May 2024

April 2024

March 2024

February 2024

- Sandhills Global Launches Auction Values, Comprehensive Resource for Industry Auction Prices

- Aircraft Values Hold Steady During Seasonal Inventory Decreases

- Late-Model Inventory Accumulating on Dealers’ Lots as More New Equipment Enters the Market

- Sandhills Global Introduces Currency Equipment Financing Solution for Canadian Brands MarketBook, CraneTrader, and ForestryTrader

January 2024

December 2023

November 2023

October 2023

September 2023

August 2023

- Sandhills Global Announces Naming Rights Partnership with Lancaster Event Center

- Pre-owned Jet Asking Values Begin Descent

- Auction Values of Used High-Horsepower Tractors Trending Downward

- Construction, Agriculture, Transport, and Aviation Industry Professionals to Convene for Sandhills Global Forum

July 2023

June 2023

May 2023

April 2023

March 2023

February 2023

January 2023

- Heavy-Duty Sleeper Truck Values in Long-Term Slide with Further Decreases Likely

- Aircraft Asking Values Remain Elevated but Descend from All-Time Highs

- Sandhills Global Market Reports Show Mix of Value Trends at Year End Across Farm Equipment, Heavy Machinery, and Heavy-Duty Truck Markets

- AuctionTime Exceeds $1.1 Billion in GAP for 2022, Caps Year with Record-Setting $85 Million Auction Event

December 2022

November 2022

October 2022

- Diverging Tractor Trends: Values Remain Strong for 175-Plus-Horsepower Models as Compact and Utility Tractor Values Cool

- Used Aircraft Values Maintain Strength as Inventory Levels Recover from Historic Lows

- Heavy-Duty Truck and Semi-Trailer Auction Values Hold Steady in September

- The 1890 Initiative to Launch in Support of Nebraska Student-Athletes

September 2022

- Skid Steer Inventory Increases for Fifth Consecutive Month, Auction Values Cooling, According to New Sandhills Global Market Report

- Aviation Values Show Signs of Cooling Across All Used Aircraft Categories as Inventory Levels Improve

- Latest Sandhills Market Report Shows Heavy-Duty Truck Inventory Settling Down After Recent Period of Growth

August 2022

- New Sandhills Global Market Reports Show Growing Gap Between Asking and Auction Values Across Equipment and Truck Markets

- Used Aircraft Inventory Levels Continue Ascent with Piston Single and Turboprop Values Remaining Strong While Jet Values Dip Lower

- Sandhills Market Reports Track Changing Trends in Medium-Duty Construction Equipment and Continued Decline in Truck and Trailer Values

July 2022

- Sandhills Global Forum Returns with In-Person Workshops, Roundtable Discussions, and Equipment Industry Seminars

- New Sandhills Global Market Report Examines Heavy-Duty Sleeper Truck Value Trends and Growing Gap Between Asking and Auction Values

- Inventory Levels Continue Climb Across Aviation Categories, Values in Decline

- Used Heavy-Duty Truck and Semi-Trailer Values Are in Decline as Inventory Grows

June 2022

May 2022

April 2022

March 2022

- Inventory Levels Show Signs of Life in Certain Truck and Construction Equipment Segments

- Jet Aircraft Asking Values Trending Upward Amidst Inventory Shortages

- RVUniverse Diversifies Print Magazine, Launches New Regional Editions

- Inventory Levels Flatten in Heavy-Duty Truck and Farm Equipment Markets

- Late-Model Piston Single and Turboprop Aircraft Values Evince Historic Month-Over-Month Gains

February 2022

January 2022

- New Sandhills Global Market Data Underscores Volatility in Short-Term Equipment Value Trends

- Late-Model Sleeper Truck Inventory Rebounds as Auction, Asking Prices Continue Rising Across Industries

- Turboprop Aircraft Values Steadily Increasing Amid Tight Inventory Levels, According to Sandhills Global Market Report

- AuctionTime.com Closes 2021 with 3-Day, Record-Setting $72 Million Sale

December 2021

November 2021

September 2021

- Combine Values Increasing as Inventory Continues to Decline, Reaching Lows Not Seen Since 10 Years Ago

- HiBid.com Sells Over $43.2 Million, Starts New Week with Classic and Late-Model Cars and Antique Motorcycles

- HiBid.com Breaks Single-Day Records for Lot and Auction Totals, Starts New Week with Huge Estate and Coin Auctions

- Following a $42.6 Million Week in Sales, HiBid.com Auctions Now Featuring Cars, Collectibles, Real Estate, and More

- Used Farm Machinery and Truck Values Still Climbing as Construction Equipment Values Remain Steady

- AuctionTime and a Sandhills Global Email Blast Bring Top Dollar for Midwest Motor Express Trucks

- ‘NCIS: New Orleans’ Props, Late-Model Luxury Vehicles, and More Open for Bidding on HiBid.com After $34.5 Million Week of Sales

August 2021

- HiBid.com Auctions Now Featuring Jewelry, Government Surplus, Rare Coins, and More Following a $47 Million Week of Sales

- Used Skid Steer Values Show Substantial Gains Based on Broad Analysis of 20,000-Plus Data Points

- Motorcycles, Antiques, and More Now Open for Bidding After HiBid Closes $40 Million Week

- Late-Model Heavy-Duty Truck and Equipment Values Show Smallest Month-Over-Month Gain Year-to-Date Across Industries

- Record Number of Auctions Power HiBid’s $50.7 Million Week of Sales; 1957 Corvette Convertible, Antique Steam Parts, SUVs Currently Up for Bid

- Used Truck and Equipment Auction and Asking Values Continue Upward Trend

- Sports Cards, Classic Autos Up for Bid on HiBid After Nearly 500,000 Lots Sold Last Week

- HiBid.com Auctions Now Featuring Vintage Collectibles, Motorcycles, Guitars, and More Following a $34 Million Week of Sales

- JBS Auctions Uses Pre-AuctionTime and AuctionTime to Meet SFI JV’s Equipment Disposal Goals

July 2021

- $42.5 Million Sold Last Week on HiBid.com, with Current Auctions Featuring Rare Coins, Online Retailer Returns, and Christmas in July

