February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Market Volatility Returns in October as Auction Values for Trucks, Trailers, and Construction Equipment Resume Downward Trend

The stabilizing patterns seen in August and September, where inventory levels decreased and auction values remained steady for used heavy-duty trucks and semi-trailers in Sandhills Global marketplaces, appear to be short-lived shifts. According to the newest Sandhills market reports, asking and auction values resumed the downward trends that initially began in Q2 2022.

“Volatility remains apparent in the truck and trailer markets with inventory fluctuations and values trending downward,” says Truck Paper Sales Manager Scott Lubischer. “Economic forces, such as freight market rates and demand, along with challenging fuel prices and general market uncertainty, are all playing significant roles in the value of trucks and trailers today.”

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used truck and trailer, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. In this month’s reports, Sandhills dives into the current trends across all the markets it monitors, including dropping value trends in medium-duty trucks, heavy-duty construction equipment, and medium-duty construction equipment.

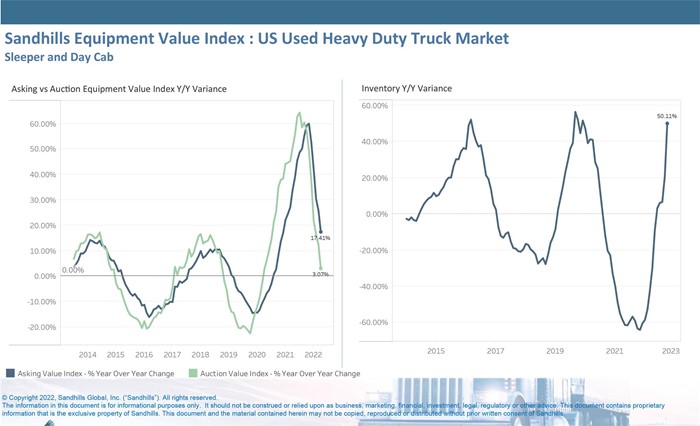

U.S. Used Heavy-Duty Trucks

- The Sandhills EVI shows used heavy-duty truck inventory, which includes sleeper and day cab trucks, increased in October, up 2.6% month-over-month, reversing course after back-to-back months of inventory decreases. Inventory levels were up 50.1% year-over-year from October 2021.

- Heavy-duty truck asking values declined for the fifth consecutive month with a 1.8% month-to-month drop. Asking values were up 17.4% YOY.

- Auction values decreased 2.3% from September to October, following a 0.7% decline from August to September. Compared to October 2021, auction values were up 3.1% YOY.

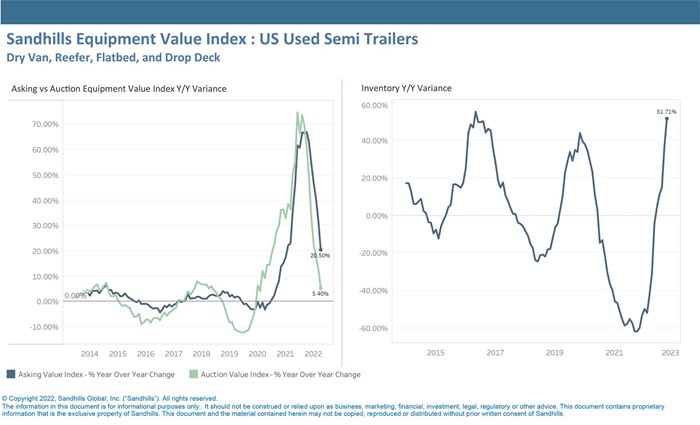

U.S. Used Semi-Trailers

- Used semi-trailer inventory declined for the fourth consecutive month in October, down 1.9% M/M, and has been trending sideways in recent months. Semi-trailer inventory levels were up 51.7% YOY.

- Similar to heavy-duty truck trends, asking values for semi-trailers dropped for the fifth consecutive month, down 1.5% M/M, but were up 20.5% YOY.

- Although auction values were still up 5.4% YOY, the semi-trailer category displayed consecutive months of decreasing auction values.

U.S. Used Medium-Duty Trucks

- The Sandhills EVI shows that used medium-duty truck inventory levels decreased 3.1% M/M, the third consecutive month of inventory declines. This category includes box flatbed, and cab and chassis trucks. It’s important to note that inventory levels were still well above October 2021, up 66.3% YOY.

- Medium-duty truck asking values held steady in October and were up 12.6% YOY.

- For the first time in two years, medium-duty truck YOY auction values decreased in October, down 2.9%.

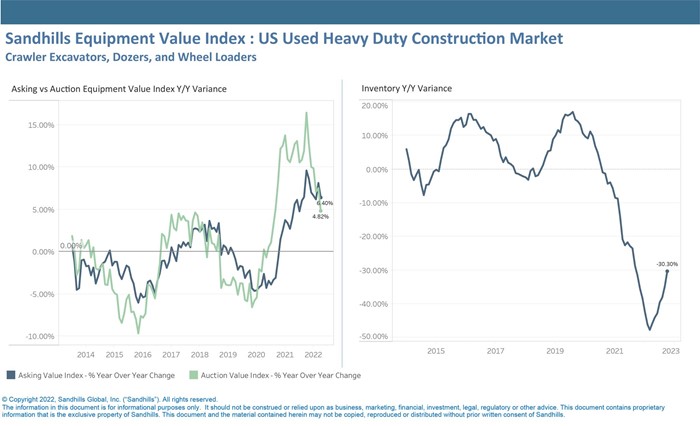

U.S. Used Heavy-Duty Construction Equipment

- Inventory levels for heavy-duty construction equipment were flat in October, showing more signs of stability after two years of nearly continuous declines. Inventory levels were 30.3% lower than in October 2021.

