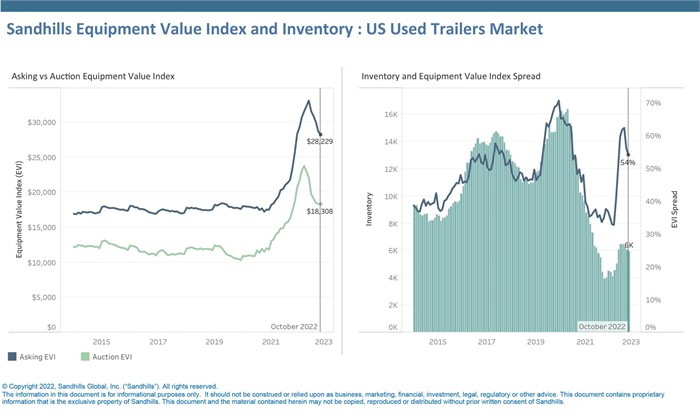

U.S. Used Semi-Trailers

- Inventory levels for semi-trailers, which includes drop deck, dry van, flatbed, and refrigerated trailers, declined for the fourth consecutive month in October. Inventory levels decreased 1.9% M/M and were up 51.7% YOY.

- Asking values dropped for the fifth consecutive month, down 1.5% M/M. Asking EVI is still up 20.5% YOY.

- After consecutive months of auction value decreases, semi-trailer auction values are still up 5.4% YOY.

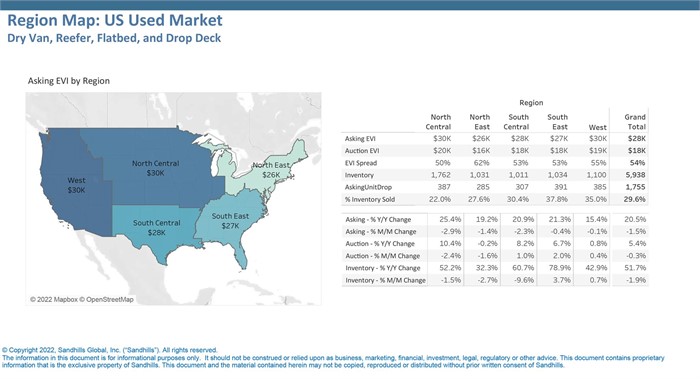

U.S. Used Semi-Trailers by Region

- The EVI spread was slightly higher for semi-trailers than heavy-duty trucks in October. Used Semi-trailer asking values were 54% higher than auction values.

- The North East region had the widest EVI spread among all regions at 62%; other semi-trailer regions ranged from 50% to 55%.

- The biggest semi-trailer value changes occurred in the North Central region. Asking values decreased 2.9% M/M and auction values dropped 2.4% M/M.

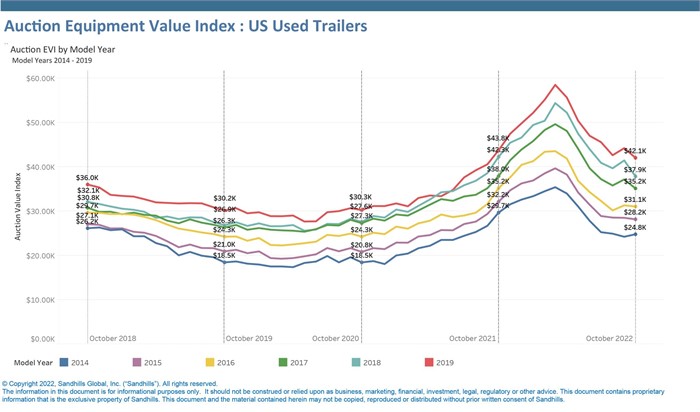

U.S. Used Semi-Trailers by Model Year

- Similar to model year value trends in heavy-duty trucks, auction values for many semi-trailer model years appreciated throughout 2021 and early 2022 due to low inventory levels and market conditions.

- Auction EVI for semi-trailers manufactured in 2017 peaked in March 2022 at $49,700. In October, Auction EVI for 2017 model year semi-trailers was $35,200, down from $38,000 the year prior.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.