- Used Equipment and Truck Inventory Levels Improve Following Protracted Decline

- HiBid Auctions Generate Nearly $36 Million Last Week, with Jewelry, Rare Coins, and Antique Auctions Now Underway

- Sandhills Global Launches Value Insight Portal for Instant Access to FleetEvaluator Valuations

- Vintage Americana and Overstock Bargains Now on HiBid.com Following High-Volume, High-Traffic Week of Auctions

- Equipment Values Continue to Increase Even as Used Inventory Levels Begin to Stabilize After Historic Declines

- Classic Cars, Trucks, and Motorcycles Now Open for Bidding After HiBid Closes $35 Million Week

- Midwest Equipment and AuctionTime Provide Fast Turnaround, Strong Selling Prices for Major Contractor

- Wide Selection of Vehicles and More Now Up for Bidding on HiBid.com Following $55 Million Week

June 2021

- Nearly $47 Million Sold Through HiBid Last Week, with Motorcycles, Boats, Antique Cars and More Now Open for Bidding

- Late-Model Heavy-Duty Trucks and Construction Equipment Leading Increase in Asking Values

- Sales on HiBid Top Half a Million Lots Last Week, with Large Estate and Car Museum Auctions Now Underway

- Heavy-Duty Truck and Construction Equipment Asking Values Still Trending Upward

- Current HiBid Auctions Include Speedboats, Jet Skis, Sports Cars, Motorcycles, and More, Following $30.7 Million Week

- HiBid Records $44 Million in Auction Sales Last Week, with Returned and Seized Items Now Up for Bidding

May 2021

- Over Half a Million Lots Sold in HiBid Auctions Last Week, with Motorbikes, Memorabilia, and More Now Up for Bidding

- Late-Model Assets Driving Value Increases Across Heavy-Duty Truck and Equipment Industries

- HiBid Auctions Feature Everything from Repo Vehicles to Fine Jewelry, with Over $40 Million Sold Last Week

- Used Construction Equipment, Heavy-Duty Truck, and Ag Machinery Values Continue Upward Trend

- HiBid Auctions Now Featuring Motorcycles, ATVs, Antique Gas Pumps, and More, Following $41 Million Week

- HiBid Auctions Top $53 Million Last Week, with Horses, Motorcycles, Appliances, and More Now Open for Bidding

- AuctionTime Sale Tops $20 Million, Includes $2.4 Million Equipment Package from Frey & Sons

April 2021

- Over Half a Million Lots Sold Last Week in HiBid Online-Only and Webcast Auctions

- Sandhills Global Market Data Shows Declining Inventory Across Used Equipment Markets Is Driving Up Values

- Auction Sales Top $39 Million Last Week on HiBid.com, with Rare Coins and Classic Cars Now Up for Bidding

- Auction and Asking Values Continue Upward Trend Across Equipment Industries

- HiBid.com Auctions Surpass $50 Million Last Week; Taking Bids Now on VR Headsets, Pickup Trucks, and More

- AuctionTime Records Largest March Sale Ever with 37% YOY Increase

- Over $36 Million Sold through HiBid.com Last Week; Bidding Now Open on Classic Cars, Electric Bikes, and More

March 2021

- HiBid.com Auctions Generated Over $41 Million in Last Week’s Sales; Bidding Now Open on Fine Art, Vehicles, and More

- Sandhills Pacific Acquires Aviation Trader

- HiBid.com Charts $39 Million in Sales Last Week; Bidding Open for Antique Coins, Estate Items, Houseboats, and More

- Sandhills Global Market Data Highlights the Equipment Classes and Age Groups Driving Historic Auction Values

- CNH Industrial and Sandhills Global Announce Strategic Partnership

- HiBid.com Records Over $43.3 Million in Last Week’s Sales, with Fine Art, Vintage Jewelry, and More Now Up For Bid

- Jewelry, Coins, Riverfront Property, and More Up for Bid on HiBid Following Nearly $30 Million Week

- Sandhills Global Market Data Shows Historic Levels for Auction Values Across Equipment Industries

- Over 1,100 Auctions on HiBid.com Generated $36.8M in Last Week’s Sales; Bid Now on Antiques, Model Trains, and More

February 2021

- Rare Vehicles, Real Estate, and More Now Up for Bid on HiBid.com After $30.5M Sold in Last Week’s Auctions

- Sandhills Market Data Finds Late Model Machines Driving Higher Asking Values

- Trucks and Construction Equipment Drive 111% YOY Increase in Record AuctionTime.com February Sale

- HiBid.com Reports Nearly $42.8 Million in Last Week’s Sales, with Real Estate, Collectible Coins, and Vehicles Now Up for Bid

- Equipment Markets Trending Up at Auction According to Latest Sandhills Global Market Data

- HiBid.com Featuring Cars, Horses, Fitness Equipment, and Real Estate Following $21 Million in Last Week’s Sales

- Kraft Auction Service’s 44th Anniversary Auction Sees Over $6 Million in Winning Online Bids Through HiBid.com

- HiBid.com Records Over $28.5 Million in Sales Last Week Across Hundreds of Auctions

January 2021

- HiBid.com Auction Sales Top $26 Million for the Week; Rare Vehicles, Furniture, Artwork, and More Now Up for Bidding

- HiBid.com Auction Sales Top $26 Million for the Week; Jewelry, Fitness Equipment, Motorhomes, and More Now Up for Bidding

- New Sandhills Global Market Data Shows YOY Value Gains in Used Machines 10 Years or Older

- HiBid Ends Record-Breaking Year, Surpassing $1.57 Billion in Sales with Over 17 Million Lots Sold

- Sandhills Global Launches LivestockMarket.com as Online Resource for Buying and Selling Livestock, Horses, and Hay

- New Sandhills Global Market Data Shows Decreasing Inventory Levels Contributing to Value Increases in Used Machines 10 Years or Older

- AuctionTime.com Breaks Records in December with More Than $163 Million in Sales

December 2020

- New Sandhills Global Market Data Shows Gains in Equipment Values Driven by Decreasing Inventory Levels

