February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Heavy-Duty Truck and Semi-Trailer Values Are in Decline as Inventory Grows

Recent Sandhills Global market reports have identified consecutive months of increases in used heavy-duty truck and semi-trailer inventory levels among Sandhills marketplaces, as well as decreases in auction values. The previous reports further emphasized the ways in which increased inventory levels historically precede auction value declines, which in turn are followed by declines in asking values. The latest market data, included in the newest Sandhills market reports, show that these inventory and auction value trends are finally prompting declines in asking values.

Inventory levels for used construction and agricultural equipment, meanwhile, remain historically low, which allows for auction and asking values to continue their ascent. However, there are some indications that used medium-duty construction equipment values may decrease in the near future.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest reports detail the ways in which inventory levels are impacting all three markets, with a closer look at distinctions between heavy-duty and medium-duty construction equipment.

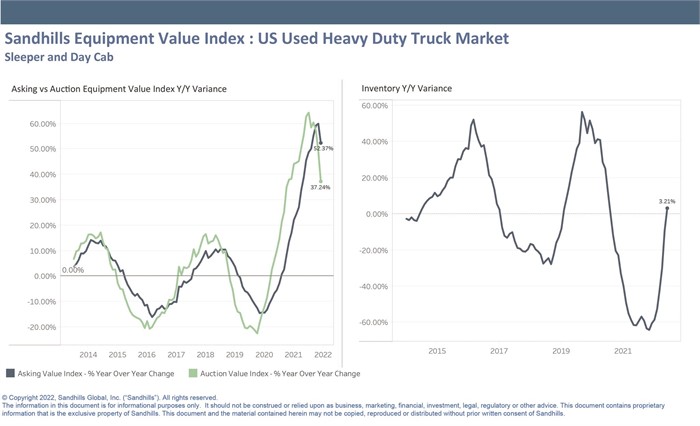

U.S. Used Heavy-Duty Trucks EVI and Inventory

- Inventory for this market, which includes used sleeper and day cab trucks, showed a positive year-over-year inventory level in June; this is the first YOY increase noted since Q2 2020, and represents the fourth consecutive month of inventory increases. Inventory increased 12.4% month/month and 3.2% YOY in June.

- Sandhills’ market reports show auction value decreases in this category for the third consecutive month. Auction EVI decreased 5.9% M/M and increased 37% YOY in June.

- June marked the first month since Q2 2020 that asking values showed a decrease. Asking EVI decreased 1.9% M/M and increased 52% YOY.

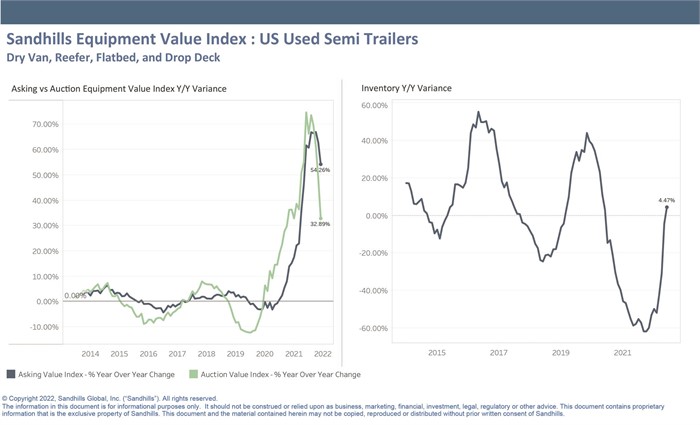

U.S. Used Semi-Trailers EVI and Inventory

- This category, which includes used dry van, flatbed, and drop-deck trailers, showed trends that were similar to the used heavy-duty truck category, with the first positive YOY inventory increase since Q2 2020 recorded this June. Inventory increased 6.5% M/M and 4.5% YOY.

- Auction EVI decreased 10.5% M/M, marking the third straight month of M/M decreases, and increased 33% YOY.

- Asking EVI decreased 4.6% M/M and increased 54% YOY; this is the first time since late 2020 that used semi-trailers posted a M/M asking EVI decrease.

