February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

Inventory Levels Flatten in Heavy-Duty Truck and Farm Equipment Markets

The newest Sandhills Global Market Report spotlights flattening inventory levels in Sandhills marketplaces, particularly in the heavy-duty truck and farm equipment markets. Heavy-duty truck inventories, for example, have been flat for four consecutive months, while agricultural equipment inventories have been leveling off since Q4 2021. Both segments had previously experienced steady inventory declines since Q2 2020.

The key metric used in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. For 2022, Sandhills has enhanced its EVI with new metrics. The data now includes model year equipment actively in use, which grows the used equipment population beyond that available in auction and retail markets. New EVI data, already available for the United States, is also now available for Canada to better reflect machine values by location. The enhanced version of Sandhills EVI requires Sandhills to restate the values starting in January 2022, so prior numbers will not be comparable to the new, more insightful values.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. This report shows how recent flattening inventory levels compare to long-term trends, and illustrates year-over-year changes in asking and auction values for the construction equipment, farm equipment, and heavy-duty truck markets.

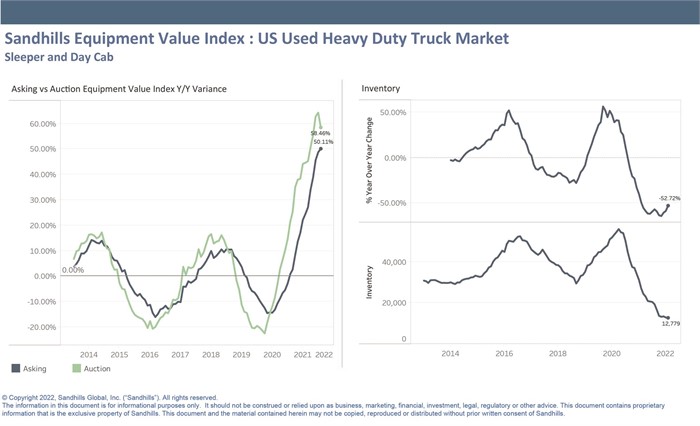

U.S. Used Heavy-Duty Trucks

- Heavy-duty truck inventory was down 52.7% YOY in February, which was a 5.8-percentage-point improvement compared January inventory levels.

- The Sandhills EVI shows heavy-duty trucks values continued an upward trend in February, posting a 58.5% YOY auction value increase and 50.1% YOY asking value increase.

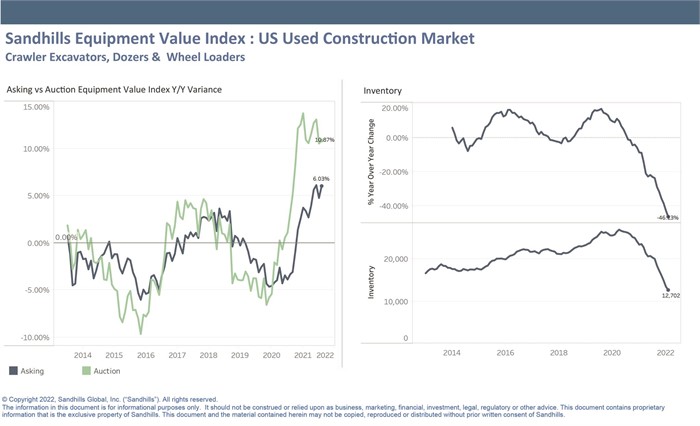

U.S. Used Heavy-Duty Construction Equipment

- Unlike the heavy-duty truck and farm equipment markets, inventory levels in heavy-duty construction equipment continue to drop. In February, inventory levels were down 46.1% YOY. January construction equipment inventory levels, by comparison, were down 42.5% YOY.

- As inventory levels decline, used construction equipment auction values (up 10.9% YOY) and asking values (up 6% YOY) continue to trend upwards.

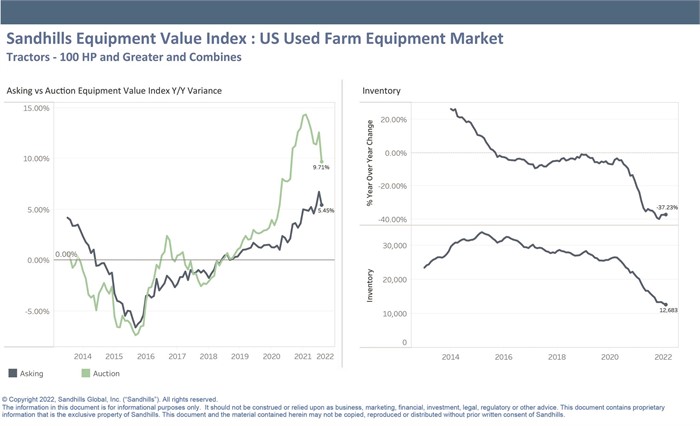

U.S. Used Farm Equipment

- From January to February, farm equipment inventory levels were flat, posting decreases of 37.4% YOY and 37.2% YOY, respectively.

- Farm equipment values continued to trend upward in February. The Sandhills EVI shows farm equipment auction values increased 9.7% YOY while asking values were up 5.5% YOY.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.