- Over $37 Million Sold Through HiBid.com Last Week; Bidding Now Open for Furnishings, Décor, Vintage Motorcycles, and More

- Agriculture, Construction & Heavy-Duty Truck Markets Up YOY in November; Sandhills Global Market Data Shows Key Age Groups and Equipment Driving Gains

- HiBid.com Auctions Generate Over $27.4M in Sales in a Record-Breaking Week; Bidding Now Open for Jewelry, Vintage Motorcycles, Arcade Games, and More

November 2020

- Over $41.6 Million in Assets Sold Through HiBid.com Last Week; Bidding Now Open for Vehicles, Restaurant Supplies, Jewelry, and More

- Sandhills Global Market Data Shows Positive Pricing Trends Across the Trucking, Construction, and Ag Markets

- HiBid.com Sees Continued High Sales with Over $36M Sold Last Week; Bidding Now Open for Coins, Jewelry, Cars, Utility Vehicles, Appliances, and More

- Over $25 Million Sold Through HiBid.com Last Week; Bidding Now Open for Sports Memorabilia, Furniture, Horses and More

- Sandhills Global Market Data Reveals Equipment Categories Trending Up, Plus Big Changes to Average YOY Values in Day Cabs and Combines

- HiBid.com Announces Record Traffic, with Over $38.7M Sold Last Week; Bidding Now Open for Antique Furniture, Limousines, Boats, and More

October 2020

- Over $35.5 Million Sold Through HiBid.com Last Week; Bidding Now Open for Fine Art, Antiques, Farm Machinery, Vintage Audio Equipment, and More

- Sandhills Global Market Data Shows 30% YOY Drop in Used Sleeper Truck Inventory, Average Values Increasing in Key Equipment Markets

- HiBid.com Sees Record Number of Bidders, Lots, and Auctions Last Week, Plus $28.9M in Sales; Antiques, Farm Equipment, and More Up for Sale Now

- Current HiBid Auctions Include Cars, Trucks, Farm Equipment, Dune Buggies, Arcade Games, and More; Last Week’s Auctions Brought in Nearly $40.5 Million

- Sandhills Global Market Data Shows Dropping Used Inventory Levels and Increasing Asset Values Across Farm Equipment and Heavy-Duty Truck Markets

- HiBid.com Auctions Brought in Nearly $32 Million Last Week; Boats, Classic and Modern Cars, Construction and Farm Equipment, Furniture, and More for Sale Now

- CWB National Leasing Becomes Exclusive Financing Partner for MarketBook Canada

September 2020

- Over $35.4 Million Sold Through HiBid.com Last Week; Bidding Now Open for Classic Cars, Salvage Autos, Horses, Catering Equipment, and More

- HiBid.com Reports Record Number of Lots and Over $26.6M in Weeklong Sales; Antiques, Vintage Tractors, Equipment and More Up for Sale Now

- Over $34.6 Million Sold Through HiBid.com Last Week; Bidding Now Open for Cars, Trucks, Farm Equipment, Tools and More

- Sandhills Global Launches UtilityTrailersToday.com, the Online Utility Trailer Marketplace

- HiBid.com Breaks Multiple Records, Reports Over $20M in Weeklong Sales; Rare Coins, Bullion, Fine Jewelry and More Up for Sale Now

- Sandhills Global Market Data Shows that Sharply Declining Used Truck Inventory Positions Heavy-Duty Truck Market for Price Recovery

- HiBid.com Auctions Soared Past $45.3 Million Last Week; Farm Equipment, Coins, Classic Cars and More for Sale Now

August 2020

- HiBid’s Industrial.HiBid.com Portal Is Dedicated to Tools, Building Materials & Other Industrial Items

- HiBid.com Reports Nearly $32M in Weeklong Sales & Record Number of Auctions, with Cars, Farm Equipment & More Up for Sale Now

- HiBid.com Continues Record-Breaking Run, Reports $28M in Weeklong Sales; Jewelry, Antiques, Ag Equipment & More Now Up for Sale

- HiBid.com Auctions Topped $33.6 Million In Record-Breaking Week; Rare Coins, Jewelry, Home Goods & More Up For Sale

- New Sandhills Global Market Report Shows Used Equipment Values Recovering in Key Truck Markets

- HiBid.com Auctions Topped $35 Million Last Week; Sports Cars, Gold Bullion, Farm Equipment & More Up for Sale

July 2020

- HiBid’s Toys.HiBid.com Portal Showcases Auctions Featuring Toys, Games & Collectibles for All Ages

- HiBid.com Breaks Records in Last Week’s Auctions; Fine Jewelry, Rare Coins, Vehicles & More for Sale in Upcoming Auctions

- Over $28.2M in Assets Sold Through HiBid.com Last Week; Rare Coins, Artwork, Trucks, Tractors and More for Sale in Upcoming Auctions

- Antiques.HiBid.com Is HiBid’s Dedicated Portal for Vintage Clothing, Handmade Tools and Other Antique Collectibles

- Sandhills Global’s Used Price Index Details Depreciation Curve of Heavy-Duty Construction Equipment & Trucks

- Nearly $27.5M in Assets Sold Through HiBid.com Last Week; Boats, Cars, Trucks, Tractors and More for Sale in Upcoming Auctions

- Electronics.HiBid.com Is HiBid’s Instant Access Portal for Laptops, HDTVs, and All Types of Technology

- HiBid Approaches $150M in Assets Sold in June, Passes $1B Milestone in Gross Merchandise Volume for 2020

- Shipping & Logistics Marketplace FR8Star Announces Remarkable Growth & New Features for Shippers, Carriers, and Brokers

- Sandhills Global’s Q2 Market Update Offers Actionable Insights for the Construction, Agriculture & Commercial Trucking Industries

- HiBid Surpasses $1B in Gross Merchandise Volume for the Year, with Nearly $45M in Assets Sold Through HiBid.com Last Week

June 2020

- Association of Equipment Management Professionals (AEMP) Announces New Strategic Partnership with Sandhills Global

- Rivers West Auction Co. Lands Outstanding Results for Calloway Northwest Retirement Sale on AuctionTime.com

