February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Used Truck Inventory Displays Largest Month-to-Month Increase Since Q3 2018

March inventory levels for used heavy-duty trucks were up 10 percentage points from February, according to the latest Sandhills Global Market Report examining heavy-duty truck trends. The month-to-month inventory increase was the largest in the used truck market since Q3 2018, a point in time where inventory levels began steadily increasing after a protracted 13-month decline. Trucks in the 0- to 5-year (up 17.2% M/M) and 5- to 10-year (up 7.7% M/M) age groups were the primary drivers of change, signaling that new truck production and fulfilled orders may be impacting the used truck market. Inventory levels in the construction and farm equipment markets were down across most age groups.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets, as well as model year equipment actively in use. Sandhills EVI data is available for both the United States and Canada, allowing Sandhills to reflect machine values by location.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The following charts display historical asking and auction values for each market, as well as overall inventory levels and age-group breakdowns, to paint a picture of recent supply and demand trends.

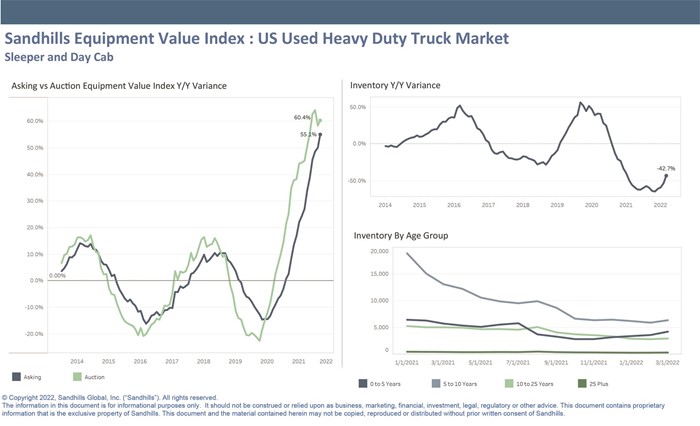

U.S. Used Heavy-Duty Trucks

- Auction values for used sleeper trucks are up 60.4% year-over-year; asking values are up 55.1% YOY, according to the Sandhills EVI.

- Heavy-duty truck inventory levels were trending flat in four straight months before March’s upswing. In February, inventory levels were down 52.7% YOY, and inventory levels in March (down 42.7% YOY) mark a 10-percentage point improvement.

- The 17.2% M/M inventory level increase in the 0- to 5-year age group played a big part in boosting overall heavy-duty truck inventory levels.

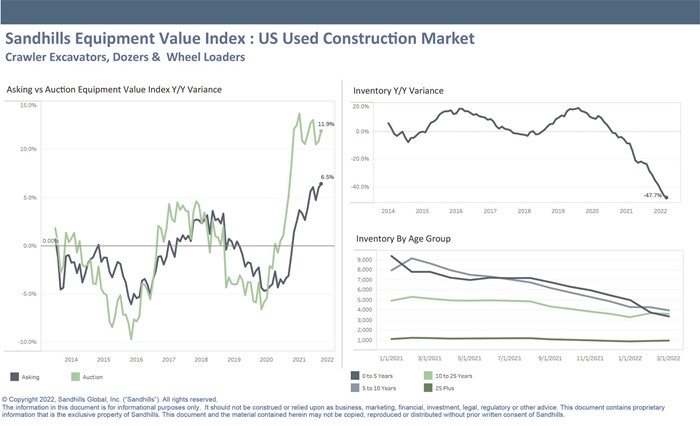

U.S. Used Heavy-Duty Construction Equipment

- The Sandhills EVI shows used construction auction values were up 11.9% YOY for March. Asking values also continued upward value trends with a 6.5% YOY increase.

- Construction equipment inventory levels were down 47.7% YOY, continuing a decline from February where inventory levels were down 46.1%YOY.

- On a month-to-month basis, inventory levels for the majority of age groups were down among construction equipment, except for the 25-plus year age group that increased 3.3% M/M.

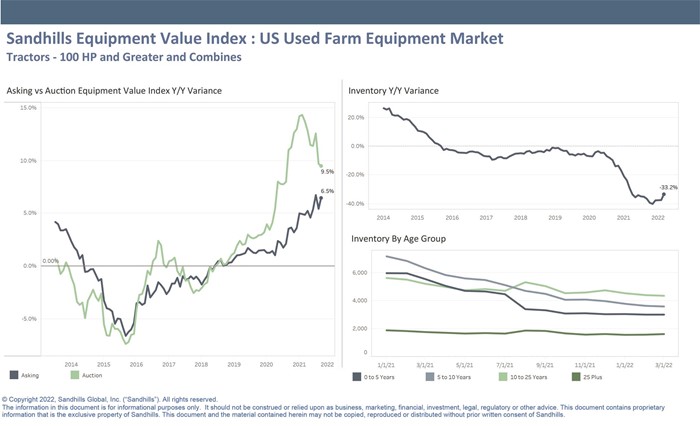

U.S. Used Farm Equipment

- The Sandhills EVI for the farm machinery market charted a 9.5% YOY increase in auction values. The asking EVI YOY variance showed a 6.5% YOY improvement.

- March inventory levels for used farm machinery were down 33.2% YOY, a four percentage-point improvement from February.

- While inventory levels continued to decline for many age groups, farm machinery in the 25-plus year age group increased 2.7% M/M.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.