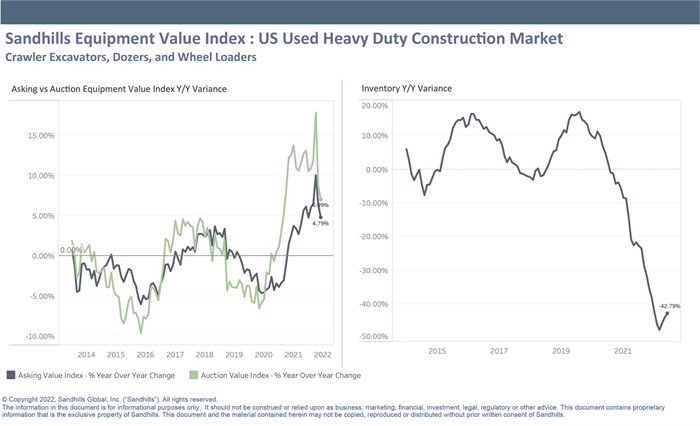

U.S. Used Heavy-Duty Construction Equipment EVI and Inventory

- Inventory levels remain steady for this category, which includes used crawler excavators, dozers, and wheel loaders, but it appears inventory levels may increase soon. Inventory increased 2.7% M/M and decreased 43% YOY in June.

- Auction and asking values for used heavy-duty construction equipment have remained steady YOY. Auction EVI decreased 1% M/M and increased 7% YOY in June, while asking EVI decreased 0.7% M/M and increased 4.8% YOY.

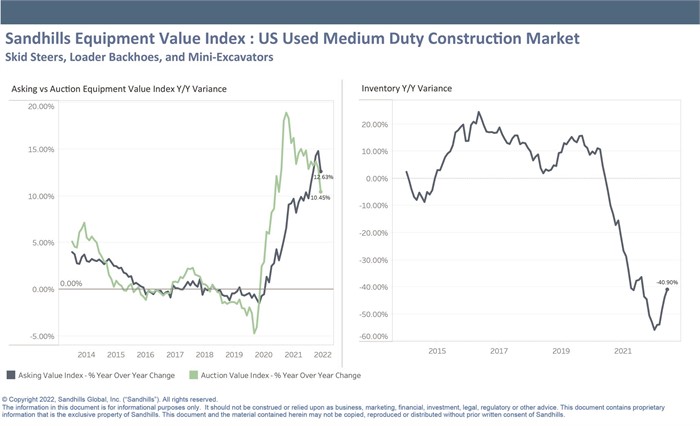

U.S. Used Medium-Duty Construction Equipment EVI and Inventory

- Inventory levels had also remained steady for the used medium-duty construction equipment category, which includes skid steers, loader backhoes, and mini-excavators, but notably jumped 7.4% M/M in June. YOY inventory levels were down 41% in June.

- Auction and asking values in this category have dipped slightly since May. Auction EVI decreased 2.6% M/M and increased 10.5% YOY, while asking EVI decreased 1% M/M and increased 12.6% YOY.

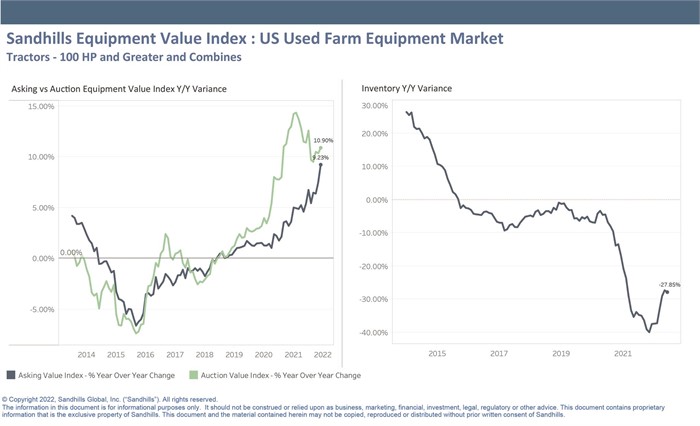

U.S. Used Farm Equipment EVI and Inventory

- Inventory declines are leveling off in the used farm equipment category, which includes combines and 100-plus-horsepower tractors. Inventory decreased 1.1% M/M and 28% YOY.

- Auction and asking values, meanwhile, continue to rise. Auction EVI increased 0.8% M/M and 11% YOY, while asking EVI increased 1.6% M/M and 9.2% YOY.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.