- Household.HiBid.com: A Dedicated Site for Auctions Featuring Furniture, Housewares & Other Household Goods

- Nearly $28M in Assets Sold Through HiBid.com Last Week; Coins, Office Supplies & More for Sale in Upcoming Auctions

- Sandhills Global’s Ag Industry Market Report: Late Model Combine Values Continuing Upward Trend Year-Over-Year

- Coins.HiBid.com: HiBid’s Specialized Portal for Rare Coins, Bank Notes and Other Collectible Currency

- HiBid.com Reports Record Auction Total and Over $32M in Assets Sold Last Week; Coins, Restaurant Equipment & More for Sale in Current Auctions

- Sandhills Global Launches Aircraft.com, Valuable New Online Resource for Aircraft Information

- Sandhills Global Launches PavingEquipment.com for Buyers & Sellers of Asphalt & Concrete Equipment

- Cars.HiBid.com Is HiBid's Auction Portal for Exotic Cars, Late Model Trucks & Other Vehicles

- Sandhills Global Launches TelematicsPlus: A Single Portal for All of Your Telematics Providers

- Nearly $28M in Assets Sold Through HiBid.com Last Week; Power Tools, Furniture & More for Sale in Upcoming Auctions

- Sandhills Global’s Market Data Reveals Hidden Value In Canadian Used Ag Equipment Market

- Sandhills Global’s Latest Market Data Provide Actionable Insights for the Construction, Agriculture & Commercial Trucking Industries

- Jewelry.HiBid.com Is HiBid's Go-To Source for Jewelry Auctions Worldwide

- HiBid.com Posts Record Sales Totals, with Over $30.4M Sold Last Week; Electronics, Rare Coins & More for Sale in Upcoming Auctions

May 2020

- HiBid.com Offers One-Stop Portal For Boat & Yacht Auctions

- Bluebill Auction Defies Market, Nabs Over $2 Million For Massive Oilfield Equipment Package Using AuctionTime & Pre-AuctionTime

- HiBid.com Reports 1.37 Million Bids Per Day Last Week; Fine Jewelry, Coins, Collectibles, Knives, Furnishings & More for Sale in Upcoming Auctions

March 2020

February 2020

- AuctionTime & RJ Stockwell Land & Auction to Host Customer Appreciation Luncheon in Wisconsin on February 26th

- AuctionTime & Old 20 Auctions to Host Customer Appreciation Luncheon in Iowa for Farmers & Equipment Dealers

- Over $15M in Assets Sold Through HiBid.com Last Week; Fine Art, Restaurant Equipment, Currency, Sports Cards & More for Sale in Upcoming Auctions

- AuctionTime.com Sells Over $9 Million in Equipment, Trucks & Trailers in February 5th Auction

- More Than 796,000 Auction Goods Totaling Nearly $68 Million Sold Through HiBid in January

- AuctionTime.com Sells Over $10 Million in Equipment, Trucks & Trailers in January 29th Auction

January 2020

- AuctionTime.com & Auction Flex to Host Auctioneer Forum February 5th in Bowling Green, Kentucky

- Over $12M in Assets Sold Through HiBid.com Last Week; Lab Equipment, Furniture, Artwork & More for Sale in Upcoming Auctions

- AuctionTime.com & Auction Flex to Host Auctioneer Forum February 5th in Alberta

- AuctionTime.com Sells Over $9 Million in Equipment, Trucks & Trailers in January 22nd Auction

- Shipping & Logistics Marketplace FR8Star Announces Successful Closing Quarter & Exclusive New Carrier Feature

- Over $10.9M in Assets Sold Through HiBid.com Last Week; Farm Equipment, ATV Parts, Furniture & More for Sale in Upcoming Auctions

- AuctionTime.com & Auction Flex to Host Auctioneer Forums in Montana & Kansas

- AuctionTime.com Sells Over $7 Million in Equipment, Trucks & Trailers in January 15th Auction

- Over $10.7M in Assets Sold Through HiBid.com Last Week; Rare Coins, Taxidermy, Jewelry & More for Sale in Upcoming Auctions

- AuctionTime.com Sells Over $7 Million in Equipment, Trucks & Trailers in January 8th Auction

- Bobcat & Sandhills Global Launch BobcatUsed.com, Announce Sandhills’ Inclusion in Preferred Dealer Website Program

- AuctionTime.com & Auction Flex to Host Auctioneer Forum January 16th in Greensboro, North Carolina

- AuctionTime.com & Auction Flex to Host Auctioneer Forum January 14th in Minnesota

- AuctionTime.com’s Biggest Sale of the Year Contributes to $105 Million in December Sales of Equipment, Trucks & Trailers

December 2019

- AuctionTime.com & Auction Flex to Host Auctioneer Forums in South Carolina & Virginia

- FleetEvaluator & Doosan Bobcat Partnership Brings Greater Value & Profitability to Equipment Dealers

- AuctionTime.com Sells Over $35 Million in Equipment, Trucks, Trailers & Attachments in Huge Three-Day Auction

- Over $32.1M in Assets Sold Through HiBid.com Last Week; Luxury Vehicles, Medical Equipment, Plumbing Supplies & More for Sale in Upcoming Auctions

- AuctionTime.com Sells Over $16 Million in Equipment, Trucks & Trailers in December 11th Auction

- Over $20.1M in Assets Sold Through HiBid.com Last Week; Fine Jewelry, Antique Coins & Vintage Furniture for Sale in Upcoming Auctions

- AuctionTime.com Sales of Equipment, Trucks & Trailers Exceed $17 Million in December 4th Auction

- Record Number of Bidders Buy Nearly $90 Million in Auction Goods Through HiBid.com in November

- AuctionTime.com Sells Over $40 Million in Equipment, Trucks & Trailers in November Auctions

- AuctionTime & WMS Auctions to Host Open House in Upper Sandusky, Ohio, for Farmers & Equipment Dealers

November 2019

- Over $20.6M in Assets Sold Through HiBid.com Last Week; Gold & Silver Coins, Farm Implements & More for Sale in Upcoming Auctions

- AuctionTime.com Sales of Equipment, Trucks & Trailers Exceed $12 Million in November 20th Auction