- The Sandhills EVI shows that asking values remain elevated from last year, up 6.4% YOY. Compared to September, asking values displayed a sideways trend, decreasing 1.7% M/M.

- Heavy-duty construction equipment auction values are trending downward, decreasing 2.5% M/M, and were up 4.8% YOY.

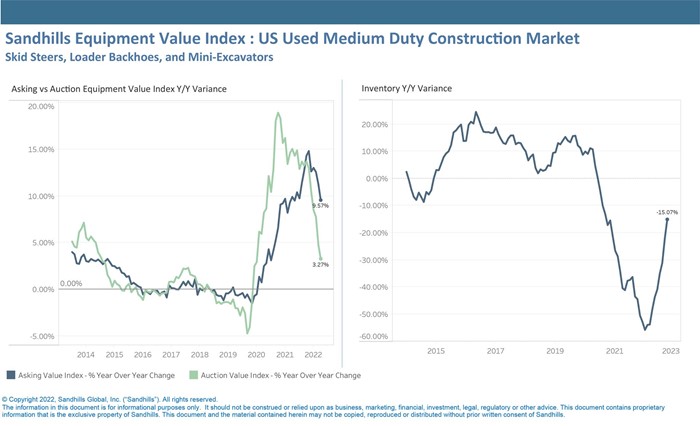

U.S. Used Medium-Duty Construction Equipment

- Mirroring trends in heavy-duty construction equipment, inventory levels for used medium-duty construction equipment have rebounded in recent months, increasing 1.6% M/M and were down just 15% YOY.

- October marked the fifth consecutive month of asking value declines in this category; the 0.5% M/M drop continues a pattern of slow descent. Asking values were up 9.6% YOY.

- Auction values held steady in October and increased 3.3% YOY.

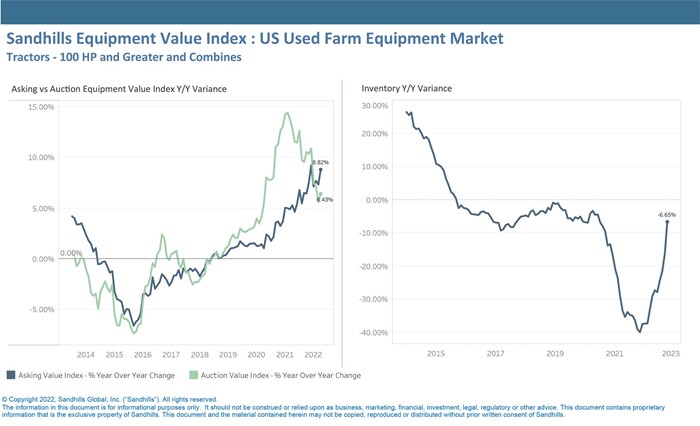

U.S. Used Farm Equipment

- Although used farm equipment inventory levels were mostly flat in October, increasing 1.5% M/M, inventory quantity continued to pull even with last year and was down 6.7% YOY.

- Asking EVI increased 2.2% M/M, and compared to October 2021, asking values were up 8.8%.

- Auction EVI also trended upward in October, increasing 2.7% M/M and 6.4% YOY.

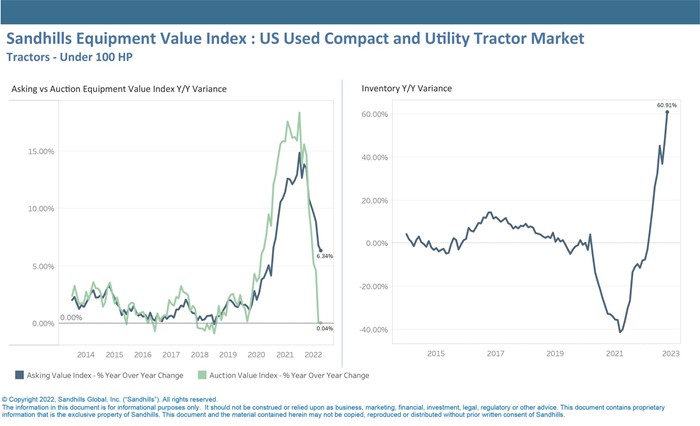

U.S. Used Compact & Utility Tractors

- Inventory levels for used compact and utility tractors reached pre-pandemic levels in October, increasing 8.9% M/M and 61% YOY.

- Asking EVI for this category decreased 0.8% M/M, continuing the horizontal value pattern seen in recent months. Asking values increased 6.3% YOY.

- Since recording new highs in Q2 2022, auction values have eased in recent months. Auction EVI decreased 0.5% M/M and was flat compared to October 2021.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.