February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

New Sandhills Global Market Report Shows Gap Widening Between Heavy-Duty Truck Asking and Auction Values

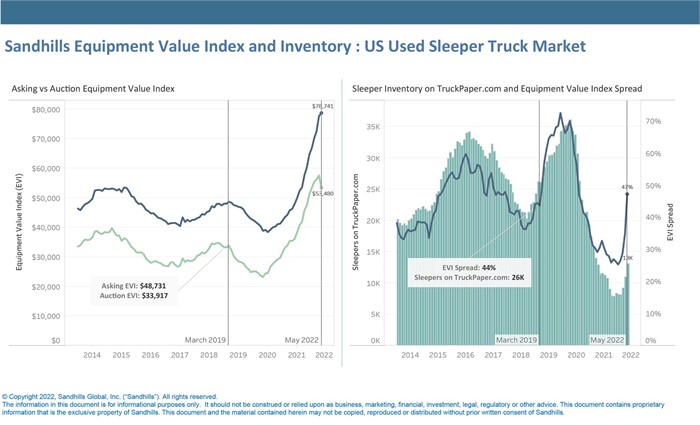

A new Sandhills Global market report finds that as used heavy-duty truck and semi-trailer inventory levels have increased among Sandhills marketplaces, a widening spread has occurred between asking and auction values. In May, for example, there was a 47% spread between asking and auction values for used heavy-duty sleeper trucks, compared to a 35% spread identified in April. A similar increase in spread occurred in the first quarter of 2019 when the heavy-duty truck market experienced a similar influx of inventory, which negatively impacted auction values and preceded a drop in asking values.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Regional EVI data is available for the United States (and key geographic regions within) and Canada, allowing Sandhills to reflect machine values by location.

The percentage gap between asking and auction values is quantified in Sandhills market reports as EVI spread. During periods of accelerated EVI spread such as that which occurred in early 2019 and is occurring again now, assessing buying and selling strategies is crucial in order to mitigate risk.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The latest report examines the effects of rapidly expanding EVI spread, including which model years and equipment types are likely to experience the biggest value changes.

U.S. Used Heavy-Duty Sleeper Trucks EVI and Inventory

- Widening EVI spread typically occurs when inventory increases or demand decreases. Used heavy-duty sleeper truck inventory increased for the third consecutive month in May.

- Historically, auction values react quicker to inventory changes than asking values do. The Sandhills EVI shows that while auction values for heavy-duty sleeper trucks have already begun to drop, asking values have maintained their upward trend.

- The rapidly widening EVI spread suggests a downturn in asking values is likely to follow.

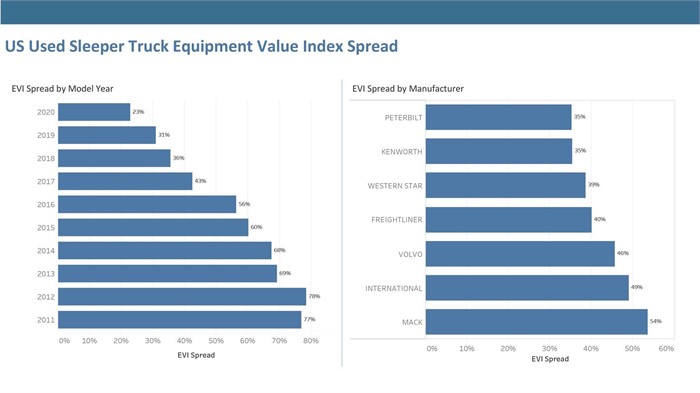

U.S. Used Heavy-Duty Sleeper Trucks EVI Spread by Model Year and Manufacturer

- The EVI spread often ranges from 10% to 150%; factors like age and brand play a key role in influencing the gap between asking and auction values.

- In May, the EVI spread for heavy-duty sleeper trucks produced in 2020 was 23%, while the EVI spread for heavy-duty sleeper trucks made in 2014, 2013, 2012, or 2011 varies between 68% and 78%.

- The EVI spread for used heavy-duty sleeper trucks also vary widely by manufacturer, as displayed in the chart.

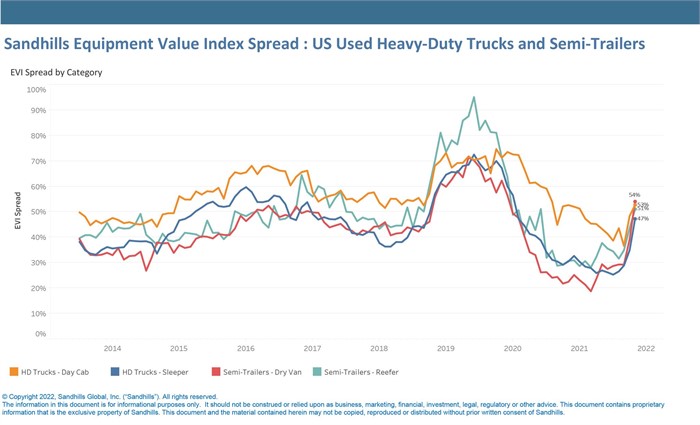

U.S. Used Heavy-Duty Trucks and Semi-Trailers EVI Spread by Category

- Different equipment categories in the used truck and trailer market (including heavy-duty day cab trucks, heavy-duty sleeper trucks, dry-van semi-trailers, and reefer semi-trailers) often trend in similar EVI spread directions over time.

- Used sleeper trucks tend to produce a historically tighter EVI spread than day cab trucks.

- In May, asking values for used heavy-duty day cab trucks were 53% higher than auction values; the EVI spread for sleeper trucks was 47%.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.