- Nearly $22.7M in Assets Sold Through HiBid.com Last Week; Art, Coins & Arnold Palmer’s Golf Car for Sale in Upcoming Auctions

- AuctionTime.com Sells Over $12 Million in Equipment, Trucks & Trailers in November 13th Auction

- Equipmentfacts to Provide Online Bidding for Deanco’s Huge 2-Day Public Auction This Week

- Over $20.7M in Assets Sold Through HiBid.com Last Week; Cars, Trucks, Furniture & More for Sale in Upcoming Auctions

- Auction Flex & HiBid to Host One-Day Forums in Brisbane, Sydney, & Melbourne, Australia, in December

- AuctionTime.com Sells Over $9 Million in Equipment, Trucks & Trailers in November 6th Auction

- AuctionTime.com & Auction Flex to Host Auctioneer Forum November 19th & 20th in Tacoma, Washington

- Over 850,000 Lots & Nearly $111.7 Million in Auction Goods Sold Through HiBid in October

- AuctionTime to Join Bruchhaus & Bruchhaus Auctions in 22nd Annual Christmastime Sale & Open House

- AuctionTime.com Reports Record-Breaking October, With Over $61 Million in Equipment, Trucks & Trailers Sold

October 2019

- Over $25.4 Million in Luxury Cars & Other Auction Goods Sold Through HiBid.com This Week

- AuctionTime.com Sells Over $11 Million in Equipment, Trucks & Trailers in October 23rd Auction

- AuctionTime.com & Auction Flex to Host Auctioneer Seminar October 29th & 30th in Orlando, Florida

- Over $23.6 Million in Auction Goods Sold Through HiBid.com This Week; Luxury Cars & More for Sale in Coming Days

- HiBid.com Hosting Auction for 149 Rare Vehicles Including Burt Reynolds’ 1978 Trans Am

- AuctionTime.com Sells Over $10.5 Million in Equipment, Trucks & Trailers in October 9th Auction

- HiBid.com Hosting Auction for Rare Vehicles Seized from DC Solar Ponzi Scheme that Allegedly Ensnared Berkshire Hathaway

- Over $18.4 Million in Auction Goods Sold Through HiBid.com This Week

- Sandhills Global to Host Remembering Our Fallen Exhibit in Lincoln, October 22nd-24th

- AuctionTime.com & Auction Flex to Host Auctioneer Forum October 22nd & 23rd in Bloomington, Minnesota

- AuctionTime.com Sells Over $12 Million in Equipment, Trucks & Trailers in October 9th Auction

- Over $11.8 Million in Auction Goods Sold Through HiBid.com This Week

- Tadano Group Launches Demag Used Mobile Cranes Website, Designed by Sandhills Global

- AuctionTime.com Sells Over $12 Million in Equipment, Trucks, Trailers & Attachments in Two-Day Auction

- AuctionTime to Welcome Farmers & Equipment Dealers for Meet & Greet in Nyssa, Oregon

- Over 750,000 Lots & $85.6 Million in Auction Goods Sold Through HiBid in September

September 2019

- AuctionTime.com Sets New September Record, Selling Over $75 Million in Equipment, Trucks & Trailers

- Over $16.1 Million in Auction Goods Sold Through HiBid.com This Week

- AuctionTime.com Sells Over $21 Million in Equipment, Trucks, & Trailers in its Biggest Two-Day Auction of 2019

- Record Number of Lots Listed This Week on HiBid.com, with Over $18 Million in Auction Goods Sold

- AuctionTime.com & Auction Flex to Host Auctioneer Seminars in Colorado & Pennsylvania

- AuctionTime.com Sells Over $17 Million in Equipment, Trucks, & Trailers in This Week’s Two-Day Auction

- Over $12.6 Million in Auction Goods Sold Through HiBid.com this Week

- AuctionTime.com & Auction Flex to Host Auctioneer Seminar September 11th in Conjunction with 2019 National Auction Summit

- AuctionTime.com Sells Over $15 Million in Equipment, Trucks, & Trailers in This Week’s Two-Day Auction

- Over $94.8 Million in Auction Goods Sold Through HiBid in August, Surpassing $1 Billion Sold This Year

- AuctionTime.com Sets New August Record, Selling Over $66 Million in Equipment, Trucks & Trailers

August 2019

- Peed Family Donates $20,000 to Sioux Falls Food Pantry for Repairs & Food Replacement Following Accident

- Over $23.8 Million in Auction Goods Sold Through HiBid.com This Week

- Equipmentfacts Provides Online Bidding for Ed’s Machinery Auction Featuring Agricultural Equipment & Attachments

- AuctionTime.com Sells Over $15.5 Million in Equipment, Trucks, & Trailers in This Week’s Two-Day Auction

- Over $19.5 Million in Auction Goods Sold Through HiBid.com this Week

- Sandhills Global to Host Dealer Forum August 29th in Evansville, Indiana

- AuctionTime.com Provides Online Bidding for Black Star ACA $173,500 Auction Package Featuring Trucks & Construction Equipment

- AuctionTime.com Sells Over $17 Million in Equipment, Trucks & Trailers in This Week’s Two-Day Auction

- Over $22.2 Million in Auction Goods Sold Through HiBid.com This Week

- AuctionTime.com & Auction Flex to Host Auctioneer Forum in Boston

- AuctionTime.com Sells Over $13 Million in Equipment, Trucks & Trailers in August 7th Auction

- AuctionTime.com Caps Record-Setting Month, Sells Over $12.7 Million in July 31st Auction

- Over $72.6 Million in Luxury Cars, Coins, Equipment & Other Auction Goods Sold Through HiBid.com in July

July 2019

- Sandhills Global To Host Major Industry Forum in Lincoln, Nebraska

- AuctionTime.com Sells Over $12.8 Million in Equipment, Trucks & Trailers this Week

- Bidders Worldwide Buy Over $11 Million in Equipment, Trucks & Trailers This Week on AuctionTime.com

- AuctionTime.com & Auction Flex to Host Auctioneer Forum July 23rd and 24th in Harrisonburg, Virginia

- AuctionTime.com Sells over $14.7 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells over $6.6 Million in Equipment, Trucks & Trailers this Week

