February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Diverging Tractor Trends: Values Remain Strong for 175-Plus-Horsepower Models as Compact and Utility Tractor Values Cool

The latest Sandhills Global market reports point to diverging trends between tractors in the 175-plus-horsepower range compared to compact and utility tractors under 100-HP within Sandhills marketplaces. Inventory for tractors 175-HP or higher has remained near historically low levels in recent months, resulting in sustained auction value increases. Many buyers of higher-HP tractors, however, remain undeterred. “Demand for tractors with 175-plus horsepower remains solid as we move towards the end of the year,” says AuctionTime Manager Mitch Helman.

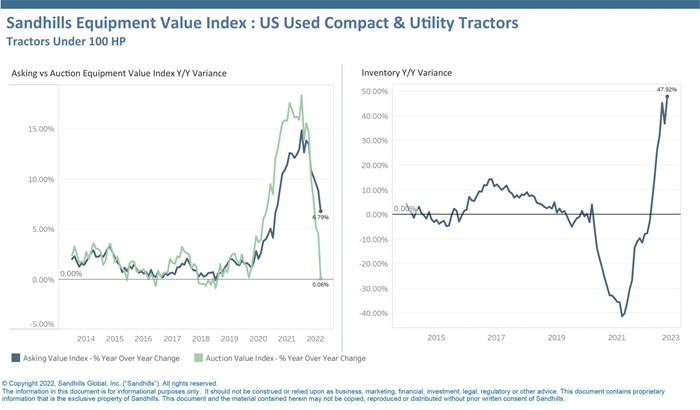

Inventory levels for compact and utility tractors, meanwhile, have increased substantially to pre-pandemic levels. Consequently, asking and auction values have dropped.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

The percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread. During periods of accelerated EVI spread, such as what Sandhills is seeing now, assessing buying and selling strategies is crucial in order to mitigate risk.

Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The new farm equipment market reports examine the underlying trends occurring in different tractor horsepower categories.

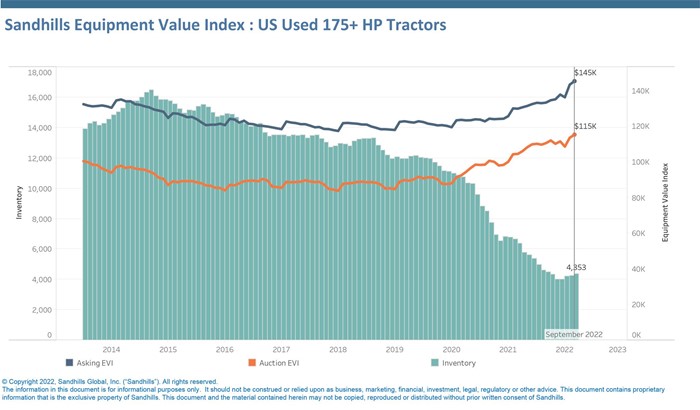

U.S. Used 175-Plus-HP Tractor Market

- Used inventory levels have slowly increased over four consecutive months for 175-plus-HP tractors. However, inventory was low compared to last year, down 32% year-over-year in September.

- The Sandhills EVI shows auction values for tractors in the 175-plus-HP range increased 1.6% month-to-month from August to September and were up 10.3% YOY.

- Asking values increased 1.4% M/M and were up 11.9% YOY.

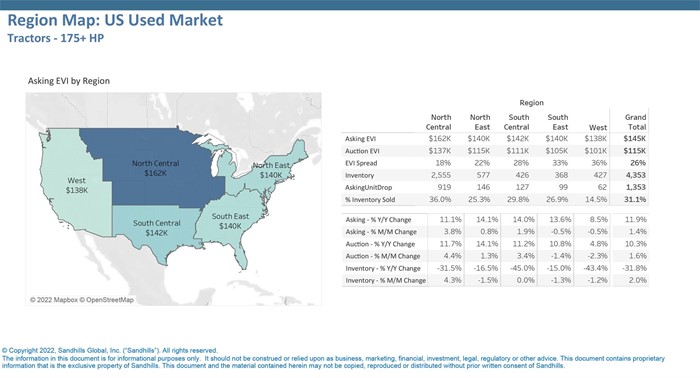

U.S. Used 175-Plus-HP Tractor Market by Region

- EVI spread varies by region. In the North Central region, asking values were 18% above auction values in September; that figure represents the lowest EVI spread among U.S. regions.

- EVI spread in the other U.S. regions ranged from 22% to 36%.

- The North Central region also recorded the highest M/M auction value (up 4.4%) and asking value (up 3.8%) increases for 175-plus HP tractors.

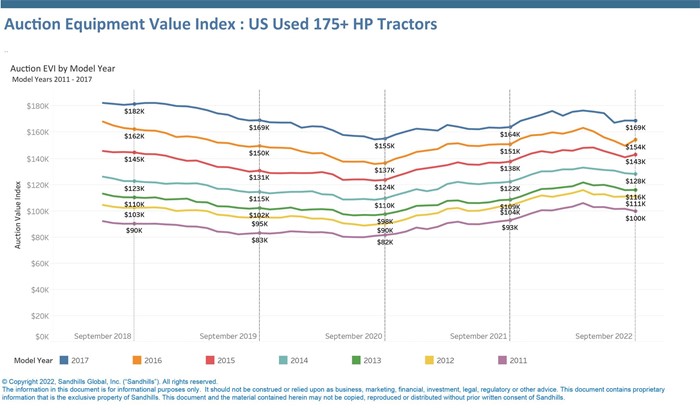

U.S. Used 175-Plus-HP Tractor Market Auction EVI by Model Year

- Under typical market conditions, auction values depreciate as equipment ages. Tractors in the 175-plus-HP range manufactured between 2011 to 2017, however, have displayed remarkable auction value strength in recent months.

- Auction EVI for 2011-model-year tractors was $100,000 in September. This figure is up $7,000 over that of September 2021 ($93,000) and $18,000 over September 2020 ($82,000).

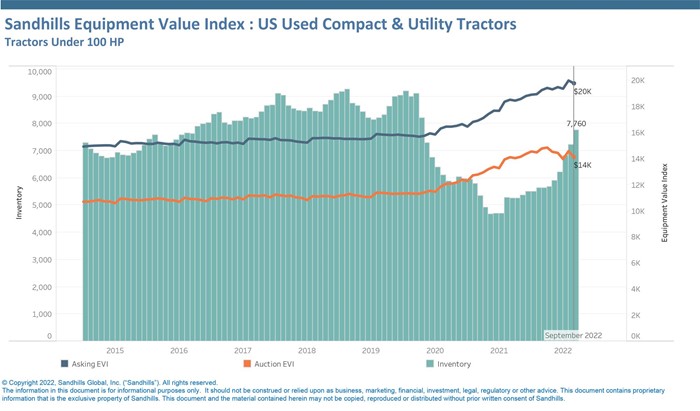

U.S. Used Compact and Utility Tractor Market

- Inventory for tractors in the under-100-HP range increased for eight consecutive months ending in September. Inventory levels were up 7.4% M/M and up 48% YOY in September.

- The Sandhills EVI shows models less than 10 years old displayed the largest inventory increase, up 63% YOY.

U.S. Used Compact and Utility Tractor Market EVI and Inventory YOY Variance

- Auction EVI for compact and utility tractors has cooled in recent months and is flat compared to September 2021. Auction values decreased 3.1% M/M from August to September.

- Asking EVI was down 1.1% M/M and increased 6.8% YOY.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.