February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Piston Single, Turboprop Aircraft Values Still Gaining Altitude Despite Continued Growth in Inventory Levels

The latest Sandhills Global market report on the aviation industry reflects a third consecutive month of inventory expansion across all categories after a long, steady decline. However, the recent sustained growth in inventory levels hasn’t reversed the rise in asking values for piston single or turboprop aircraft in Sandhills marketplaces. Pre-owned aircraft on the market are still relatively scarce in comparison with a year ago.

Sandhills’ aviation products include Controller, Controller EMEA, Executive Controller, Charter Hub, AviationTrader, Aircraft Cost Calculator, and AircraftEvaluator. AircraftEvaluator is Sandhills’ proprietary asset valuation tool for all types of aircraft, built using the same technology behind FleetEvaluator. Widely used and trusted across equipment, truck, and trailer industries, FleetEvaluator identifies asset values with unparalleled accuracy.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

This report includes detailed analysis of asking values and inventory trends in the worldwide used aircraft market along with charts that help readers visualize the data. It describes and quantifies important trends in the buying and selling of used piston single, turboprop, and jet aircraft.

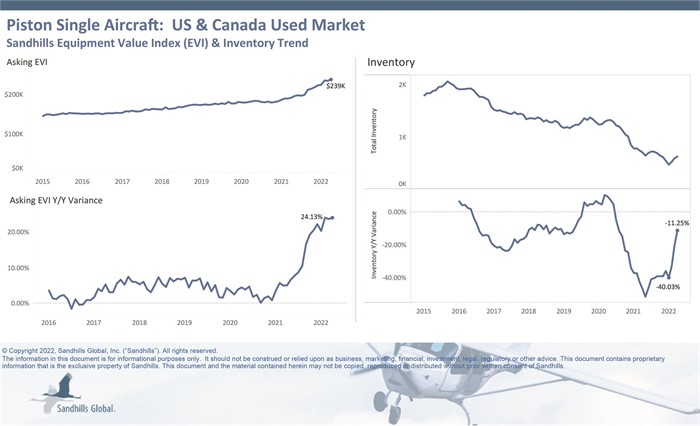

U.S. and Canada Used Piston Single Aircraft

- The Sandhills EVI for the piston single aircraft category posted a 24.1% year-over-year rise in asking values, up from 23.8% YOY the month prior. April 2022 values were $239,000 compared with $193,000 in April 2021. Month-over-month piston single aircraft asking values were up 1.4% over March 2022.

- For the third straight month, inventory of piston single aircraft has exhibited an upward trend after a steady decline. YOY inventory was still down by 11.3% overall in April. However, this represents a 9-percentage point improvement from the previous month, and a 29-percentage point increase from the beginning of the year.

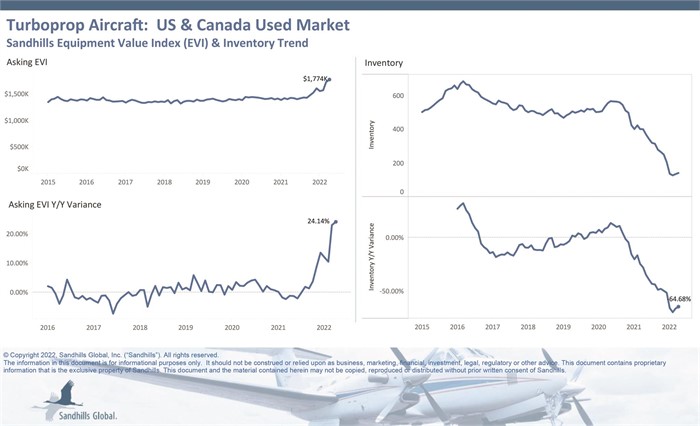

U.S. and Canada Used Turboprop Aircraft

- Among turboprop aircraft, the Sandhills EVI logged a 24.1% YOY gain in asking values. April 2022 equipment values showed $1.8 million compared to $1.4 million in April 2021. Asking values in this category increased by 2.6% M/M.

- Turboprop aircraft inventory was down 64.7% YOY in April 2022, up 2 percentage points from March 2022.

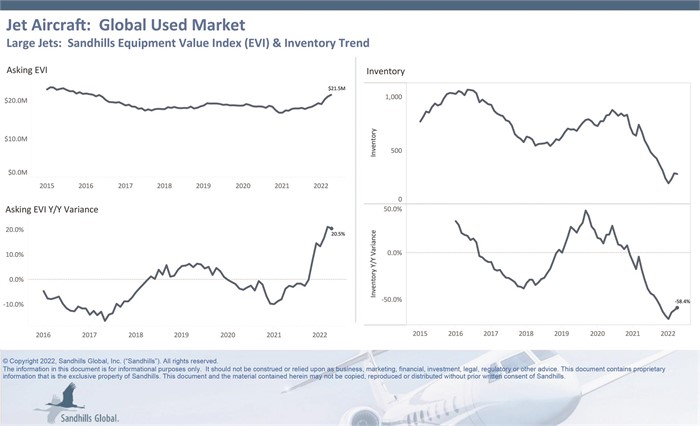

Global Used Jet Aircraft

- Sandhills market reports break out the worldwide jet aircraft category into Light, Mid, Super Mid, and Large classes.

- The Large Jets class (EVI), which constitutes the highest percentage of total inventory, charted a 20.5% YOY value increase within the asking market. This was a decrease of approximately half a percentage point from the month prior. Asking values for April 2022 were $21.5 million, up from $17.8 million one year earlier. April’s large jet inventory level was 58.4% lower on a YOY basis, but 5 percentage points higher than in March 2022.

Obtain The Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, commercial trucking, and aviation industries represented by Sandhills Global marketplaces, including Controller.com, AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator and AircraftEvaluator, Sandhills’ proprietary asset valuation tools, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.