- Sandhills Global Launches OtherStock.com for Buyers & Sellers

June 2019

- AuctionTime.com Sells over $17 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells over $11.5 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells over $10.6 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com & Auction Flex to Host Auctioneer Forums in Kansas & Louisiana

- AuctionTime.com Sells over $9.2 Million in Equipment, Trucks & Trailers this Week

- IEDA Announces Launch of Revamped Website, Hosted by Sandhills Global

- Sandhills Global to Host Dealer Forum on June 27th in Ontario, Canada

May 2019

- AuctionTime.com Sells Over $65 Million in its Highest-Grossing May Auctions to Date

- AuctionTime.com Sponsors Charter Flight to Washington, D.C., Memorials for Nebraska Veterans & Gold Star Children

- HiBid.com Hosting Online Auction Featuring Rare, Antique & Vintage Toys

- AuctionTime.com & Auction Flex to Host Auctioneer Forums in Indiana & Texas

- Sandhills Global Partner UNICO Group Launches Drive Home Coverage Solution for Truck Buyers

April 2019

- HiBid.com Hosting Online Auction Featuring Luxury Yachts & Boats

- HiBid.com Hosting May 4th Chris Kyle Memorial Benefit Auction to Benefit U.S. Veterans & First Responders

- Sandhills Global Announces New Collector Car Facts Website, Powered by HiBid.com

- Sandhills Global Launches LiftsToday.com for Buyers & Sellers of Lifts & Lift Equipment

- AGCO & Sandhills Global Launch www.AGCOUsed.com, Connecting Used Equipment Available at AGCO Dealerships

- HiBid.com Hosting May 18th Auction Featuring Hundreds of Antiques & Fine Art Pieces

- Two-Day Equipment Auction Featuring Over 2,000 Pieces Happening April 17th & 18th

- Sandhills Publishing to Host Parts Forum on April 17th in Lincoln, Nebraska

- Sandhills Publishing Announces Company Name Change

- HiBid.com Hosting April 15th Estate Auction Featuring High-Value Asian Art, Collectibles & More

- Bidding Opens April 8th for Huge Two-Day Equipment, Truck & Trailer Auction on AuctionTime.com

- AuctionTime.com & Auction Flex to Host Auctioneer Forum April 9th & 10th in Baltimore

March 2019

- HiBid.com Hosting Auction for Exotic Sports Cars Seized by U.S. Marshals

- Huge Two-Day Equipment Auction Happening Now on AuctionTime.com

- Sandhills to Host Dealer Forum on March 21st in Chicago

- Equipmentfacts Provides Online Bidding for Oilfield Equipment Auction in Texas

- AuctionTime.com & Auction Flex to Host Auctioneer Forum March 19th & 20th in Florida

- AuctionTime.com Gears up for April 17th Construction Equipment Auction the Week of Bauma

February 2019

January 2019

- Sandhills East Acquires Web Management Consultants Ltd.

- Sandhills Publishing to Host Dealer Forum in Alberta, Canada

- AuctionTime.com & Auction Flex to Host Auctioneer Forum January 29th & 30th in Louisville

- VS Networks & Sandhills Publishing to Place In-Store SmartPlay Kiosks in AGCO Dealerships

- Sandhills Publishing Reports Record-Breaking $2.93 Billion across Auction Platforms in 2018

- AuctionTime.com Ends Highest Grossing Year to Date with over $113.6 Million in December Sales

December 2018

- AuctionTime.com Sells over $37.4 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells Over $42 Million in Equipment in its Largest Online Auction to Date

- Equipmentfacts Named Online Bidding Provider for Superior Energy Auctioneers

- AuctionTime.com Gears up for its Biggest Online Auction to Date

- AuctionTime.com Sells over $20 Million in Equipment, Trucks & Trailers this Week

- Equipmentfacts Provides Online Bidding for Oilfield Equipment Auction in North Dakota

- Auction Flex & HiBid.com to Host Auctioneer Forum December 19th in Chicago

- AuctionTime.com Sells over $13.3 Million in Equipment, Trucks & Trailers this Week

November 2018

- AuctionTime.com Sells over $18.6 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells Over $10 Million in Equipment, Trucks & Trailers in this Week’s Online-Only Auctions

- AuctionTime, Auction Flex & HiBid.com Announce Upcoming Auctioneer Forums & Webinars

- AuctionTime.com Sells Over $13 Million in Equipment, Trucks & Trailers in this Week’s Online-Only Auctions

- HiBid.com Launches Online Portal Specifically for Coin & Currency Auctions

- AuctionTime.com Announces Huge Crane & Rigging Equipment Auction on December 19th

- AuctionTime.com Sells Nearly $12 Million in Equipment, Trucks & Trailers this Week

- AuctionTime.com Sells $10.7 Million in Equipment, Trucks & Trailers this Week

October 2018

- Auction Flex & HiBid.com to Host Auction Forum November 7th in Orlando

- AuctionTime.com Sells Over $11 Million in Equipment, Trucks & Trailers this Week

- Equipmentfacts Provides Online Bidding for over $8 Million Equipment Auction Held by Permian International Energy Services

- AuctionTime.com Sells Over $7.5 Million in Equipment this Week

- AuctionTime.com Now Accepting Crane & Rigging Equipment for Huge November 28th Online-Only Auction

- HiBid.com Launches Regional Auction Portals for Online Auctions

- AuctionTime.com Sells Over $12.2 Million in Equipment this Week

- AuctionTime.com Now Accepting Consignments for December Auctions

- AuctionTime.com Sells Over $10 Million in Equipment this Week

- Equipmentfacts Is Named Iron Auction Group’s Exclusive Online Bidding Provider

- HiBid.com Launches Online Auction Gallery Portal

- AuctionTime.com & Auction Flex to Host Auctioneer Forum October 11th & 12th in Lincoln, Nebraska

September 2018

- Over $11 Million in Equipment Sold this Week on AuctionTime.com

- AuctionTime.com Sponsors Charter Flight to Washington, D.C., Memorials for Nebraska Women Veterans

- Over $12 Million in Equipment Sold this Week on AuctionTime.com

- Bidding Opens October 8th for Huge Collectable Car & Truck Auction on AuctionTime.com

- Sandhills Publishing Launches PowerSystemsToday.com, an Online Marketplace for Generators

- Over $15 Million in Equipment Sold this Week on AuctionTime.com

August 2018

- Equipmentfacts Announces Upcoming Online Equipment & Truck Auctions

- Sandhills Publishing Announces Business System Integrations with Arcadium Technologies

- Sandhills Publishing Launches OilfieldTrader.com, an Online Marketplace for Oilfield Equipment

- Sandhills Publishing to Host Dealer Forum in Ontario, Canada

- Sandhills Publishing & InTempo Software Team up to Streamline Asset Management & Integrate Real-Time Asset Valuations

- Sandhills Publishing to Host Upcoming Annual Industry Forum in Lincoln, Nebraska

July 2018

- Sandhills Publishing Launches MotorSportsUniverse.com for Buyers & Sellers of ATVs, UTVs, Go Karts, Snowmobiles, Motorcycles, Dirt Bikes & More

- AuctionTime.com & Auction Flex To Host Auctioneer Forum July 17th In Jacksonville

- Sandhills Publishing Acquires Equipmentfacts, Establishes Office Location In New Jersey

June 2018

- Sandhills Publishing Partners with RoviTracker to Offer Telematics Technology with Integrated Asset Valuation Data

- Machinery Trader Launches Used Equipment Website for Dynapac North America

- Sandhills Publishing To Host Exhibit Honoring Fallen Military Veterans At Lincoln Campus June 19th Through June 29th

May 2018

April 2018

February 2018

January 2018

- Sandhills Publishing Launches RVUniverse.com, the RV Marketplace

- AuctionTime.com Launches Online Equipment Auction Website for United Country Real Estate

- Sandhills Publishing & Charter Software Inc. Partner to Integrate Inspection Reports & Asset Valuations within the ASPEN Business Management System

- HiBid.com Reports Over $1.1 Billion In Inventory Sold In 2017

- Sandhills East Announces New Office Location In Germany

- MarketBook Expands in South Africa With New Office Location in Johannesburg

- Sandhills Publishing To Host Auctioneer Forum January 18th & 19th In Lincoln, Nebraska

- AuctionTime.com Reports Over $623 Million In Equipment Sold In 2017

- AuctionTime.com Sells Over $109 Million In December Online-Only Auctions, Ends Highest Grossing Year To Date

December 2017

- Sandhills Pacific Opens Office Location In New Zealand

- Sandhills East Opens Office Location In Amsterdam, Netherlands

- AuctionTime.com Sells Record-Breaking $46 Million In Equipment In Its Final Sale Of The Year

- AuctionTime.com Sells Over $26 Million In Equipment In Record-Breaking Online Auction

- AuctionTime.com Sells Over $21 Million In Equipment This Week In Online Auctions

- Featured Auctions On HiBid.com Take Advantage Of Year-End Momentum

November 2017

- Sandhills Publishing Announces Cyber Center Grand Opening At Global Headquarters In Lincoln, Nebraska

- Sandhills Publishing To Host December Forum In Phoenix, Arizona

- Legend Coin Auctions Leverages HiBid.com For Professional Website & Consistently Successful Online Auctions

- Sandhills Publishing Establishes Office In Sioux Falls, South Dakota

- Sandhills Publishing Teams Up With FR8Star To Simplify Shipping & Logistics

- Sandhills Publishing To Open Office Location In Chicago

- Sandhills Publishing Launches CraneTrader, Connecting International Buyers and Sellers of Cranes, Rigging and Lift Equipment

- HiBid To Webcast Upcoming Live Antiques & Collectibles Auction Nov. 18th & 19th

- AuctionTime.com To Close Out December With Multi-Day Online Equipment Auctions

- Online-Only Toy Collectibles Auction Currently Accepting Bids Through HiBid.com, Set To Close Nov. 12th

- HiBid Opens Online Bidding for Largescale Vehicle Auction from Texas-Based Auction Company

October 2017

September 2017

August 2017

- Sandhills Publishing Launches NeedTurfEquipment.com, Connecting Buyers & Sellers Of New & Used Turf Equipment

- Auction Flex & HiBid Join Forces With Currency To Offer Express Financing & Simplify Auction Transactions

- Sandhills East Acquires Additional Brands In Italy Following Recent Acquisitions & Establishment Of Local Office

July 2017

- Sandhills Publishing Teams Up With Currency To Offer Express Equipment Financing, Thousands Of Dealers Opt In Immediately

- HiBid & Auction Flex Roll Out Local State Website Portals For Auctioneers & Bidders

- Sandhills Pacific Acquires Australia’s TruckWorld.com.au

- Sandhills Publishing To Host Global Forum Industry Event In Lincoln, Nebraska

June 2017

April 2017

- Sandhills Publishing Sponsors Trip To Washington D.C. Memorials For Nebraska Vietnam Veterans

- Sandhills East Acquires Spain’s Editalplus, S.L., Broadens Presence In Local Construction Equipment & Commercial Trucking Markets

- Sandhills Publishing To Host Industry Forum In Roanoke, Virginia

- Sandhills East Acquires Spain’s MOMA Agri & MOMA Farm, Broadens Presence In Local Agriculture Equipment Market

March 2017

- Sandhills Publishing To Open New Office Location In Sidney, Nebraska

- AuctionTime Joins Forces With Auction Flex, Expands Product Offerings To Better Serve Auctioneers

- Sandhills Publishing Forms Strategic Alliance With Aircraft Cost Calculator, Broadens Resources Available To Buyers & Sellers In Aviation Industry

- Sandhills East Acquires Resale Weekly

February 2017

January 2017

November 2016

September 2016

August 2016

- Sandhills Introduces New Equipment Inspections Features In Inventory Management App

- Sandhills Publishing To Begin Construction On New Building In Early September

- Next Week On AuctionTime.com: Over 1,800 Assets For Sale

- Sandhills Publishing Announces Dates for 2017 Global Forum

- CPU Magazine's CPULAN 2016 Event To Draw Hundreds Of PC Gaming Enthusiasts To Lincoln Sept. 23-24

- Sandhills Publishing Announces NeedWorkToday.com, A Resource That Connects Workers With Employers In The Construction, Agriculture, Aviation, and Transportation Industries

- Sandhills Publishing Hosts Annual Global Forum in Lincoln, Nebraska

December 2015

November 2015

September 2015

August 2015

May 2015

March 2015

New Sandhills Global Market Data Underscores Volatility in Short-Term Equipment Value Trends

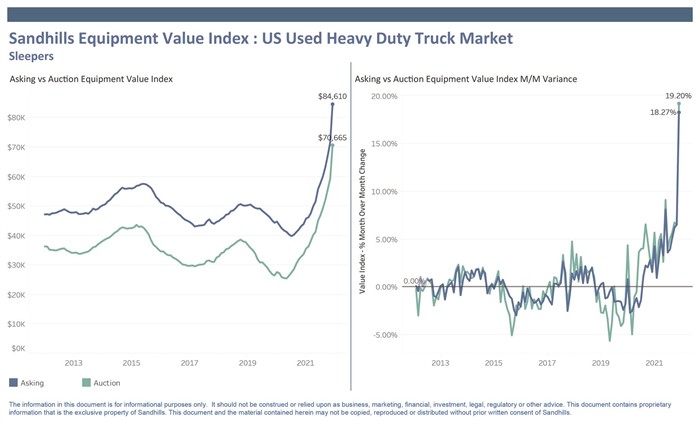

LINCOLN, Nebraska — January 20, 2022Recent equipment value movement across heavy-duty sleeper trucks show just how volatile values can be from month to month. A new Sandhills Global Market Report details that, from November to December 2021, heavy-duty sleeper truck values in Sandhills marketplaces rose 19.2% at auction, while asking values were up 18.3% M/M. The report also examines the short-term value trends in crawler excavators and high-horsepower (300-HP and greater) tractors.

The key metric used in this reporting is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions.

Chart Takeaways

Sandhills Market Reports highlight the most significant changes in Sandhills’ used heavy-duty truck, construction equipment, and farm machinery markets. Each report includes detailed analysis and charts that help readers visualize the data. The short-term value changes featured in this report also detail which age groups are driving the highest increases in each equipment category.

U.S. Used Heavy-Duty Sleeper Trucks

- Low inventory for heavy-duty sleeper trucks continues to impact used values.

- From November to December 2021, average asking values and auction values both increased $12,000.

- Asking values for late-model sleeper trucks (those in the 0- to 5-year age group) were up 19% M/M. Asking values for older models (over 5 years), by comparison, increased only 3.5% to 4% M/M.

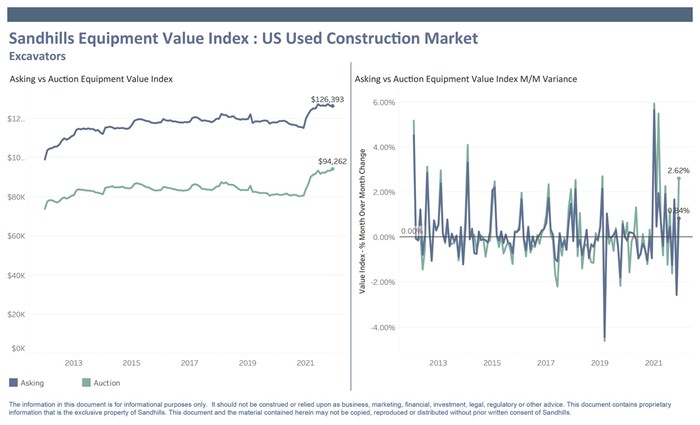

U.S. Used Excavators

- The Sandhills EVI finds that crawler excavator auction values were up 2.62% M/M, and asking values increased 0.84% M/M.

- Crawler excavators in the 10- to 25-year age group displayed the highest asking value increase, up 2.34% M/M.

- Asking values for the less-than-10-year age group increased between only 0.5% and 1.0% M/M.

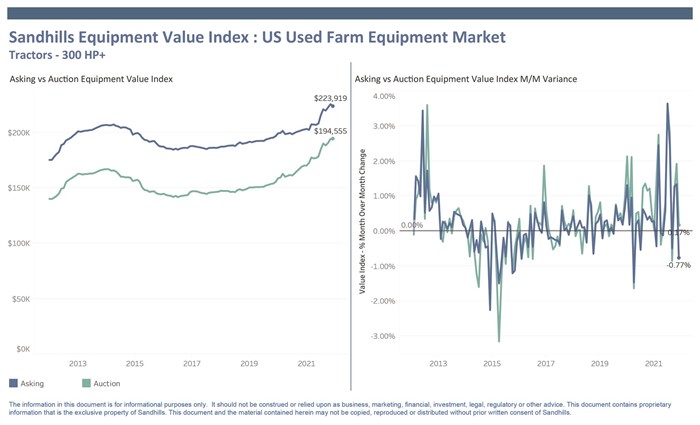

U.S. Used Tractors 300 Horsepower and Greater

- Compared to other major used equipment categories, high-horsepower tractors remained flat with a 0.17% M/M auction value increase and a 0.77% M/M decrease in asking value.

- The slight downward trajectory is a departure from the upward increases in high-horsepower tractors seen throughout Q4 2021.

- The 10- to 25-year age group produced the highest asking value increase, up 1.45% M/M. The less-than-10-year age group was flat from November to December 2021.

Obtain the Full Report

For more information, or to receive detailed analysis from Sandhills Global, contact us at [email protected].

About the Sandhills Equipment Value Index

The Sandhills Equipment Value Index (EVI) is a principal gauge of the estimated market values of used assets—both currently and over time—across the construction, agricultural, and commercial trucking industries represented by Sandhills Global marketplaces, including AuctionTime.com, TractorHouse.com, MachineryTrader.com, TruckPaper.com, and other industry-specific equipment platforms. Powered by FleetEvaluator, Sandhills’ proprietary asset valuation tool, Sandhills EVI provides useful insights into the ever-changing supply-and-demand conditions for each industry.